COMPANY CONFIDENTIAL Exhibit 99.1

Analyst & Investor Day December 17, 2019

Cautionary Note Regarding Forward-Looking Statements This presentation contains "forward-looking statements" within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, including but not limited to statements regarding ShotSpotter, Inc. (the “company”) and its overall business, market leadership, total addressable market, expectations regarding product development milestones, future marketing initiatives, future sales and expenses, and revenue and profit guidance for 2019 and 2020. These forward-looking statements are made as of the date of this presentation and are based on current expectations, estimates, forecasts and projections as well as the beliefs and assumptions of management. words such as "expect," "anticipate," "should," "believe," "target," "project," "goals," "estimate," "potential," "predict," "may," "will," "could," "intend," “strategy”, “opportunity” and variations of these terms or the negative of these terms and similar expressions are intended to identify these forward-looking statements. Forward-looking statements are subject to a number of risks and uncertainties, many of which involve factors or circumstances that are beyond the company’s control. The company’s actual results could differ materially from those stated or implied in forward-looking statements due to a number of factors, including but not limited to: the company’s ability to maintain and increase sales; the availability of funding for the company’s customers to purchase the company’s solutions; the complexity, expense and time associated with contracting with government entities; the company’s ability to maintain and expand coverage of existing public safety customer accounts and further penetrate the public safety market; the company’s ability to sell its solutions into new markets; the lengthy sales cycle for the company’s solutions; changes in federal funding available to support local law enforcement; the company’s ability to innovate and expand its product development, the company’s ability to deploy and deliver its solutions; and the company’s ability to maintain and enhance its brand. In addition, other factors that could impact actual results to differ from the forward-looking statements the company makes are described in the reports the company files with the Securities and Exchange Commission (the “SEC”) (available at www.sec.gov), particularly in the Risk Factors section of the company’s latest Annual Report on Form 10-K and Quarterly Report on Form 10-Q. Except as required by law, the company assumes no obligation to update these forward-looking statements publicly, or to update the reasons why actual results could differ materially from those anticipated in the forward-looking statements, even if new information becomes available in the future. 2

Introduction & Strategic Vision – Ralph Clark Market Opportunity & Product Roadmap – Sam Klepper Technology – Paul Ames & Rob Calhoun Project Management & Service Implementation – Joe Hawkins Break Customer Support & Professional Services – Nasim Golzadeh Customer Success – Paul Reeves Latin America Business Development – Jon Magin Break North American Sales – Gary Bunyard Business Model & Financials – Alan Stewart Question & Answer Session - All Tour of Incident Review Center / Mission Product Demo Webcast Participants: E-Mail for Questions: jhorne@marketstreetpartners.com Agenda

Introduction and Strategic Vision Ralph Clark, President & CEO

Purpose Customers Company Investors Purpose To earn the trust of law enforcement to help them provide equal protection to all and strengthen the police-community relationship, ultimately reducing gun violence.

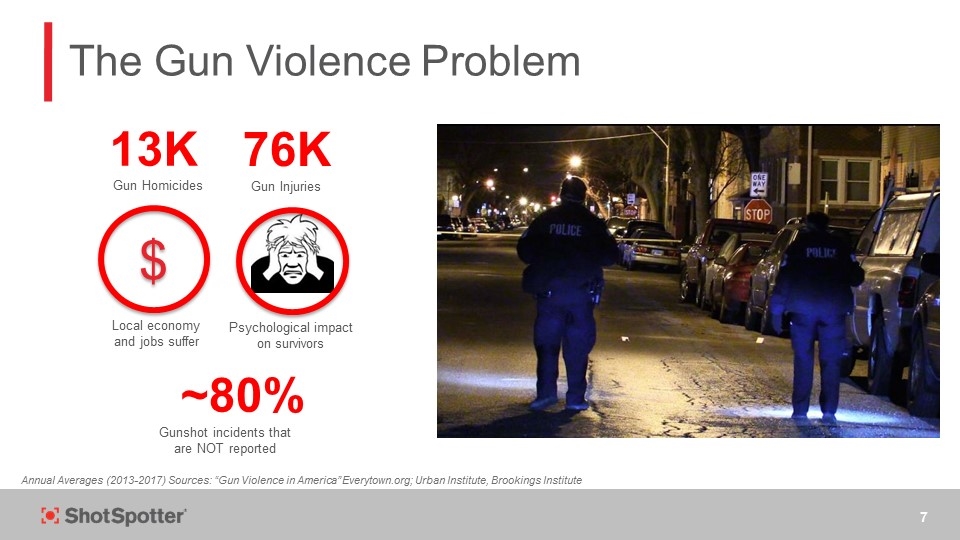

The Gun Violence Problem Annual Averages (2013-2017) Sources: “Gun Violence in America” Everytown.org; Urban Institute, Brookings Institute 13K 76K Gun Homicides Gun Injuries Local economy and jobs suffer ~80% Gunshot incidents that are NOT reported Psychological impact on survivors $

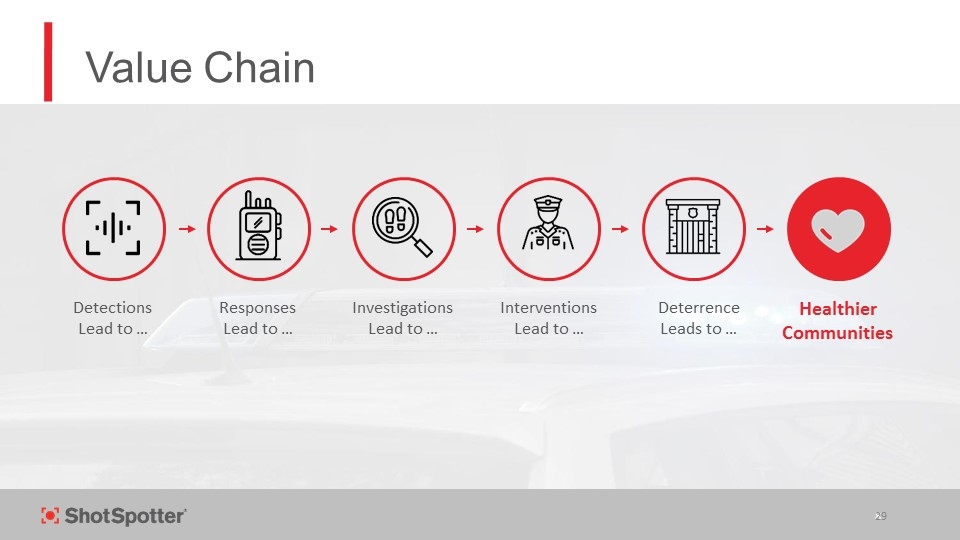

Value Chain 29 Detections Lead to … Responses Lead to … Investigations Lead to … Interventions Lead to … Deterrence Leads to … Healthier Communities

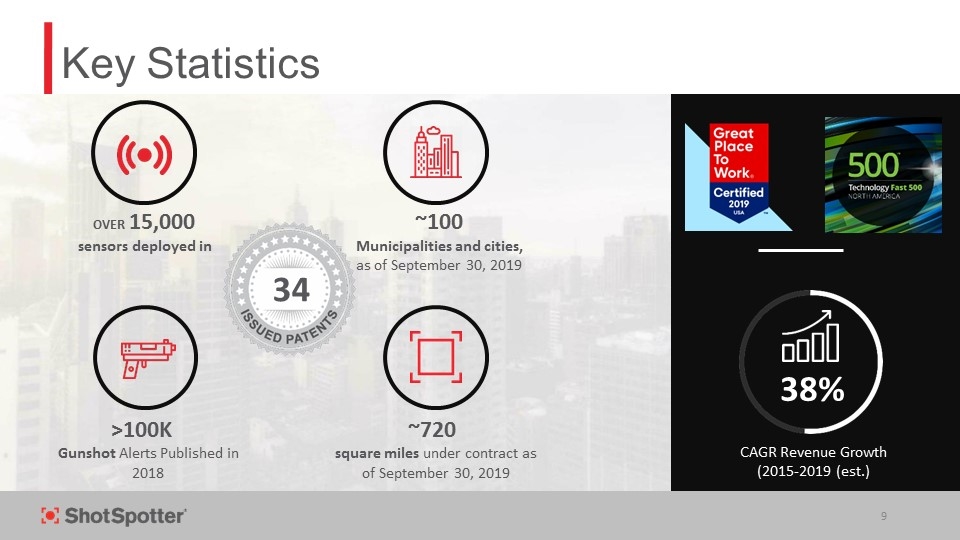

OVER 15,000 sensors deployed in ~720 square miles under contract as of September 30, 2019 >100K Gunshot Alerts Published in 2018 ~100 Municipalities and cities, as of September 30, 2019 34 38% CAGR Revenue Growth (2015-2019 (est.) Key Statistics

Grow Business to Over $100M of Diversified, Profitable, Recurring Revenues Protect and Maintain ~ $43M of Deployed ARR Add ~ 600 New Gross Domestic Miles ~ 100 Miles of Expansion ~ 500 Miles from New Customers ~ 100 Cities Grow International Business to ~ $15M in Annual Revenues Grow Missions & Security to ~ $10M in Annual Revenues Medium Term Growth Strategy

Continue to Invest in Technological Innovation and Seek Platform Extension Opportunities Leverage NPS & Customer On-boarding / Success to Broader and Deeper Market Adoption Expand Go-to-Market Capabilities and External Partnerships Remain Passionate and Purposeful in Our Collective Work of Making a Difference Growth Levers

Market Opportunity Product Update Sam Klepper, SVP Marketing & Product Strategy

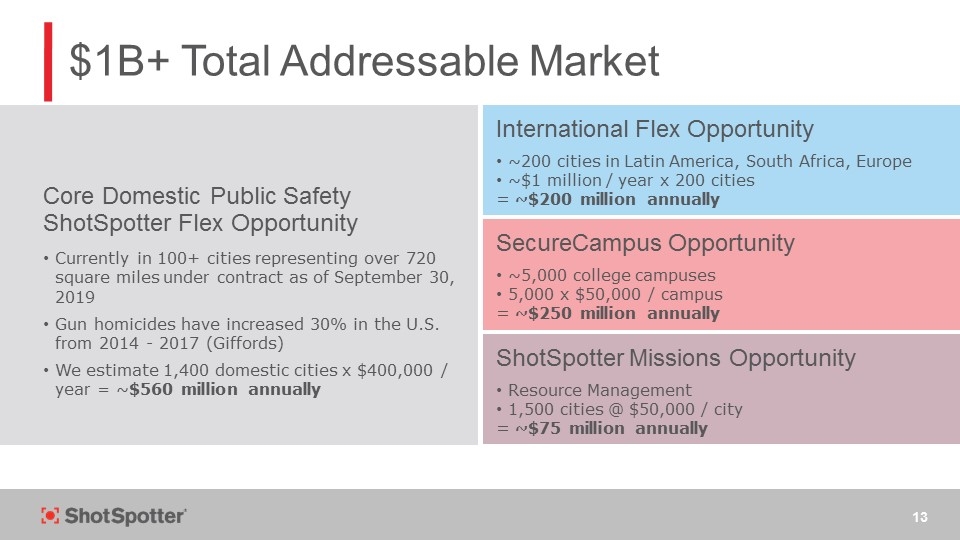

$1B+ Total Addressable Market Core Domestic Public Safety ShotSpotter Flex Opportunity Currently in 100+ cities representing over 720 square miles under contract as of September 30, 2019 Gun homicides have increased 30% in the U.S. from 2014 - 2017 (Giffords) We estimate 1,400 domestic cities x $400,000 / year = ~$560 million annually International Flex Opportunity ~200 cities in Latin America, South Africa, Europe ~$1 million / year x 200 cities = ~$200 million annually SecureCampus Opportunity ~5,000 college campuses 5,000 x $50,000 / campus = ~$250 million annually ShotSpotter Missions Opportunity Resource Management 1,500 cities @ $50,000 / city = ~$75 million annually

