|

|

May 7, 2020 |

Exhibit 99.2

|

|

May 7, 2020 |

I hope this year’s annual shareholder letter finds you and your loved ones safe and in good health as we collectively confront the COVID-19 crisis. My faith informs my view that “this too shall pass”. I am confident that ShotSpotter will ultimately emerge out of this stronger, more resilient, and with deeper connections with our loyal customer base as they navigate their own COVID-19 challenges.

It is truly amazing how quickly the tectonic shift in the global economic outlook occurred following the first reported case of COVID-19 in the U.S. on January 20, 2020. As a company, we were fortunate in that we already had a fairly complete and robust contingency plan in place. That plan included critical investments in technology infrastructure, people and process, and was designed to enable us to be prepared to operate in extremely adverse circumstances such as a major data center or network failure, a targeted cyber-attack or a disruptive earthquake in Northern California. Who would have ever imagined that our Black Swan contingency plan would be triggered by a tiny microbe that appears to have originated on the other side of the globe?

In early March, we issued a broad work from home mandate for everyone, including our colleagues in the Incident Review Center (more on that later). We also issued a total travel ban for all employees at the same time. This was driven in large part by our desire to put people first and optimize the health and welfare of our employees as well as contribute our small part in helping to flatten the curve. Although it has caused delays in going live with customer deployments due to our inability to have local boots on the ground, it was the right call. As I write this letter, we are all still working from home and not traveling. We are adapting well given the circumstances. Frequent company-wide and team video conference calls are standard fare including Zoom Story Time where volunteer employees read stories to their colleague’s children. I am very pleased to report that, to the best of my knowledge, no one in the company to date or any of their immediate family members has contracted the virus. Of course, how and when we return to the office and travel will be in compliance with all applicable laws and the guidance of health authorities, with the objective of preserving the health and safety of our employees and those of our customers and the communities they serve to guide us.

I will return to my thoughts about our COVID-19 experience over the past several weeks along with how we plan to move forward in 2020 and beyond later. However, let’s first take a moment to review our performance in 2019.

Revenue Growth

Our GAAP revenues grew year over year by 17.2%, from $34.8 million in 2018 to $40.8 million in 2019. The revenue increase of $6 million was due to new miles going live in the year from new and existing customers and miles that went live in 2018 for which we recognized a full year’s worth of revenues in 2019. These increases were partially offset by attrition of approximately $900,000 and the timing of renewals from certain customers resulting in deferred revenues. Eleven new customers went live in 2019, which when combined with expansion miles of existing customers that went live during the year, resulted in a total of 82 new net square miles in 2019.

|

ShotSpotter Shareholder Letter |

1 |

Revenue Retention

Our 2019 revenue retention rate remained quite favorable at 111%. This indicates low churn and means that revenues recognized during the year, including from customer expansions and targeted price increases, more than offset revenues that we lost from customers that did not renew their contracts during the year.

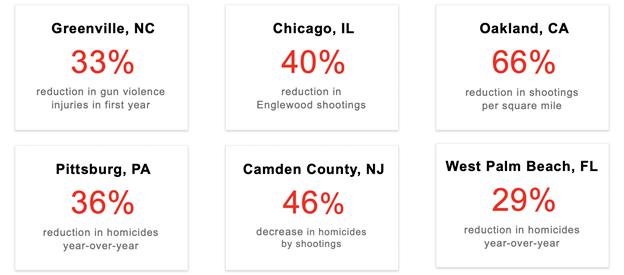

Our goal is to maintain a 100%+ revenue retention rate going forward. The stickiness of our service is driven by the effectiveness of our solution in addressing the pervasive and costly problem of gun violence for our customers. Our unparalleled position is driven by our highly specialized and unique technology, superior service and a consultative approach to customer success, ensuring proper onboarding and best practices implementation. Our goal is to drive measurable positive customer outcomes. Over the years, our customers have publicized their stories of successfully reducing crime with ShotSpotter Flex playing an important part. Here are a few:

