ShotSpotter Reports First Quarter 2021 Financial Results

44% Year-over-Year Increase in Revenues Drives Another Quarter of Record Revenues, Solid Adjusted EBITDA and GAAP Profitability

NEWARK, Calif., May 11, 2021 (GLOBE NEWSWIRE) -- ShotSpotter, Inc. (NASDAQ: SSTI), a leader in precision policing technology solutions that enable law enforcement to more effectively respond to, investigate and deter crime, today reported financial results for the first quarter ended March 31, 2021.

First Quarter 2021 Financial and Operational Highlights

- Revenues increased 44% to $15.0 million from $10.5 million for the first quarter of 2020.

- Gross profit increased 42% to $8.7 million (58% of revenues) from $6.1 million (58% of revenues) for the first quarter of 2020.

- Net income increased to $79,000 from $13,000 for the first quarter of 2020.

- Adjusted net income1 increased to $244,000 from $13,000 for the first quarter of 2020.

- Adjusted EBITDA1 increased to $3.3 million from $2.2 million for the first quarter of 2020.

- Went "live" with ShotSpotter Respond in six new cities and with five expansions in current customer cities.

- Maintained a strong balance sheet with $10.9 million in cash and cash equivalents and had $20.0 million available on the Company’s line of credit at the end of the quarter.

- Repurchased over 56,000 shares for a total of approximately $2.2 million.

- Full year 2021 revenue guidance increased to $60 million to $61 million (previously $58 million to $60 million), representing growth of over 30% compared to full year 2020.

1See the section below titled “Non-GAAP Financial Measures” for more information about Adjusted net income and Adjusted EBITDA, and their reconciliation to GAAP net income.

Management Commentary

“We grew revenues by 44% to a record $15 million while maintaining strong margins and generating profitable results, including a 22% Adjusted EBITDA margin (Adjusted EBITDA divided by revenues) for the period,” said ShotSpotter CEO Ralph Clark. “During the quarter we went live with ShotSpotter Respond in six new cities, expanded with five existing customers and had a robust number of new city and expansion projects staffed and to be deployed in Q2 and early Q3 of this year. Additionally, a number of ShotSpotter Connect deals have already been booked and are expected to be taken live in Q2 and early Q3.

“We have made solid progress in expanding and enhancing our product suite to offer an end-to-end precision policing platform that provides more efficient and effective ways to respond to, investigate, and prevent crime beyond gunshot detection. Today, we announced the availability of the fully functional and demonstrable version of ShotSpotter Investigate, our purpose-built case management solution. This is ahead of our original schedule and will enable us to immediately build a backlog of early adopter prospects 60+ days sooner than we had anticipated. ShotSpotter Investigate, ShotSpotter Connect and our leading acoustic gunshot detection solution ShotSpotter Respond represent a triumvirate of precision policing tools that enable more efficient, effective, and equitable application of public safety being demanded by police departments and the communities they serve.

“We are encouraged with the injection of federal stimulus dollars into municipal governments and the return of earmarks. The positive funding environment combined with the measurable increase in violent crime and calls for policing reform are creating what we believe are strong tailwinds for the growth of our business and the ability to effect positive social change through adoption of 21st century policing strategies that leverage data, technology, and digital precision.”

First Quarter 2021 Financial Results

Revenues for the first quarter of 2021 increased 44% to $15.0 million from $10.5 million for the same period in 2020. The increase in revenues reflects a significant year-over-year increase in ShotSpotter Respond coverage areas and renewals in the first quarter of 2021 that were delayed from the prior quarter, as well as contribution from LEEDS, which was acquired in the fourth quarter of 2020.

Gross profit for the first quarter of 2021 increased 42% to $8.7 million (58% of revenues) from $6.1 million (58% of revenues) for the same period in 2020.

Total operating expenses for the first quarter of 2021 increased 39% to $8.5 million from $6.1 million for the same period in 2020. The increase in operating expenses was primarily due to increased insurance costs, legal fees, personnel-related costs as well as acquisition-related expenses associated with our acquisition of LEEDS.

Net income totaled $79,000, or $0.01 per basic and diluted share based on 11.6 million basic and 11.9 million diluted weighted average shares outstanding, a 508% increase compared to $13,000, or $0.00 per basic and diluted share based on 11.3 million basic and 11.7 million diluted weighted average shares outstanding for the same period in 2020.

Adjusted net income for the first quarter of 2021 increased to $244,000 from $13,000 in the same period last year.

Adjusted EBITDA for the first quarter of 2021 increased 53% to $3.3 million from $2.2 million in the same period last year.

Financial Outlook

The company increased its full year 2021 revenue guidance to $60 million to $61 million (previously $58 million to $60 million). The company expects to remain GAAP profitable for the full year of 2021.