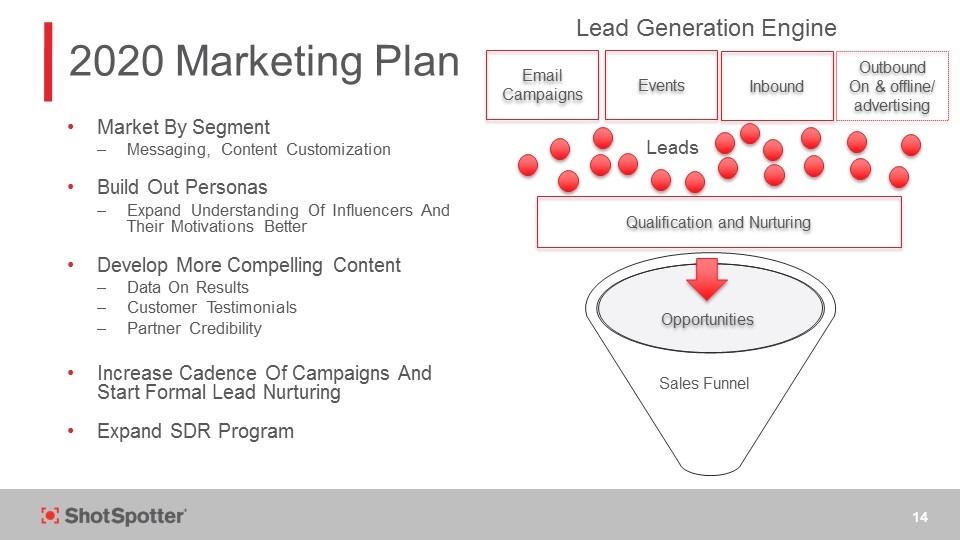

2020 Marketing Plan Market By Segment Messaging, Content Customization Build Out Personas Expand Understanding Of Influencers And Their Motivations Better Develop More Compelling Content Data On Results Customer Testimonials Partner Credibility Increase Cadence Of Campaigns And Start Formal Lead Nurturing Expand SDR Program Sales Funnel Lead Generation Engine Email Campaigns Events Inbound Outbound On & offline/ advertising Qualification and Nurturing Leads Opportunities

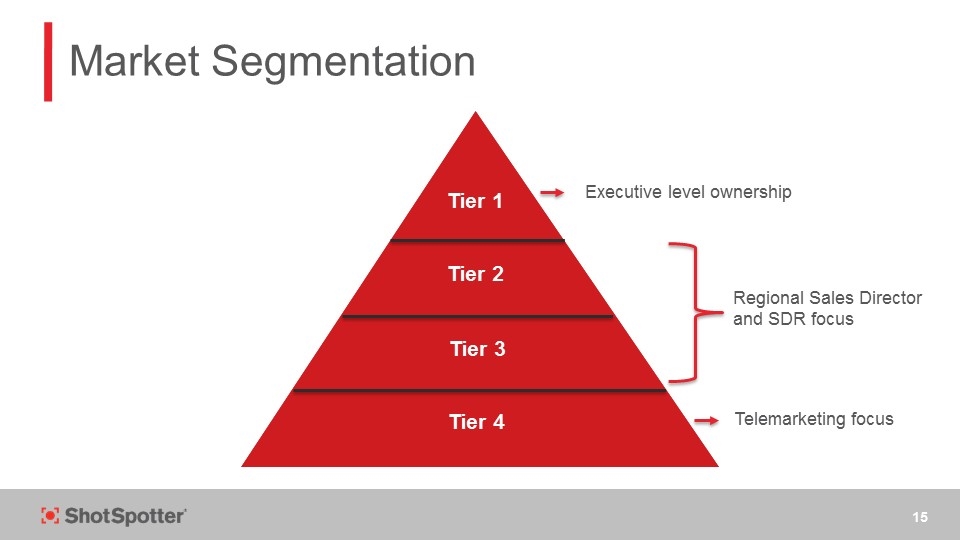

Market Segmentation Tier 1 Tier 2 Tier 3 Executive level ownership Regional Sales Director and SDR focus Telemarketing focus Tier 4

Law Enforcement Buyer Ecosystem Chief of Police DAs Local Hospitals Mayor/City Council Other Chiefs Associations Community Dept Staff

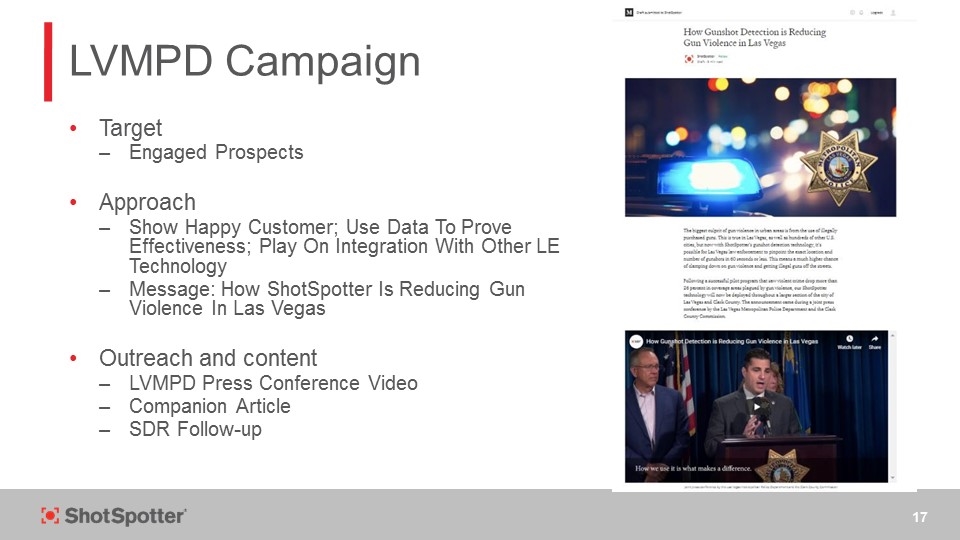

LVMPD Campaign Target Engaged Prospects Approach Show Happy Customer; Use Data To Prove Effectiveness; Play On Integration With Other LE Technology Message: How ShotSpotter Is Reducing Gun Violence In Las Vegas Outreach and content LVMPD Press Conference Video Companion Article SDR Follow-up

NIBIN Campaign Target 150+ Agencies Using CGIC but no ShotSpotter Champion/Buyer Head of CGIC/Chief or Deputy Chief Message ShotSpotter Maximizes Investment in CGIC Outreach and content Webinar - Customers Getting Results with SST + NIBIN Article “5 Key Steps” Video clips NIBIN Users who Added ShotSpotter Police Executive Research Forum (PERF) Research SDR Follow-up

Effectiveness: Chief Testimonials Chief video from IACP

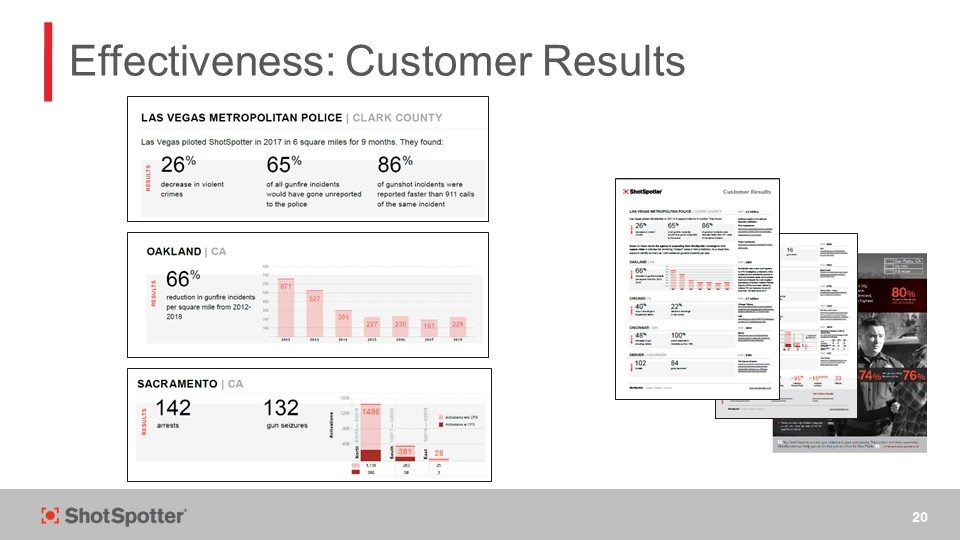

Effectiveness: Customer Results

Effectiveness: 3rd Party Studies Urban Institute Conducted Study Of ShotSpotter’s Impact On Crime And How Police Adoption Can Impact Results Denver, Milwaukee And Richmond (2016-2019) Published Best Practices Guide Confirmed ShotSpotter's Ability To: Identify Gunshots That Are Not Called Into 911 Improve Response Times Improve Evidence Recovery

Privacy Concerns: Audit Policing Project At NYU Law School Conducted Independent Review Of ShotSpotter Privacy Policies And Procedures Given Total Access To All Systems And Documentation And Total Editorial Control Over Report Content “We Ultimately Conclude That The Risk Of Voice Surveillance Is Extremely Low.”

ShotSpotter Missions Launch (HunchLab) Goal: Engage LE Agencies As Innovation Partners To Get Proprietary Insights Needed To Shape Missions Into A World-class Law Enforcement Tool Initial Target: Current ShotSpotter Flex Customers Intentionally Delayed Formal Launch Until Completed Integration With ShotSpotter Gunfire Data And Testing Of Initial Messaging And Pricing Formally Launched Early Adopter Program (EAP) For Missions With Flex Customers Starting Late Summer Of 2019 Special EAP Pricing One “Free” Mile of Flex For One Year; Ends 12/31/19 Good Progress With Signing Up Customers Signed Five EAP Deals; Expect Two More By EOY Expect Three of the Seven to Have Signed Three-Year Contracts