Source: www.shotspotter.com/results

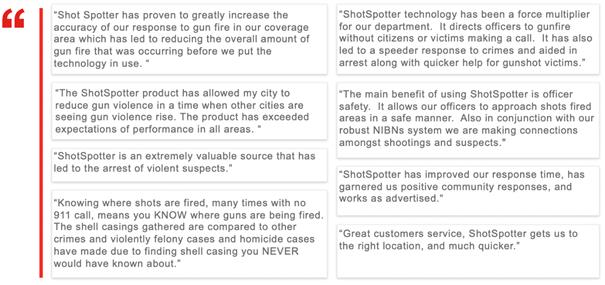

We believe our revenue retention rate correlates with our Net Promoter Score (NPS), which is a bit of a company passion. We have seen our NPS steadily rise to our most recent 2019 score of +53%, which put ShotSpotter in the “excellent” category of NPS. While NPS is a strong indicator, it is the process, underlying questions and insights we gain from the NPS Survey that drive our action plan and priorities. Here is one of the many unprompted quotes we received in our last NPS Survey:

“ShotSpotter has been an extremely important component with regard to evidence collection and feeding NIBIN [the National Integrated Ballistic Information Network], especially since 76% of gunfire incidents in our SST coverage areas are unreported”.

|

ShotSpotter Shareholder Letter |

2 |

NPS is about increasing customer intimacy and creating promoters driving strong word of mouth referrals. This is a key driver in efficient customer acquisition costs. We measure customer acquisition costs as sales and marketing spend per $1.00 of new annualized contract value, which was $0.43 in 2019. I believe these costs continue to be low compared to other comparable SaaS companies.

Operations

We published over 140,000 gunshot alerts to our customers in 2019. We continued to enhance our core ShotSpotter Flex offering through: improved machine classification; location accuracy; new reporting capabilities like the investigative lead summary (ILS); and important policy changes from our NYU Law School Privacy Audit. Organizationally, we expanded and re-tooled our sales organization, adding a new Vice President position to lead a newly formed solution sales team to proactively drive our three service offerings (Flex, Security and Missions) through existing territory sales. We also added another Vice President to lead the territory sales directors. Both Vice Presidents report directly to Gary Bunyard, our existing Senior Vice President, Sales and Security. Also reporting to Gary is a new director of sales operations, who focuses on renewals and proposals and RFP responses.

During the year, we also separated and elevated our Customer Success organization from the Sales organization. A newly hired Vice President of Customer Success now reports directly to me as a part of the leadership team. Our strategy is to seamlessly integrate the customer journey as they work with different functional organizations within ShotSpotter. We intend to grow the Customer Success function in staffing and capabilities in 2020.

These moves, adds and changes are all designed to generate profitable growth, maintain minimal customer attrition and increase customer intimacy—with the objective of growing the sales network effect of a strong referral base. We believe we can continue to maintain a SaaS industry leading position and low-cost customer acquisition costs that our vertical market orientation affords us.

|

ShotSpotter Shareholder Letter |

3 |

Probably the most under-appreciated but also most uniquely powerful aspect of our business is the operating leverage and efficiency we have. The company achieved full year GAAP profitability of $1.8 million, or $0.15 per share diluted, on approximately $40 million in GAAP revenue in 2019. When we survey the SaaS business model landscape, we often see companies that are still are still not profitable at $100 million annual run rates.

Our gross margin increased 500 basis points, from 55% in 2018 to 60% in 2019, while our total operating expenses only grew by only $1 million from 2018 to 2019. Our net cash flows from operating and investing activities were $8.8 million.