The company’s financial outlook statements are based on current expectations. The preceding statements are forward-looking, and actual results could differ materially depending on market conditions and the factors set forth under “Safe Harbor Statement” below.

Conference Call

ShotSpotter will hold a conference call today (May 11, 2021) at 4:30 p.m. Eastern Time (1:30 p.m. Pacific Time) to discuss these results and provide an update on business conditions.

ShotSpotter management will host the presentation, followed by a question and answer period.

U.S. dial-in: 1-855-327-6838

International dial-in: 1-604-235-2082

Conference ID: 10014323

The conference call will be broadcast simultaneously and available for replay via the investor section of the company’s website at www.shotspotter.com.

Please call the conference telephone number 5-10 minutes prior to the start time. An operator will register your name and organization. If you have any difficulty connecting with the conference call, please contact ShotSpotter’s investor relations team at 1-949-574-3860.

A replay of the call will be available after 7:30 p.m. Eastern Time on the same day through June 11, 2021, 11:59 p.m. Eastern Time.

U.S. replay dial-in: 1-844-512-2921

International replay dial-in: 1-412-317-6671

Replay ID: 10014323

Non-GAAP Financial Measures

Adjusted net income: Adjusted net income, a non-GAAP financial measure, represents the company’s net income or loss before acquisition related expenses.

Adjusted EBITDA: Adjusted EBITDA, a non-GAAP financial measure, represents the company’s net income or loss before interest (income) expense, income taxes, depreciation, amortization and impairment, stock-based compensation expense and acquisition related expenses. Adjusted EBITDA is a measure used by management internally to understand and evaluate the company’s core operating performance and trends across accounting periods and in connection with developing future operating plans, making strategic decisions regarding the allocation of capital and considering initiatives focused on cultivating new markets for our solutions. In particular, the exclusion of these expenses in calculating adjusted EBITDA facilitates comparisons of the company’s operating performance on a period-to-period basis.

ShotSpotter believes adjusted net income and adjusted EBITDA also provide useful information to investors and others in understanding and evaluating our operating results in the same manner as our management and board of directors. For example, ShotSpotter adjusts EBITDA for stock-based compensation expense and acquisition related expenses because such expenses often vary for reasons that are generally unrelated to financial and operational performance in any particular period. Stock-based compensation is utilized by ShotSpotter to attract and retain employees with a goal of long-term retention and the alignment of employee interests with those of the company and its stockholders, rather than to address operational performance for any particular period based financial performance measures, in particular net income or loss, and our other GAAP financial results.

The following table presents a reconciliation of adjusted net income to GAAP net income, the most directly comparable GAAP measure, for each of the periods indicated (in thousands):

| Three Months Ended March 31, | ||||||||

| 2021 | 2020 | |||||||

| (unaudited) | ||||||||

| GAAP net income | $ | 79 | $ | 13 | ||||

| Less: | ||||||||

| Acquisition related expenses | 165 | — | ||||||

| Adjusted net income | $ | 244 | $ | 13 | ||||

| Adjusted net income per share, basic | $ | 0.02 | $ | 0.00 | ||||

| Adjusted net income per share, diluted | $ | 0.02 | $ | 0.00 | ||||

| Weighted average shares used in computing adjusted net income per share, basic | 11,584,605 | 11,337,491 | ||||||

| Weighted average shares used in computing adjusted net income per share, diluted | 11,898,362 | 11,715,426 | ||||||

The following table presents a reconciliation of adjusted EBITDA to net income, the most directly comparable GAAP measure, for each of the periods indicated (in thousands):