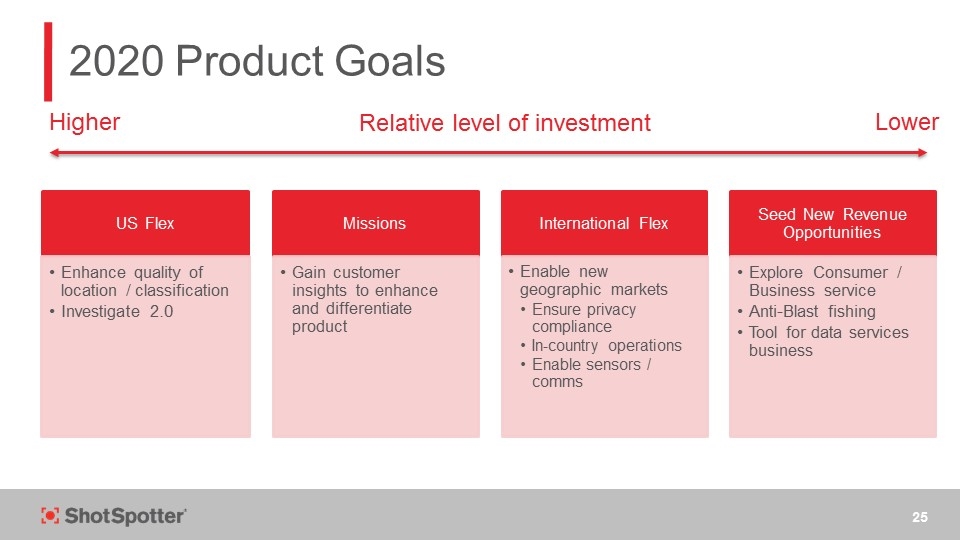

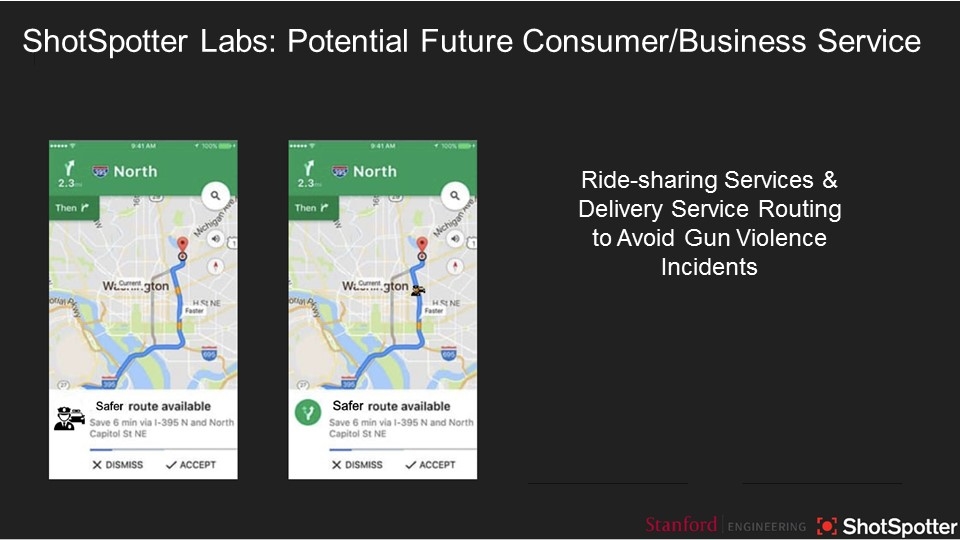

2020 Product Goals Higher Lower Relative level of investment US Flex Missions Gain customer insights to enhance and differentiate product International Flex Enable new geographic markets Seed New Revenue Opportunities Explore Consumer / Business service In-country operations Ensure privacy compliance Anti-Blast fishing Enhance quality of location / classification Enable sensors / comms Tool for data services business Investigate 2.0

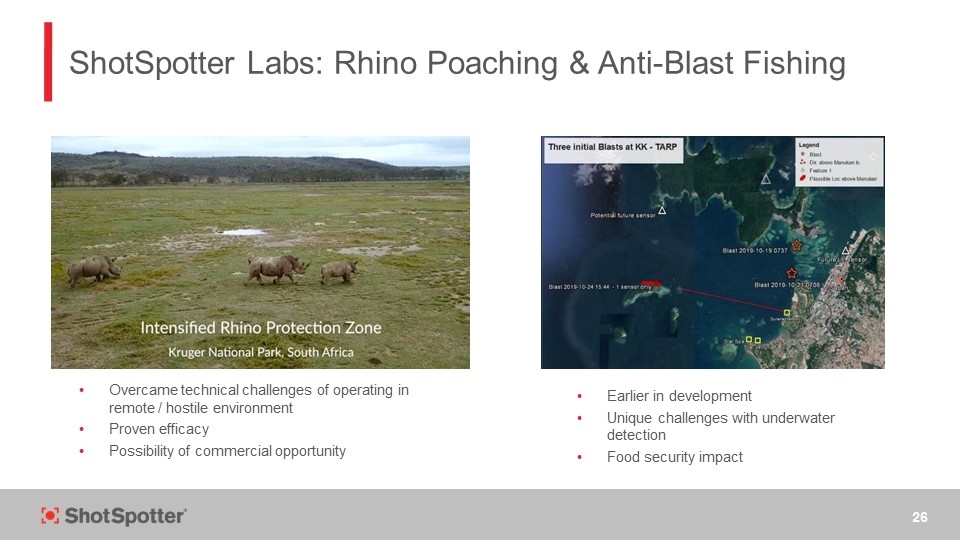

ShotSpotter Labs: Rhino Poaching & Anti-Blast Fishing Overcame technical challenges of operating in remote / hostile environment Proven efficacy Possibility of commercial opportunity Earlier in development Unique challenges with underwater detection Food security impact

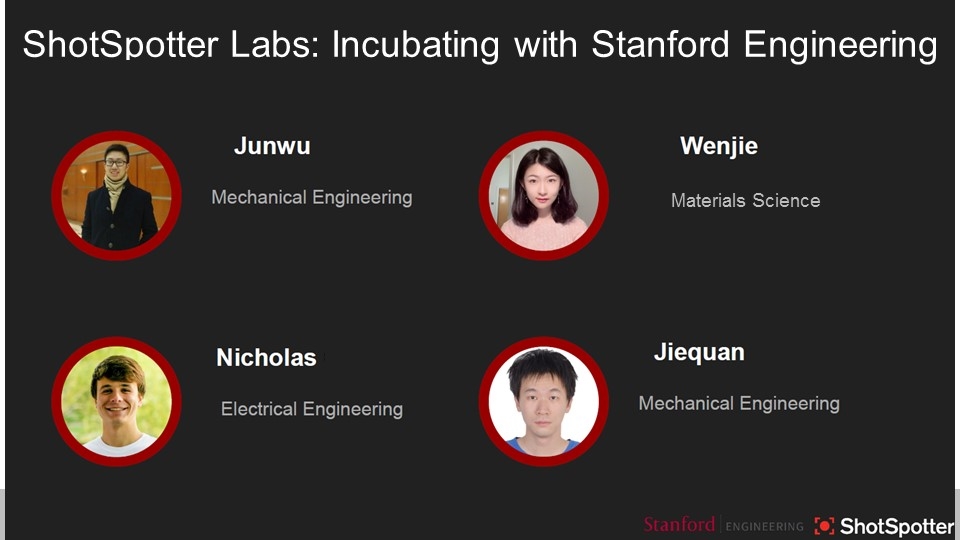

COMPANY CONFIDENTIAL ShotSpotter Labs: Incubating with Stanford Engineering Materials Science

COMPANY CONFIDENTIAL ShotSpotter Labs: Potential Future Consumer/Business Service Ride-sharing Services & Delivery Service Routing to Avoid Gun Violence Incidents

Technology Paul Ames, SVP Technology Rob Calhoun, Co-Founder

ShotSpotter Technology Overview ShotSpotter Flex Is A Wide-Area, Acoustic Gunshot Detection Location And Alerting System

ShotSpotter Core Technology Overview

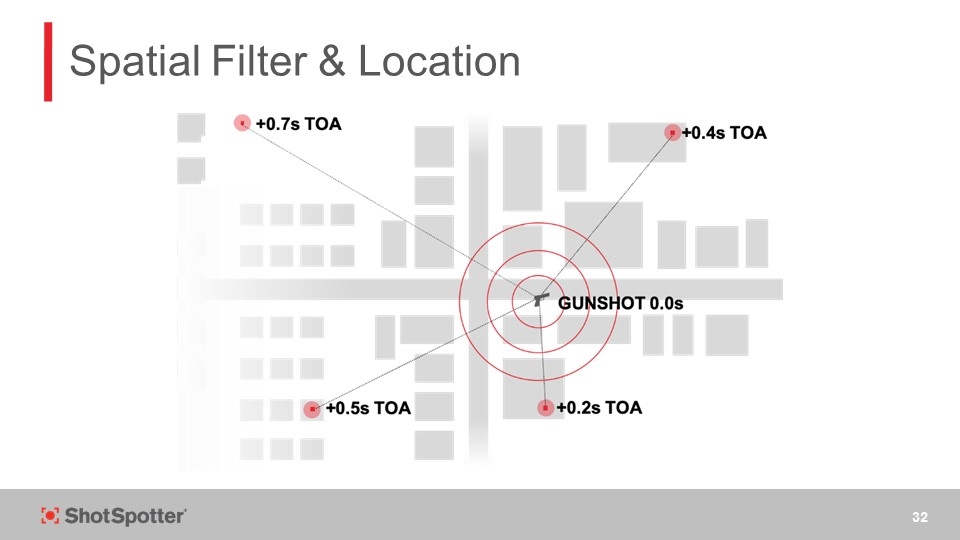

Spatial Filter & Location

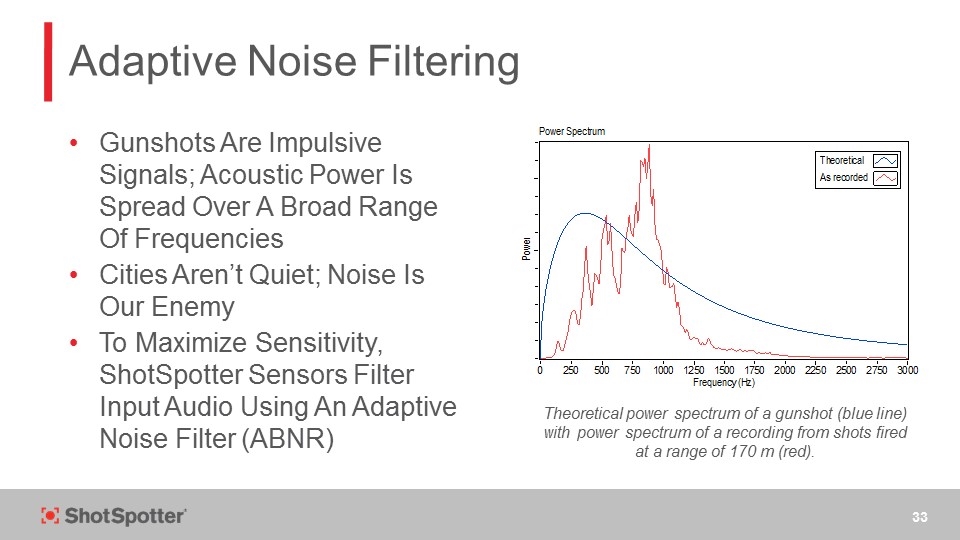

Adaptive Noise Filtering Gunshots Are Impulsive Signals; Acoustic Power Is Spread Over A Broad Range Of Frequencies Cities Aren’t Quiet; Noise Is Our Enemy To Maximize Sensitivity, ShotSpotter Sensors Filter Input Audio Using An Adaptive Noise Filter (ABNR) Theoretical power spectrum of a gunshot (blue line) with power spectrum of a recording from shots fired at a range of 170 m (red).