As the leading provider of precision-policing and security solutions for law enforcement and security personnel, with little direct competition, we are somewhat protected from the typical pricing pressure experienced in more competitive markets. We also benefit from operating expense leverage further down the income statement. Our ShotSpotter Flex solution has strong market fit and is a full-featured solution that we pioneered over 20 years ago. A significant amount of time and investment has gone into Flex in years past, yielding over 30 patents and a formidable competitive moat. Importantly, we are not required to get in a feature arms race with other offerings, which allows us to invest incrementally and smartly in capabilities that reduce our costs and/or increase value and stickiness for our customers-this is key. In addition, the vertical nature of the customer base we serve – our ability to discover, convert and support customers – affords us a significant efficiency in our sales and marketing spend. Lastly, our fanatical pursuit of NPS results in promoters who help sell our solution through strong word of mouth. Unlike non-state and local government commercial markets, our customers do not compete with one another. In fact, they do the opposite. They collaborate, and when something works, they are likely to tout their success with other agencies and their peers.

Capital Allocation

Capital allocation, or how a company allocates its financial resources, gets scant coverage in the general business press. This is unfortunate given that it is arguably one of the biggest levers a company has in driving investor value after scaling an attractive business model with strong unit economics. Our capital allocation priority is to profitably grow our business by focusing on organic growth opportunities, but to remain both disciplined and opportunistic when it comes to share repurchases and acquisitions that we believe can increase value to stockholders and other stakeholders – including our employees, our customers and the communities served by our customers – over the long term.

Our capital allocation options include: retain and increase cash on the balance sheet; pay a dividend; do acquisitions; and do share repurchases. With our long-term focus in mind, we have done three of the four. We have accumulated cash to appropriately strengthen our balance sheet and increase liquidity, including through our 2019 follow-on offering where we sold 250,000 shares of our stock for net proceeds of $10.6 million after deducting offering expenses. In late 2018, we purchased the technology assets of HunchLab, which has become the foundation for our Missions solution. During 2019, we implemented a stock repurchase program under which we repurchased 257,824 shares for $6.7 million. We ended the year with $24.6 million in cash and no debt. We will continue to allocate our capital in a way we believe has the greatest opportunity to increase value to our stockholders and other stakeholders over the long term.

|

ShotSpotter Shareholder Letter |

4 |

Our work-from-home policy required us to completely reconstitute our headquarters-based Incident Review Center (IRC) as a distributed work-from-home center on a 24/7 basis. As this reality emerged, I was not at all concerned about the hard infrastructure piece of this, as we had already provisioned company-configured laptops, increased network bandwidth, VPN tunnels, enhanced security and more. Nor was I was concerned about the training or work ethic of our reviewers, who do incredible work in demanding situations. What I was concerned about, however, was the soft infrastructure or relationship magic amongst our reviewers and their collaboration between them and our Level 2/3 technical support engineers. Although I was confident that we would be able to provide a mostly intact service, I argued that we should notify customers of this change and warn them that there might be a slight diminution of service. Fortunately, a better argument was made that we should notify customers of the change but that customers should not expect anything different other than our already high level of service. I am thrilled to say that turned out to be 100% correct. Our collective IRC and Customer Support team has really stepped up and our customers have been receiving the same excellent service from our IRC that they always have, without any interruption or disruption.

Three very important lessons came out of this, the first of which I learn and re-learn all the time. One- I don’t always get it right and thank goodness I have an amazing senior leadership team that talks me off the rail every now and then. Two- when you have a purpose-built, strong company culture that is based on trust, collaboration can happen digitally and transcend time and space. And Three- it’s amazing what can happen when you challenge people to step up. This reminds me of the 1949 movie Twelve O’Clock High, in which Gregory Peck plays the character Brigadier General Frank Savage.

|

ShotSpotter Shareholder Letter |

5 |

General Savage totally believes in his team but is also not afraid to be demanding with respect to setting high standards, just above what people think they can do. Amazingly, they come through with fantastic results exceeding everyone’s expectations. Great movie, by the way.

Medium-Term Growth Strategy

Our goal over the medium term (4-5 years) is to have impact well beyond our current 100+ customers given what we see in the global market opportunity for acoustic gunshot detection and ancillary services. We are aware of the strong headwinds we face due to the coronavirus pandemic and its associated problems, which could dampen our growth prospects over the next several months. That being said, we remain confident that the fundamental tenets of our medium to long term market opportunity remain intact. We do not currently see anything that would suggest we are going to experience an urban gun crime peace dividend or diminished need for our solution. Sadly, the world has become more dangerous, with more guns, less social cohesion and increasingly manpower-challenged police departments.