| Three Months Ended March 31, | ||||||||

| 2021 | 2020 | |||||||

| (unaudited) | ||||||||

| GAAP net income | $ | 79 | $ | 13 | ||||

| Less: | ||||||||

| Interest income | (11 | ) | (93 | ) | ||||

| Income taxes | 49 | (1 | ) | |||||

| Depreciation, amortization and impairment | 1,677 | 1,367 | ||||||

| Stock-based compensation expense | 1,375 | 887 | ||||||

| Acquisition related expenses | 165 | — | ||||||

| Adjusted EBITDA | $ | 3,334 | $ | 2,173 | ||||

Safe Harbor Statement

This press release contains "forward-looking statements" within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, including but not limited to statements regarding revenue and GAAP profitability guidance for full year 2021, future deployments of ShotSpotter Respond and ShotSpotter Connect, the Company’s expectations for demand for ShotSpotter Investigate and the funding environment for the company’s products. Words such as "expect," "anticipate," "should," "believe," "target," "project," "goals," "estimate," "potential," "predict," "may," "will," "could," "intend," variations of these terms or the negative of these terms and similar expressions are intended to identify these forward-looking statements. Forward-looking statements are subject to a number of risks and uncertainties, many of which involve factors or circumstances that are beyond the company’s control. The company’s actual results could differ materially from those stated or implied in forward-looking statements due to a number of factors, including but not limited to: the company’s ability to successfully negotiate and execute contracts with new and existing customers in a timely manner, if at all; the company’s ability to address the business and other impacts and uncertainties associated with the COVID-19 pandemic; the company’s ability to maintain and increase sales, including sales of the company’s newer product lines; the availability of funding for the company’s customers to purchase the company’s solutions; the complexity, expense and time associated with contracting with government entities; the company’s ability to maintain and expand coverage of existing public safety customer accounts and further penetrate the public safety market; the company’s ability to sell its solutions into international and other new markets; the lengthy sales cycle for the company’s solutions; changes in federal funding available to support local law enforcement; the company’s ability to deploy and deliver its solutions; and the company’s ability to maintain and enhance its brand, as well as other risk factors included in the company’s most recent annual report on Form 10-K and quarterly report on Form 10-Q and other SEC filings. These forward-looking statements are made as of the date of this press release and are based on current expectations, estimates, forecasts and projections as well as the beliefs and assumptions of management. Except as required by law, the company undertakes no duty or obligation to update any forward-looking statements contained in this release as a result of new information, future events or changes in its expectations.

About ShotSpotter, Inc.

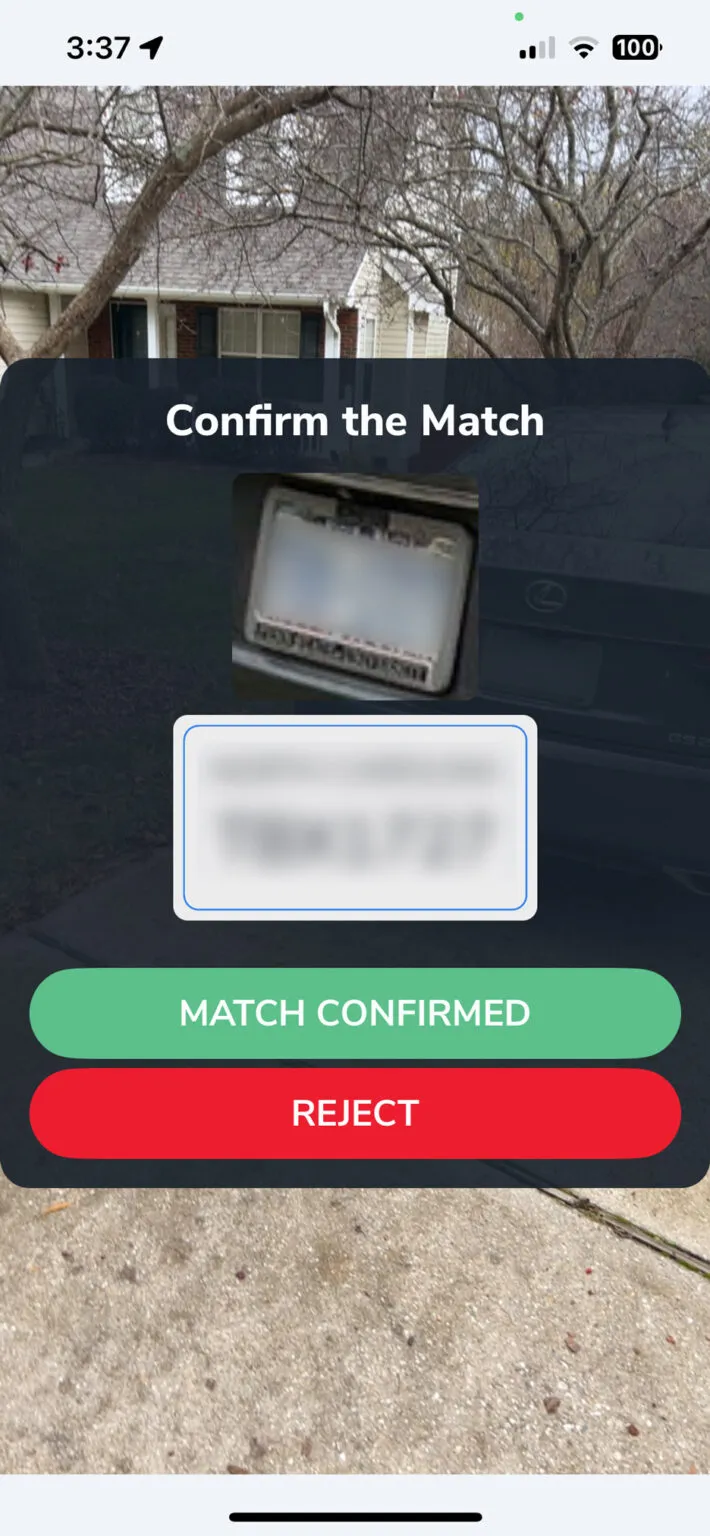

ShotSpotter (NASDAQ: SSTI) is a leader in precision policing technology solutions that enable law enforcement to more effectively respond to, investigate and deter crime. The company’s products are trusted by more than 100 U.S. cities to help make their communities safer. The platform includes its flagship product, ShotSpotter Respond™, the leading gunshot detection, location, and forensic system, ShotSpotter Connect™, patrol management software to dynamically direct patrol resources to areas of greatest risk and more effectively deter crime, and ShotSpotter Investigate™, an investigative case management solution that help detectives connect the dots and share information more effectively to improve case clearance rates. ShotSpotter also serves the corporate and college security markets and has been designated a Great Place to Work® Company.