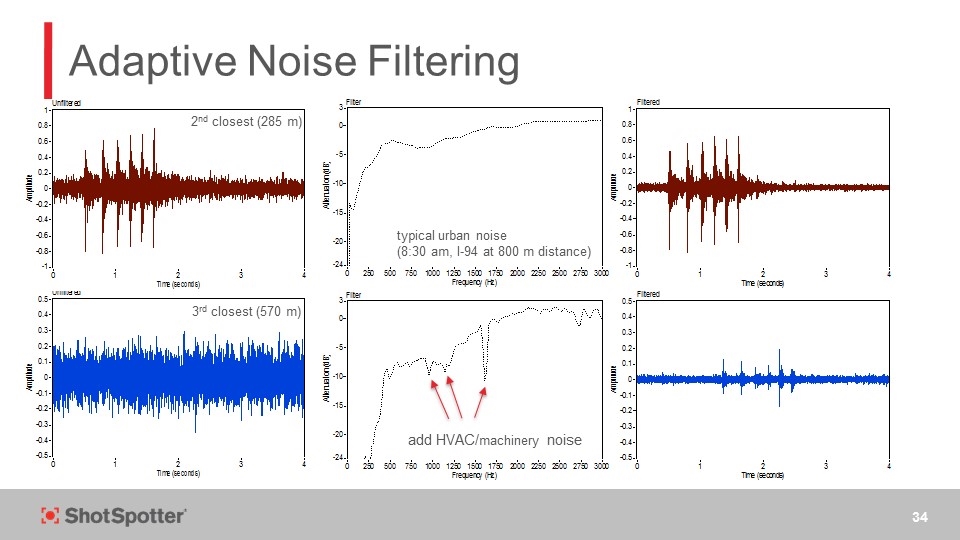

Adaptive Noise Filtering 2nd closest (285 m) 3rd closest (570 m) add HVAC/machinery noise typical urban noise (8:30 am, I-94 at 800 m distance)

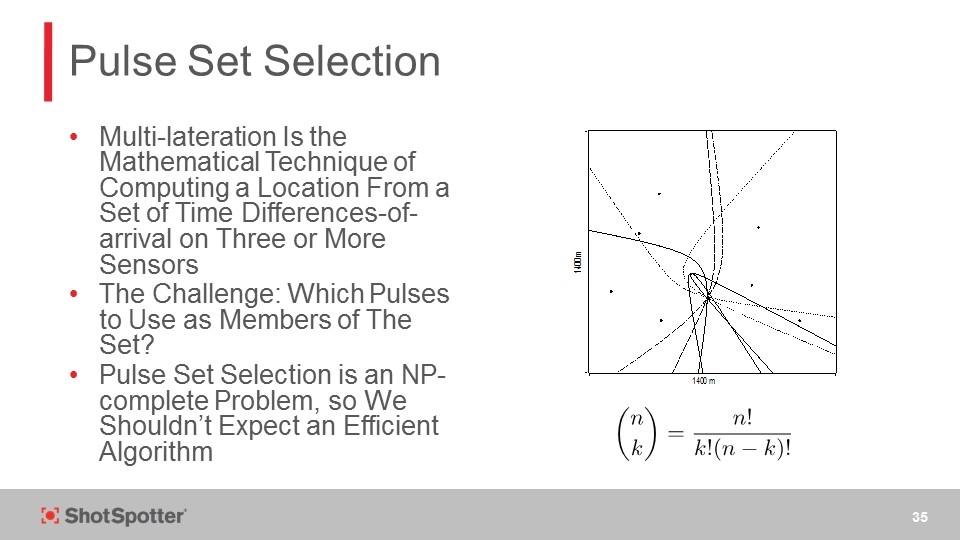

Pulse Set Selection Multi-lateration Is the Mathematical Technique of Computing a Location From a Set of Time Differences-of-arrival on Three or More Sensors The Challenge: Which Pulses to Use as Members of The Set? Pulse Set Selection is an NP-complete Problem, so We Shouldn’t Expect an Efficient Algorithm

Pulse Set Selection: Techniques We use multiple algorithms to pick pulse sets: Combinatorial optimization Cross-sensor pattern-matching Forward solutions (numerical optimization) Others... The algorithms compete against each other, trying to find the largest set of sets of pulses consistent from near-line-of-sight gunshot impulses xx

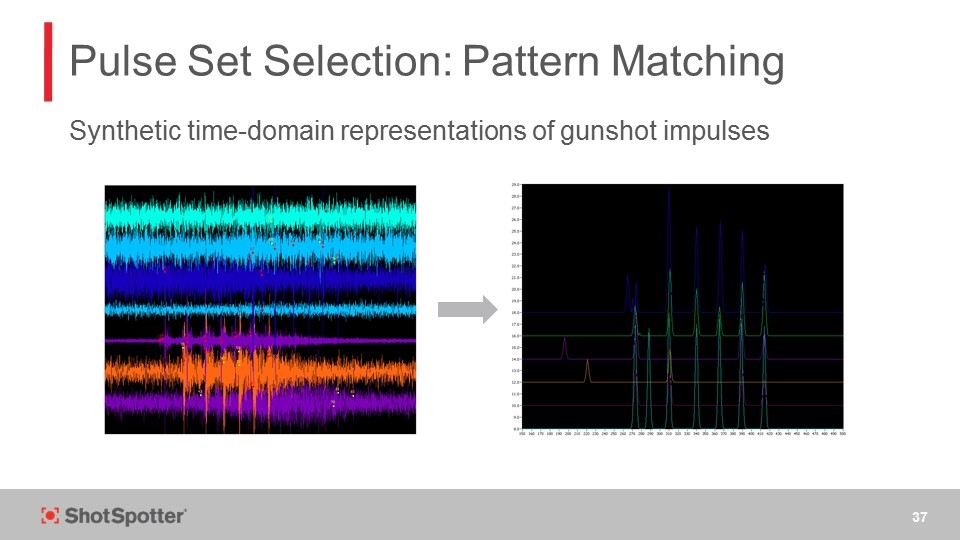

Pulse Set Selection: Pattern Matching Synthetic time-domain representations of gunshot impulses

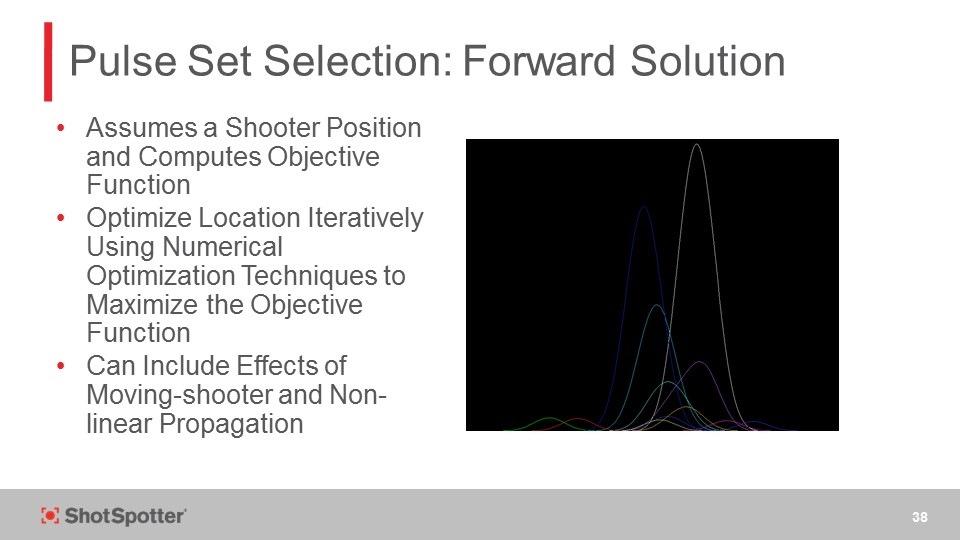

Pulse Set Selection: Forward Solution Assumes a Shooter Position and Computes Objective Function Optimize Location Iteratively Using Numerical Optimization Techniques to Maximize the Objective Function Can Include Effects of Moving-shooter and Non-linear Propagation

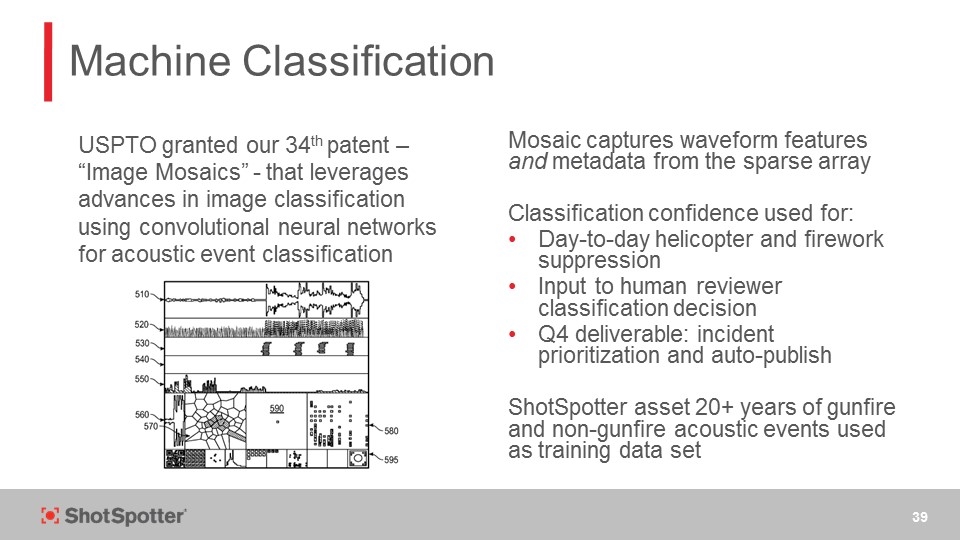

USPTO granted our 34th patent – “Image Mosaics” - that leverages advances in image classification using convolutional neural networks for acoustic event classification Machine Classification Mosaic captures waveform features and metadata from the sparse array Classification confidence used for: Day-to-day helicopter and firework suppression Input to human reviewer classification decision Q4 deliverable: incident prioritization and auto-publish ShotSpotter asset 20+ years of gunfire and non-gunfire acoustic events used as training data set

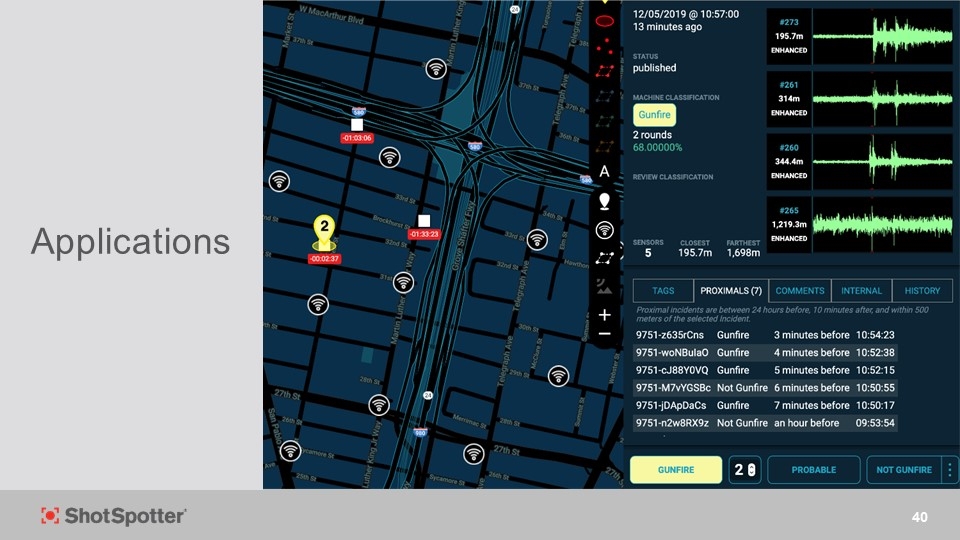

Applications

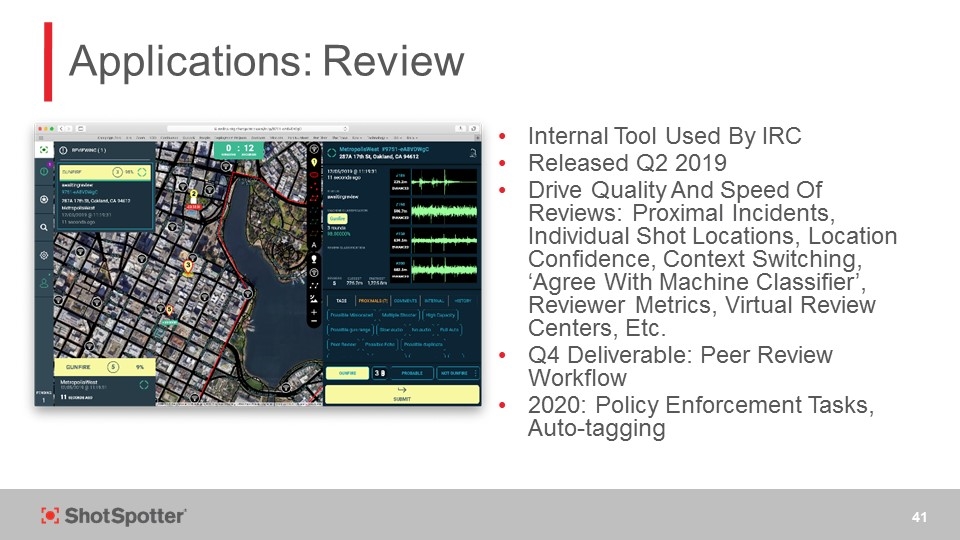

Applications: Review Internal Tool Used By IRC Released Q2 2019 Drive Quality And Speed Of Reviews: Proximal Incidents, Individual Shot Locations, Location Confidence, Context Switching, ‘Agree With Machine Classifier’, Reviewer Metrics, Virtual Review Centers, Etc. Q4 Deliverable: Peer Review Workflow 2020: Policy Enforcement Tasks, Auto-tagging