Our path to $100 million in annual recurring revenue over the medium term remains the same. The first task is to retain our 100+ customers in order to hold onto the approximately $43 million in annual recurring revenue1 we closed the year with in 2019. Our next priority is to engage in expansion opportunities from those existing 100 customers, which we estimate to be approximately 100 miles totaling approximately $6-7 million in annual recurring revenue. We also need to double the customer base from 100 to 200, adding another approximately 100 net new customers. These customers would on average need deploy 5 square miles each for a total of 500 square miles, adding another approximately $33-35 million of annual recurring revenue.

Our international business in the medium term consists of opportunities in the Caribbean, Latin America and South Africa. We have established a good foundation in the Caribbean and South Africa and expect to add customers from Mexico, Brazil, Colombia and Panama in the near future. We believe over the medium term we can generate approximately $10-15 million in annual recurring revenue from international business.

Missions, our precision policing solution based on our HunchLab technology acquisition from Azavea, is off to a solid start. Agencies are increasingly looking to implement intelligence-led, data-driven strategies, and we believe Missions suits that purpose perfectly. As a ShotSpotter Flex upsell that directly integrates our proprietary gunfire data, we believe Missions can drive at least $5 million in annual recurring revenue over the medium term and could potentially drive growth beyond that to the extent we were prepared to go global and/or consider offering Missions to non-ShotSpotter Flex users more broadly.

The security business pipeline is growing as we increasingly field inbound interest from corporate prospects in addition to our traditional college campus security prospects. This year we specifically dedicated a sales resource along with complementary marketing programs with the goal of making that an approximately $5 million annual recurring revenue business over the medium term.

|

ShotSpotter Shareholder Letter |

6 |

|

In total this represents an opportunity for approximately $110 million in annual recurring revenues, which does not include ancillary growth drivers such as data sales, ShotSpotter Labs or modest price increases. Nor does it include platform extensions into the post-gunfire incident investigation space, which could be developed organically or sourced through acquisition. Our target operating model for |

|

the medium term at $100 million in revenue would yield approximately 65-70% gross margin and Adjusted EBITDA margin2 of approximately 45%+. COVID-19 Part II It is encouraging to see how people are coming together to address this pandemic. COVID-19 taught us an important lesson on how connected and dependent we are on one another. In many ways, it has brought out the best in us. Having ongoing dialogue with our customers, we became intimately familiar with the resource challenges they were having around personal protective equipment (PPE). |

|

Police departments are the proverbial cobbler’s children when it comes to PPE, despite the fact that their job requires them to engage in up-close and personal contact. We are grateful to have been able to leverage our contract manufacturing partner and their proprietary Asian based supply chain network to source and procure 20,000 N-95 masks that we distributed to many of our law enforcement partners. Although our donation was extremely modest, relative to the need of our customers, they were appreciative of the gesture and very surprised about our nimbleness in proving the art of the possible.

We will be in a brave new world even when things “open back up”. Our customers and prospects will be fatigued at best and more likely, distracted due to a whole new set of enforcement measures and demands. A major crisis such as COVID-19 often reshapes policing, and we will be an active partner with our customers to help shape and adapt to this new reality. It is very likely that in the near term, municipal budgets will be reduced, putting pressure on elected officials and their police departments to prioritize their spending, while demands for municipal services could simultaneously increase. Potential material reductions in force would exacerbate this challenging environment. We do see, however, some partial relief on municipal budget pressures coming from federal stimulus. For example, the Edward Byrne Memorial Justice Assistance Grant (JAG) Program within the Department of Justice received a plus-up of $850 million for fiscal 2020 as a part of the recent $2.2 trillion federal stimulus bill.

1.We define annual recurring revenue as the revenue we would contractually expect to receive from customers over the following 12 months, without any increase or reduction in any of their subscriptions, and assuming that contracts existing as of the measurement date will all renew at their respective contract expirations.