Company Contact:

Alan Stewart, CFO

ShotSpotter, Inc.

+1 (510) 794-3100

astewart@shotspotter.com

Investor Relations Contacts:

Matt Glover

Gateway Investor Relations

+1 (949) 574-3860

SSTI@gatewayir.com

JoAnn Horne

Market Street Partners

+1 (415) 445-3240

jhorne@marketstreetpartners.com

ShotSpotter, Inc.

Condensed Consolidated Statements of Operations

(In thousands, except share and per share data)

(Unaudited)

|

Three Months Ended March 31, |

||||||||

| 2021 | 2020 | |||||||

| Revenues | $ | 15,013 | $ | 10,458 | ||||

| Costs | ||||||||

| Cost of revenues | 6,300 | 4,342 | ||||||

| Impairment of property and equipment | 25 | — | ||||||

| Total costs | 6,325 | 4,342 | ||||||

| Gross profit | 8,688 | 6,116 | ||||||

| Operating expenses | ||||||||

| Sales and marketing | 3,935 | 2,516 | ||||||

| Research and development | 1,713 | 1,352 | ||||||

| General and administrative | 2,871 | 2,271 | ||||||

| Total operating expenses | 8,519 | 6,139 | ||||||

| Operating income (loss) | 169 | (23 | ) | |||||

| Other income (expense), net | ||||||||

| Interest income, net | 11 | 93 | ||||||

| Other expense, net | (52 | ) | (58 | ) | ||||

| Total other income (expense), net | (41 | ) | 35 | |||||

| Income before income taxes | 128 | 12 | ||||||

| Provision (benefit) for income taxes | 49 | (1 | ) | |||||

| Net income | $ | 79 | $ | 13 | ||||

| Net income per share, basic | $ | 0.01 | $ | 0.00 | ||||

| Net income per share, diluted | $ | 0.01 | $ | 0.00 | ||||

| Weighted average shares used in computing net income per share, basic | 11,584,605 | 11,337,491 | ||||||

| Weighted average shares used in computing net income per share, diluted | 11,898,362 | 11,715,426 | ||||||

ShotSpotter, Inc.

Condensed Consolidated Balance Sheets

(In thousands)

| March 31, 2021 | December 31, 2020 | |||||||

| (Unaudited) | ||||||||

| Assets | ||||||||

| Current assets | ||||||||

| Cash and cash equivalents | $ | 10,940 | $ | 16,043 | ||||

| Accounts receivable and contract asset | 16,806 | 12,921 | ||||||

| Prepaid expenses and other current assets | 1,954 | 2,172 | ||||||

| Total current assets | 29,700 | 31,136 | ||||||

| Property and equipment, net | 15,221 | 15,346 | ||||||

| Operating lease right-of-use assets | 753 | 882 | ||||||

| Goodwill | 2,816 | 2,811 | ||||||

| Intangible assets, net | 14,294 | 14,540 | ||||||

| Other assets | 1,659 | 1,605 | ||||||

| Total assets | $ | 64,443 | $ | 66,320 | ||||

| Liabilities and Stockholders' Equity | ||||||||

| Current liabilities | ||||||||

| Accounts payable | $ | 1,404 | $ | 1,192 | ||||

| Deferred revenue, short-term | 24,672 | 24,174 | ||||||

| Accrued expenses and other current liabilities | 3,686 | 5,613 | ||||||

| Total current liabilities | 29,762 | 30,979 | ||||||

| Deferred revenue, long-term | 336 | 405 | ||||||

| Other liabilities | 574 | 631 | ||||||

| Total liabilities | 30,672 | 32,015 | ||||||

| Stockholders' equity | ||||||||

| Common stock | 58 | 58 | ||||||

| Additional paid-in capital | 128,175 | 128,771 | ||||||

| Accumulated deficit | (94,275 | ) | (94,354 | ) | ||||

| Accumulated other comprehensive loss | (187 | ) | (170 | ) | ||||

| Total stockholders' equity | 33,771 | 34,305 | ||||||

| Total liabilities and stockholders' equity | $ | 64,443 | $ | 66,320 | ||||

Source: ShotSpotter, Inc.

Released May 11, 2021