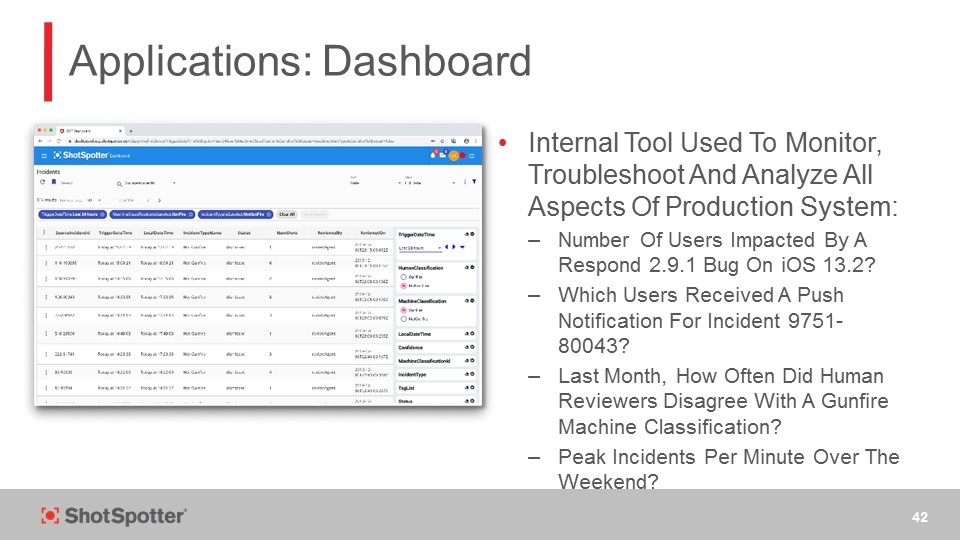

Applications: Dashboard Internal Tool Used To Monitor, Troubleshoot And Analyze All Aspects Of Production System: Number Of Users Impacted By A Respond 2.9.1 Bug On iOS 13.2? Which Users Received A Push Notification For Incident 9751-80043? Last Month, How Often Did Human Reviewers Disagree With A Gunfire Machine Classification? Peak Incidents Per Minute Over The Weekend?

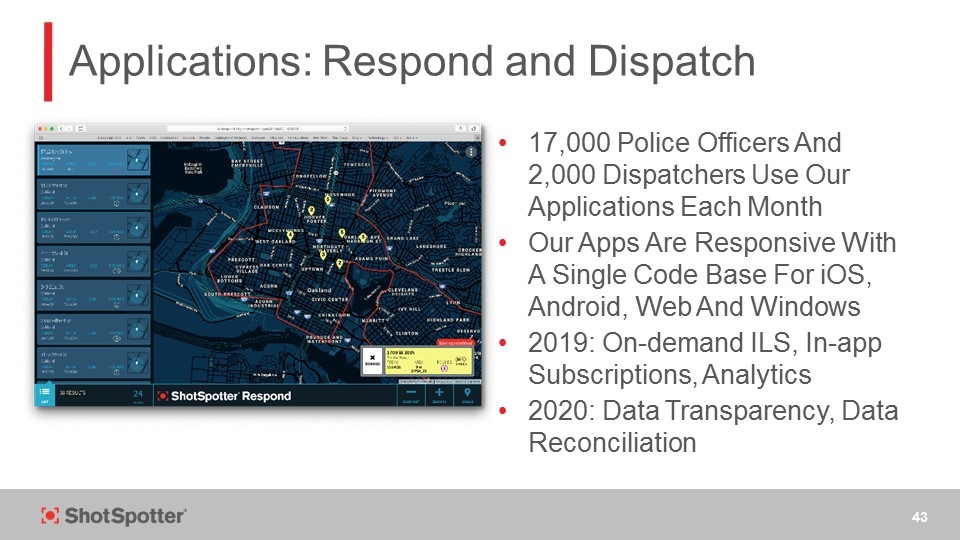

Applications: Respond and Dispatch 17,000 Police Officers And 2,000 Dispatchers Use Our Applications Each Month Our Apps Are Responsive With A Single Code Base For iOS, Android, Web And Windows 2019: On-demand ILS, In-app Subscriptions, Analytics 2020: Data Transparency, Data Reconciliation

Competitive Architectures

Competitive Architectures Proximity Sensor Single Microphone That Uses Loudness To Detect A Gunshot Machine Classification On-board With No Human Review Coverage Limited To The Area Around The Sensor No Ability To Locate The Gunshot, Other Than Saying It’s ‘Somewhere Around Here’ Multi-mic Cluster Sensor Four Or More Off-plane Microphones Capabilities Depend On Bullet Speed: Supersonic Or Subsonic Supersonic: Bullet Shock Wave Time Of Arrival Can Be Used To Calculate Trajectory And Range If Bullet Passes Within ~30 Meters Of Sensor Subsonic: Muzzle Blast Time Of Arrival Can Be Used To Calculate Azimuth; Location Limited To ‘Somewhere In That Direction’ Machine Classification On-board With No Human Review It’s Worth Noting That Almost All Gunfire In A City Is Subsonic And Not Directed At A Sensor

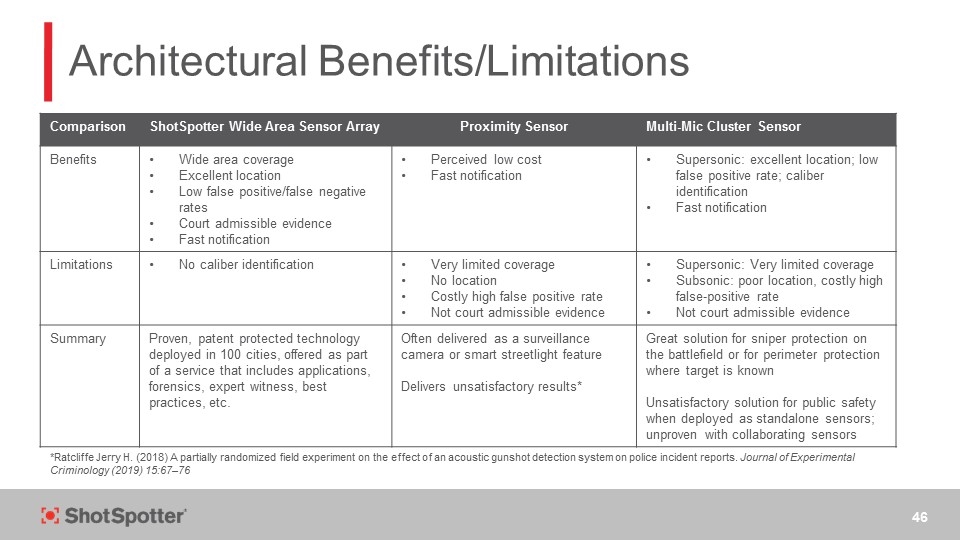

Architectural Benefits/Limitations Comparison ShotSpotter Wide Area Sensor Array Proximity Sensor Multi-Mic Cluster Sensor Benefits Wide area coverage Excellent location Low false positive/false negative rates Court admissible evidence Fast notification Perceived low cost Fast notification Supersonic: excellent location; low false positive rate; caliber identification Fast notification Limitations No caliber identification Very limited coverage No location Costly high false positive rate Not court admissible evidence Supersonic: Very limited coverage Subsonic: poor location, costly high false-positive rate Not court admissible evidence Summary Proven, patent protected technology deployed in 100 cities, offered as part of a service that includes applications, forensics, expert witness, best practices, etc. Often delivered as a surveillance camera or smart streetlight feature Delivers unsatisfactory results* Great solution for sniper protection on the battlefield or for perimeter protection where target is known Unsatisfactory solution for public safety when deployed as standalone sensors; unproven with collaborating sensors *Ratcliffe Jerry H. (2018) A partially randomized field experiment on the effect of an acoustic gunshot detection system on police incident reports. Journal of Experimental Criminology (2019) 15:67–76

Project Management & Service Implementation Joe Hawkins SVP, Operations

Operations Mission Lead The Company’s Project Teams In Designing, Configuring And Deploying New Shotspotter Flex, CampusSecure, SiteSecure And Missions Service To Our Customers Build, Install, Manage And Maintain The Acoustic Sensor Networks That Make ShotSpotter Work Sensor Array Design, Installation And Provisioning Remote Monitoring, Diagnostics And Network Management Field Service & Repair Continuously Monitor And Evaluate Gunshot Location Service Performance And Make Changes To Improve Performance Wherever Possible We Ensure The Service Our Customers Want And Pay For Works As Promised… Or Better!

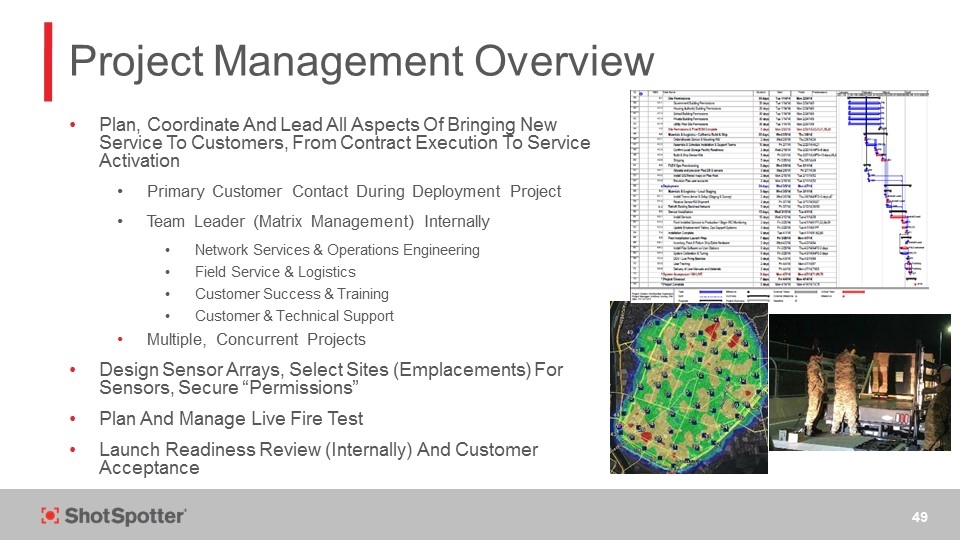

Project Management Overview Plan, Coordinate And Lead All Aspects Of Bringing New Service To Customers, From Contract Execution To Service Activation Primary Customer Contact During Deployment Project Team Leader (Matrix Management) Internally Network Services & Operations Engineering Field Service & Logistics Customer Success & Training Customer & Technical Support Multiple, Concurrent Projects Design Sensor Arrays, Select Sites (Emplacements) For Sensors, Secure “Permissions” Plan And Manage Live Fire Test Launch Readiness Review (Internally) And Customer Acceptance

Deployment Experience Seven Person Team 40 Years Collective Shotspotter Experience Extensive Backgrounds In Network Design, Systems Engineering, Sales And Public Safety Deep Relationships With Law Enforcement Shotspotter Flex™ 150+ Projects, 250+ Systems, 700+ Square Miles Projects Ranging 1 To 36 Square Miles 15 Projects >10 Square Miles 30 Projects Between 5-10 Square Miles 25 Projects Between 3-5 Square Miles 75+ Projects 3 Square Miles Or Less Securecampus™ & Sitesecure™ 9 College Campuses Up To 3.25 Square Miles 1 Freeway Security Network 1 Government “Critical Infrastructure” Facility