2.We define Adjusted EBITDA margin as net income or loss before interest (income) expense, income taxes, depreciation and amortization and stock-based compensation expense, divided by total revenues.

|

ShotSpotter Shareholder Letter |

7 |

As a company, we will need to sharpen and re-position our value proposition, where appropriate, to make it relevant to prospects in this brave new world. We will travel less and have more video sales calls and consultative engagements. As such we are required to master high production quality and impactful video calls. We also need to fine-tune our sales playbook and customer onboarding practices to reflect this new digital reality that will limit our face to face interactions. We are already making excellent progress on this front.

When an agency decides whether to move forward with or renew their ShotSpotter services, I have often said, “it’s not about the money” and “it is (or was) much more about deciding to prioritize an intelligence-led, focused deterrence strategy in order to prevent and reduce gun violence”. While that was very true last month and in prior years, it may not be the case now in this new normal. We’re going to have to become much more involved and value added in helping our customers where needed, to get creative to identify and get funding. Opening our Washington DC office this June is fortuitous in this regard. We have already been working on the legislative front on securing a funding stream specifically targeted for gunshot detection technology (see HR Bill 5385 with bipartisan sponsorship from Representatives Kelly and Sensenbrenner). Being local in DC gives us the opportunity to get in front of and have many more touch points with people and organizations directly responsible for and influence of major funding streams we can help direct to our customers for ShotSpotter.

We unfortunately do not see an appreciable reduction in gunfire despite broad-based quarantine directives. Sadly, it is business as usual and we know we are headed into our traditional seasonal gun violence uptick, as the weather warms up and school is in recess for the summer. We believe that uptick could potentially spike even more, with increased unemployment, higher economic anxiety, more drug and alcohol abuse and less social cohesion (remember people fighting in the aisles of Walmart for toilet paper?). Even more concerning will be the re-establishment of gang/drug trade territories that are up for grabs coming out of quarantine. Unfortunately, gangs do not “lawyer up” with attorneys to settle disputes, they “grip up” with guns. Add in law-enforcement workforce depletions and we have a potentially very challenging situation. In this scenario, we believe the demand for our solutions could increase, as technology-enabled, intelligence-led strategies should have to be part of the discussion inside of agencies facing this difficult reality.

|

ShotSpotter Shareholder Letter |

8 |

I am so incredibly proud of this team and the strong collaborations we have forged with our many customers, not only at the agency level but at the personal level. We have a purpose-built culture with strong stakeholder alignment. At the business level, we have built a unique and specialized technology with strong barriers to entry. We have good recurring revenue visibility and a strong balance sheet. But most of all we continue to make solid progress in a largely underserved and under-penetrated market, doing work that matters in helping solve a very large societal problem.

I’ll close this letter by saying, I hope you and your loved ones stay safe and healthy.

Looking forward to our journey over the coming year and beyond.

Sincerely,

Ralph Clark

This letter contains forward-looking statements, including but not limited to statements regarding: the duration of the company’s headquarters closure and travel ban and their impact on the company’s operations; the company’s ability to maintain a high revenue retention rate, high NPS and low customer acquisition costs; the company’s plans to grow its customer success organization in 2020; the company’s plans to retain existing customers, take advantage of expansion opportunities within its existing customer base, and add additional customers, both internationally and domestically; the company’s plans to generate revenues from sales of ShotSpotter Missions and its security product offering; and the company’s efforts to assist its customers with securing funding for purchases of the company’s services. The company’s actual results could differ materially from those stated or implied in forward-looking statements due to a number of factors, such as the duration and extent of the COVID-19 crisis and including those described in the risk factors included in the company’s most recent annual report on Form 10-K and other SEC filings. These forward-looking statements are made as of the date of this letter and are based on current expectations, estimates, forecasts and projections as well as the beliefs and assumptions of management. Except as required by law, the company undertakes no duty or obligation to update any forward-looking statements contained in this letter as a result of new information, future events or changes in its expectations.

|

ShotSpotter Shareholder Letter |

9 |