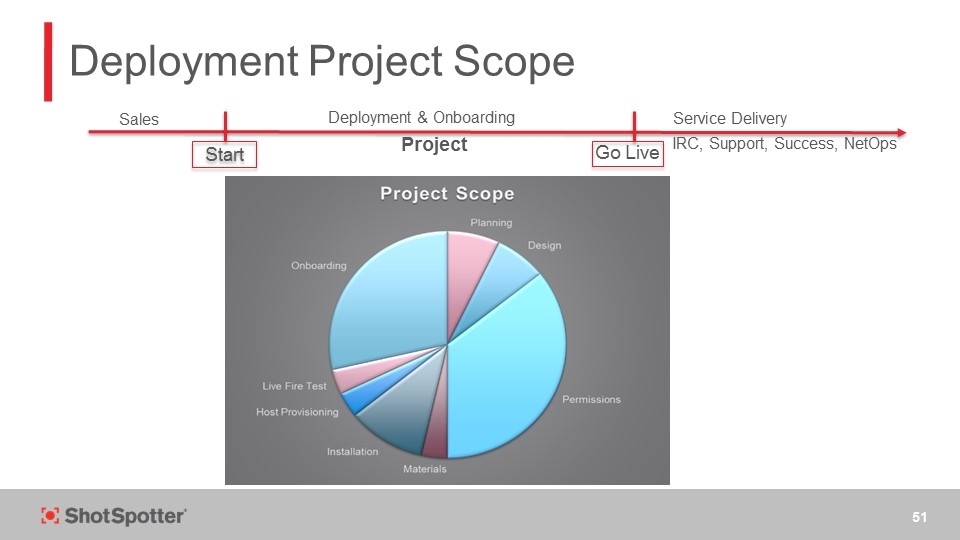

Deployment Project Scope Sales Service Delivery Deployment & Onboarding IRC, Support, Success, NetOps Project Start Go Live

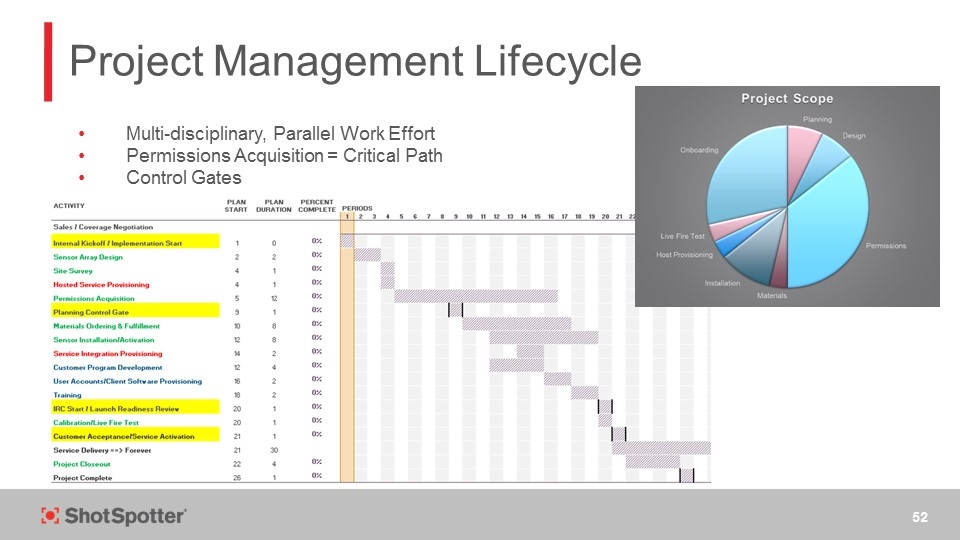

Project Management Lifecycle Multi-disciplinary, Parallel Work Effort Permissions Acquisition = Critical Path Control Gates

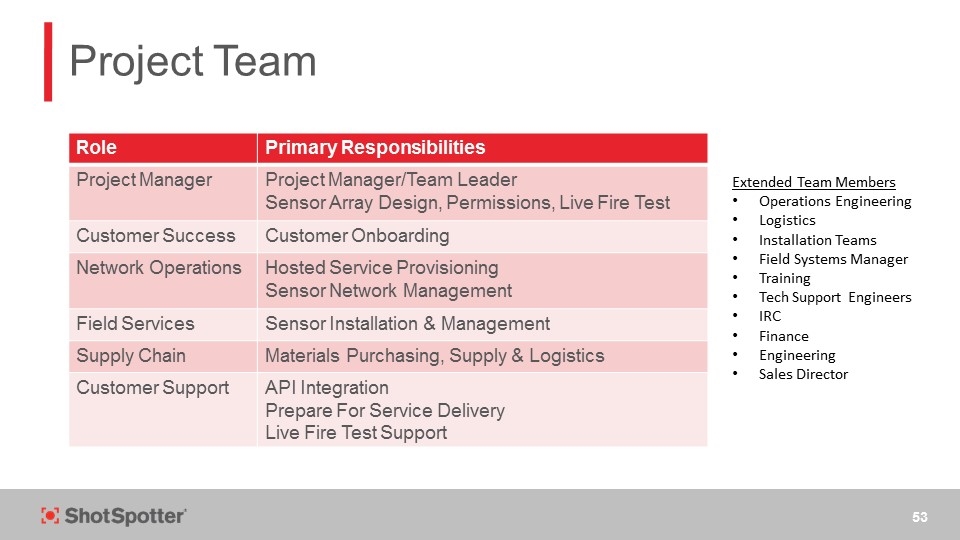

Project Team Role Primary Responsibilities Project Manager Project Manager/Team Leader Sensor Array Design, Permissions, Live Fire Test Customer Success Customer Onboarding Network Operations Hosted Service Provisioning Sensor Network Management Field Services Sensor Installation & Management Supply Chain Materials Purchasing, Supply & Logistics Customer Support API Integration Prepare For Service Delivery Live Fire Test Support Extended Team Members Operations Engineering Logistics Installation Teams Field Systems Manager Training Tech Support Engineers IRC Finance Engineering Sales Director

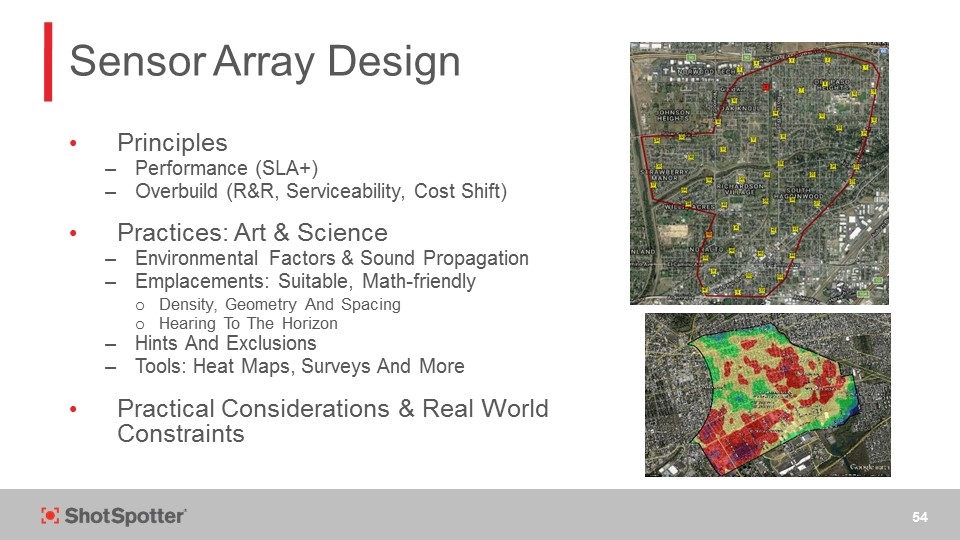

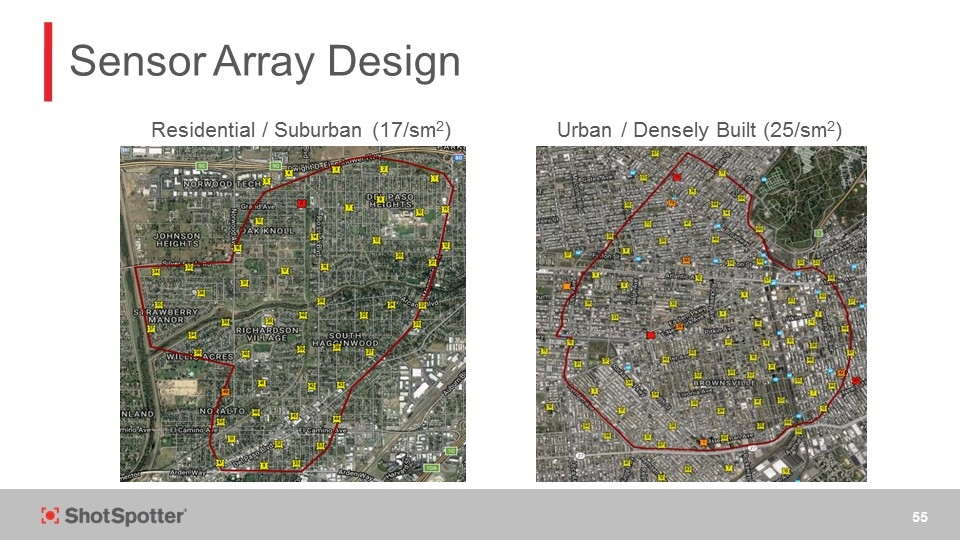

Sensor Array Design Principles Performance (SLA+) Overbuild (R&R, Serviceability, Cost Shift) Practices: Art & Science Environmental Factors & Sound Propagation Emplacements: Suitable, Math-friendly Density, Geometry And Spacing Hearing To The Horizon Hints And Exclusions Tools: Heat Maps, Surveys And More Practical Considerations & Real World Constraints

Sensor Array Design Residential / Suburban (17/sm2) Urban / Densely Built (25/sm2)

Customer Support & Incident Review Center Nasim Golzadeh SVP, Customer Support and Professional Services

Customer Support

Customer Support and Professional Services Our Mission: Serving Law Enforcement to Detect, Protect, Connect Incident Review Center (IRC) Customer Support Forensic Services Integration Services Training

Incident Review Center (IRC)

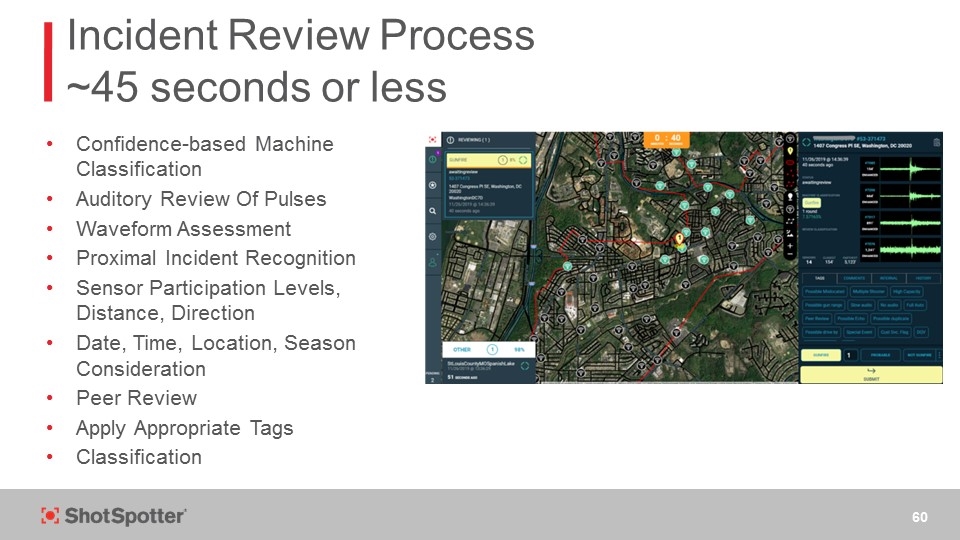

Incident Review Process ~45 seconds or less Confidence-based Machine Classification Auditory Review Of Pulses Waveform Assessment Proximal Incident Recognition Sensor Participation Levels, Distance, Direction Date, Time, Location, Season Consideration Peer Review Apply Appropriate Tags Classification

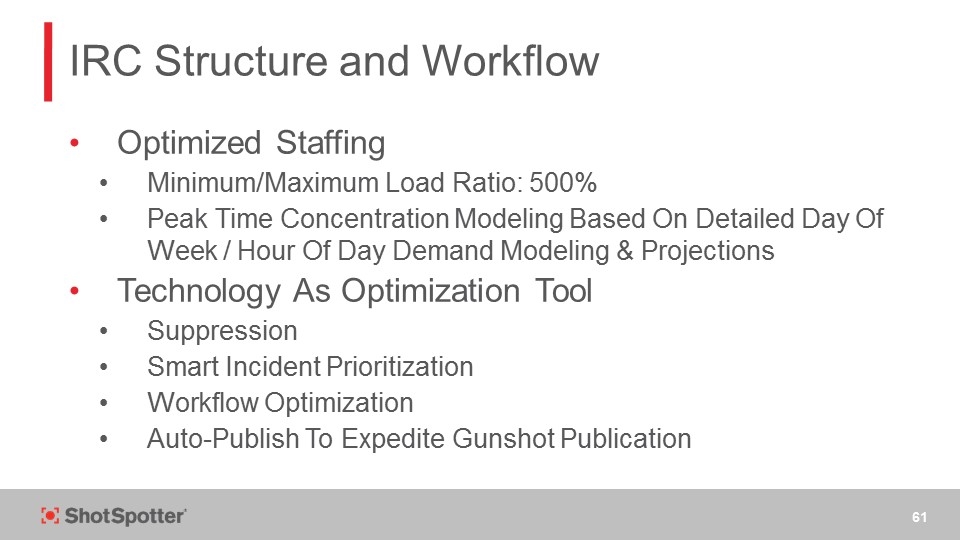

IRC Structure and Workflow Optimized Staffing Minimum/Maximum Load Ratio: 500% Peak Time Concentration Modeling Based On Detailed Day Of Week / Hour Of Day Demand Modeling & Projections Technology As Optimization Tool Suppression Smart Incident Prioritization Workflow Optimization Auto-Publish To Expedite Gunshot Publication

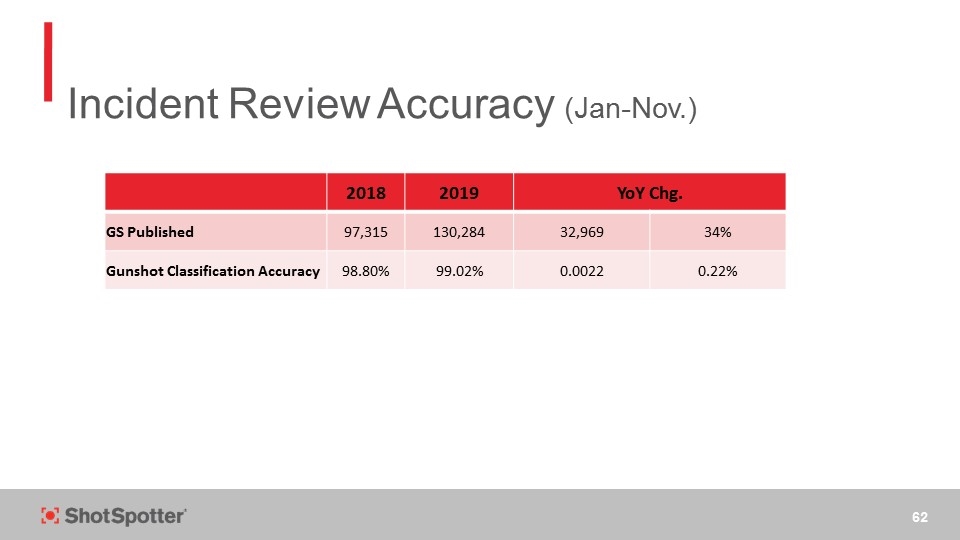

Incident Review Accuracy (Jan-Nov.) 2018 2019 YoY Chg. GS Published 97,315 130,284 32,969 34% Gunshot Classification Accuracy 98.80% 99.02% 0.0022 0.22%

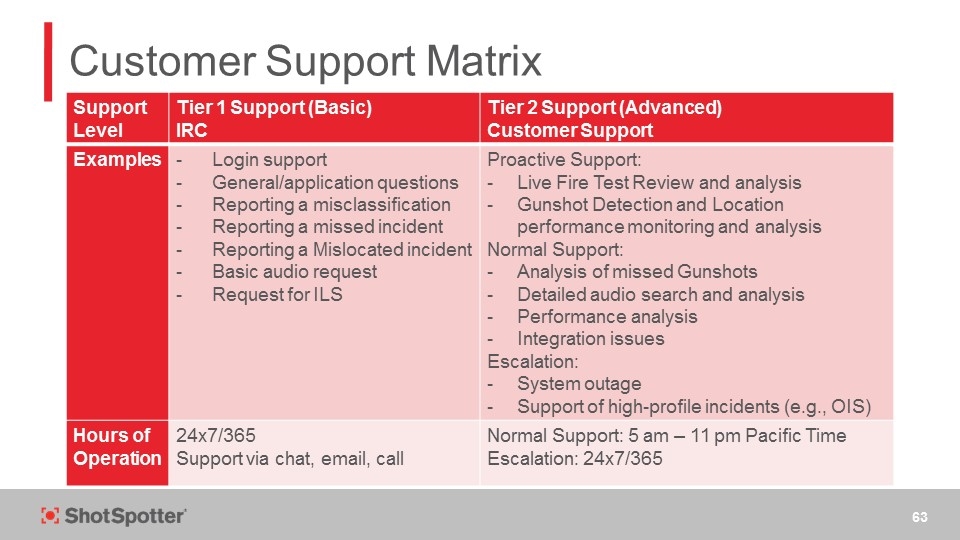

Customer Support Matrix Support Level Tier 1 Support (Basic) IRC Tier 2 Support (Advanced) Customer Support Examples Login support General/application questions Reporting a misclassification Reporting a missed incident Reporting a Mislocated incident Basic audio request Request for ILS Proactive Support: Live Fire Test Review and analysis Gunshot Detection and Location performance monitoring and analysis Normal Support: Analysis of missed Gunshots Detailed audio search and analysis Performance analysis Integration issues Escalation: System outage Support of high-profile incidents (e.g., OIS) Hours of Operation 24x7/365 Support via chat, email, call Normal Support: 5 am – 11 pm Pacific Time Escalation: 24x7/365

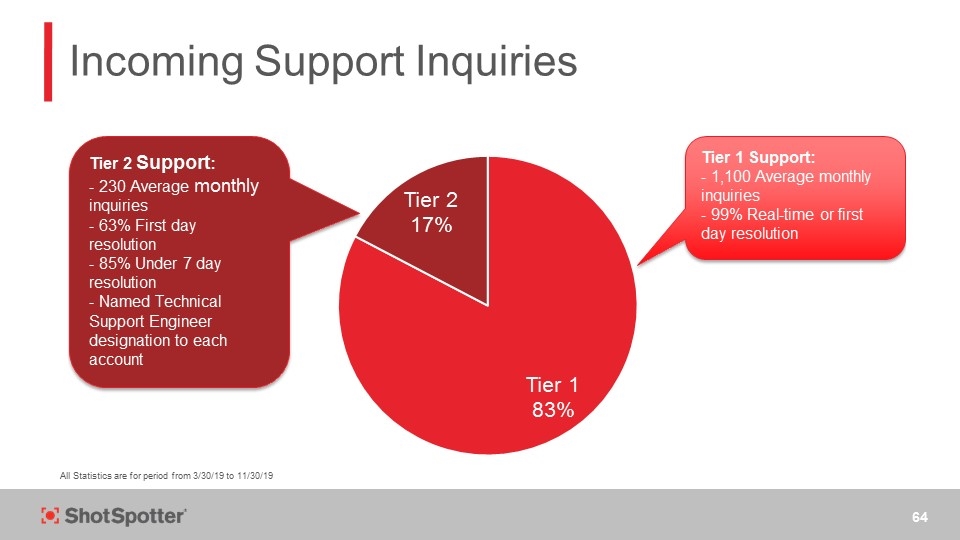

Incoming Support Inquiries All Statistics are for period from 3/30/19 to 11/30/19

Forensic Service and Litigation Support

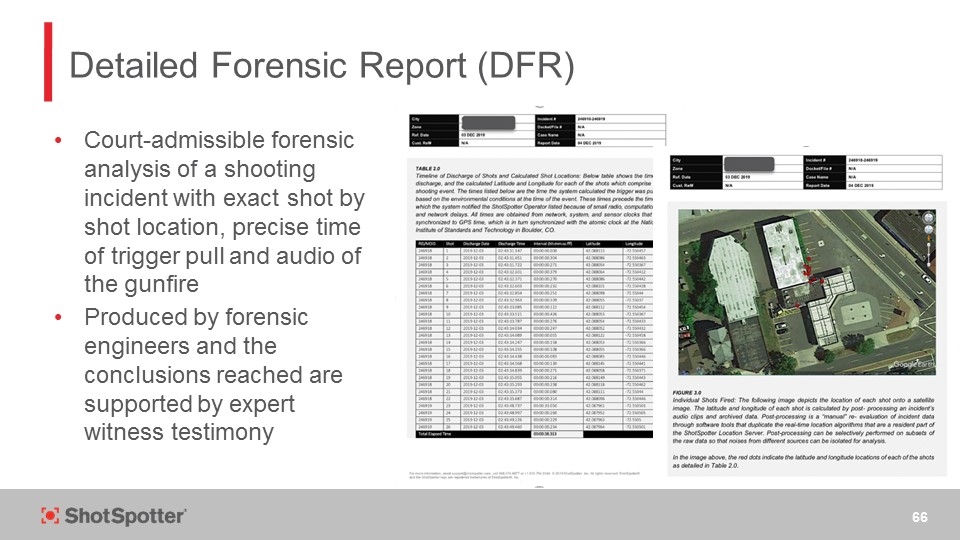

Detailed Forensic Report (DFR) Court-admissible forensic analysis of a shooting incident with exact shot by shot location, precise time of trigger pull and audio of the gunfire Produced by forensic engineers and the conclusions reached are supported by expert witness testimony

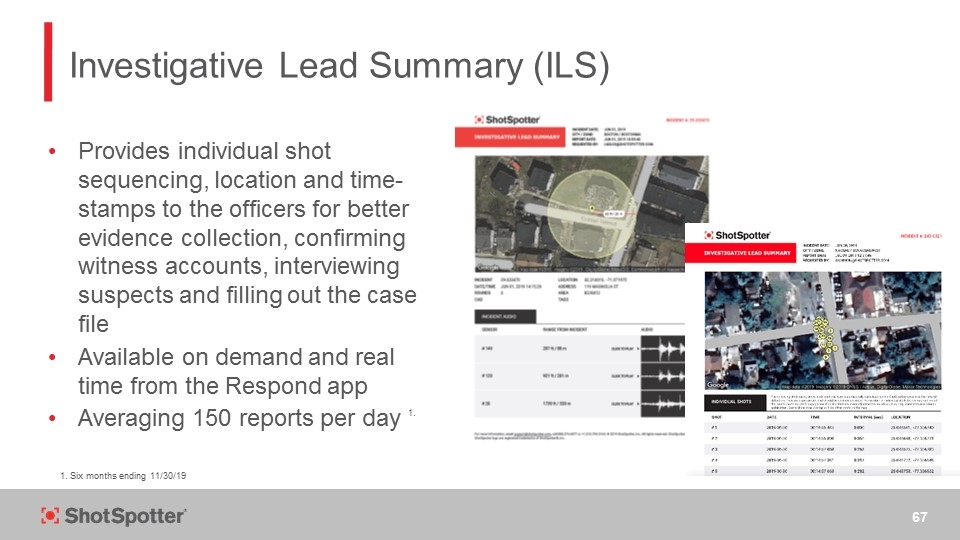

Investigative Lead Summary (ILS) Provides individual shot sequencing, location and time-stamps to the officers for better evidence collection, confirming witness accounts, interviewing suspects and filling out the case file Available on demand and real time from the Respond app Averaging 150 reports per day 1. 1. Six months ending 11/30/19

Litigation Support Assistance Extended To District Attorney’s Offices During Evidentiary Challenges To ShotSpotter Evidence Documentation Case Studies Prior Case Law Expert Witness Preparation Expert Witness Testimony For Trials, Hearings, Grand Jury Presentments And Depositions Testified To In 17 States And The District Of Columbia, With Favorable Rulings On 5 Daubert Challenges And 11 Frye Challenges. ShotSpotter Evidence Has Been Testified To In Over 160 Criminal Prosecutions Throughout The Country 1. 1. Since 2013 1.

United States vs. Godinez Shooting Of An ATF Agent In Chicago By A Known Gang Member On May 4, 2018 The DFR Precisely Located Where The Defendant Was Standing When He Fired 5 Rounds At The Agent The Other 2 Rounds Detected And Located Were Return Fire From A Chicago Police Officer Attached To The ATF Unit ShotSpotter’s Expert Testified At The Trial The Defendant Was Convicted Of Assault Of A Federal Officer And Discharging A Firearm In A Crime Of Violence And Sentenced To More Than 16 Years In Prison

Integration Services Increased Efficiency And Effectiveness Within The Customers’ Public Safety Ecosystem Increased Stickiness Revenue Opportunity VMS CAD/RMS LPR RTCC UAV Mapping Predictive Policing

ShotSpotter Notification Engine/API Footprint 60+ Existing Point-to-point Integrations Versatility Successful Integration With 25+ Different Public Safety Vendors/Systems Growth Growing Adoption Rate 25 New Integrations In 2019, Versus 10 In 2018 An Intentional Focus On Growing Our Integration Footprint

Customer Success Paul Reeves VP, Customer Success

ShotSpotter Customer Success Mission: Ensure Every ShotSpotter Customer Maximizes The Value (Success) Of ShotSpotter’s Public Safety and Security Solutions.

ShotSpotter Customer Success Team ATF Special Agent - 26 years NIBIN National Coordinator – 15 years Major, Hillsborough County Sheriff – 31 years ATF Special Agent-in-Charge – 25 years Assistant Chief, Miami Gardens PD – 28 years Patrol – Officer, NYC - 5 years Crime Analyst – East Palo Alto PD - 15 years Crime Analyst – Denver PD - 15 years

Customer Success Program

Maximizing Customer Success Onboarding Best Practices Annual Account Reviews Value Realization Coaching & Training Go-Live Partner Strategy and Program Design Analytics: Ongoing Health/KPIs Monitoring User Engagement: User Groups, Education Ongoing Coaching & Training

Net Promoter Survey Completed October 11, 2019

How NPS is Used Quantitative Measurement Of Customer Sentiment That Can Impact Sales And Renewals Coarse But Useful Indicator: Is It Working? Helping Identify References For Testimonials/ Identify Areas For Improvement Company-wide Bonuses Are Tied To NPS

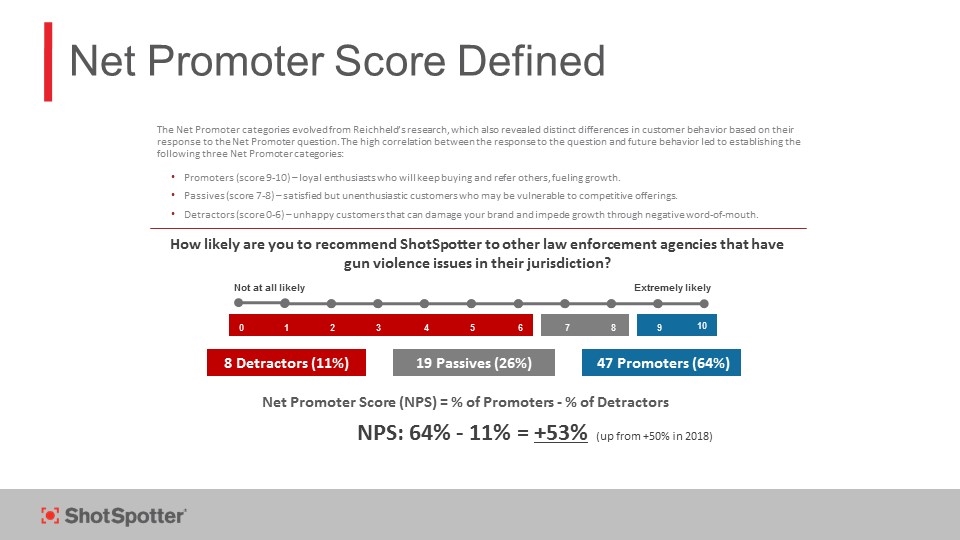

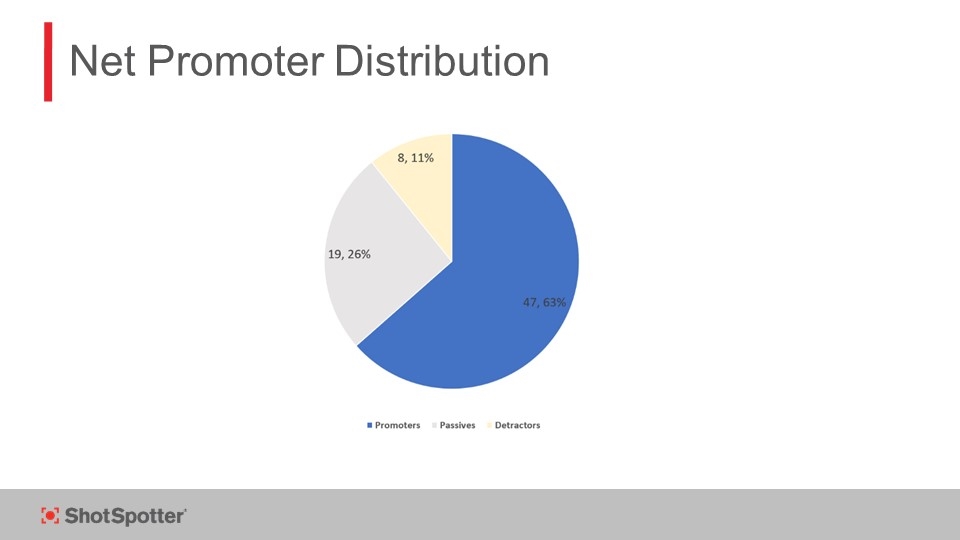

Net Promoter Score Defined The Net Promoter categories evolved from Reichheld’s research, which also revealed distinct differences in customer behavior based on their response to the Net Promoter question. The high correlation between the response to the question and future behavior led to establishing the following three Net Promoter categories: Promoters (score 9-10) – loyal enthusiasts who will keep buying and refer others, fueling growth. Passives (score 7-8) – satisfied but unenthusiastic customers who may be vulnerable to competitive offerings. Detractors (score 0-6) – unhappy customers that can damage your brand and impede growth through negative word-of-mouth. How likely are you to recommend ShotSpotter to other law enforcement agencies that have gun violence issues in their jurisdiction? 8 Detractors (11%) 19 Passives (26%) 47 Promoters (64%) Net Promoter Score (NPS) = % of Promoters - % of Detractors NPS: 64% - 11% = +53% (up from +50% in 2018) Extremely likely Not at all likely 0 1 2 3 4 5 6 7 8 9 10

Net Promoter Distribution

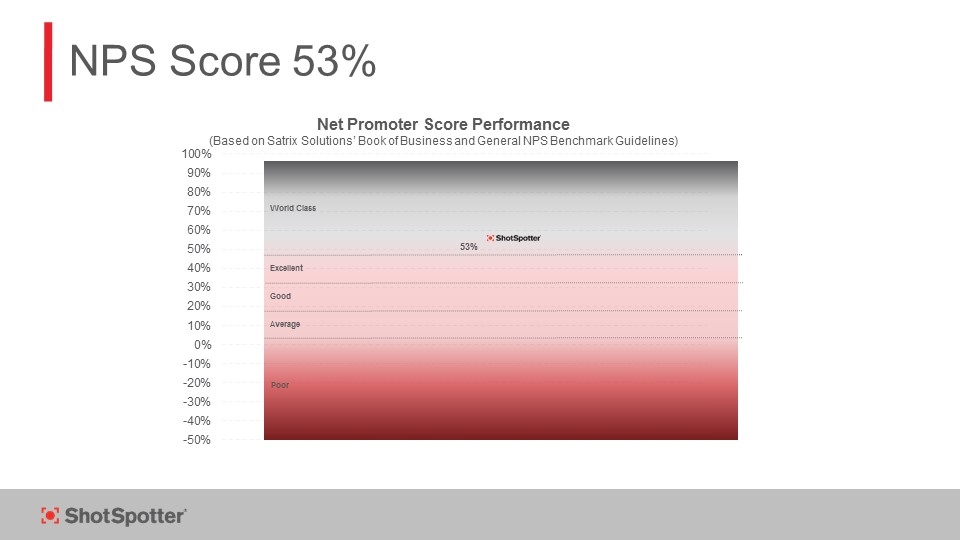

World Class Excellent Good Average Poor NPS Score 53%

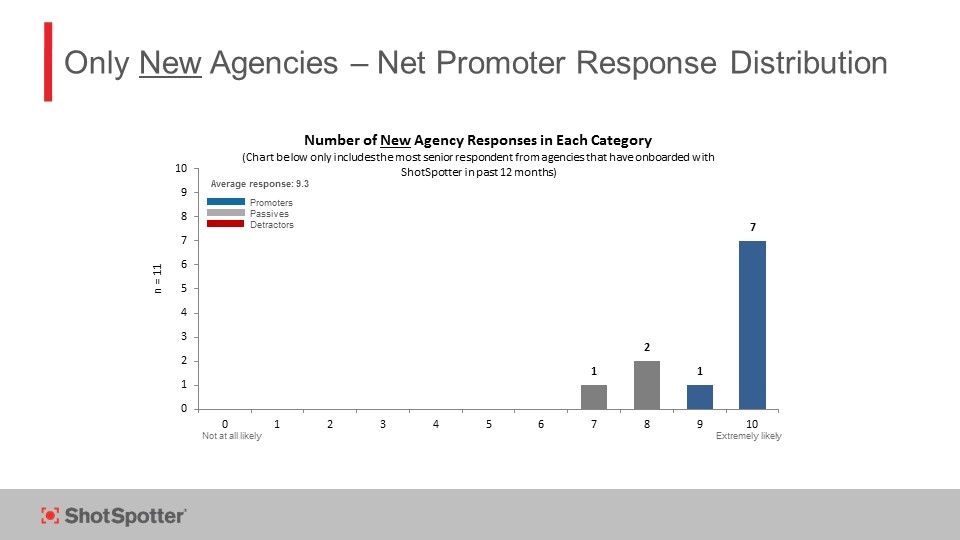

Average response: 9.3 Detractors Passives Promoters Not at all likely Extremely likely Only New Agencies – Net Promoter Response Distribution

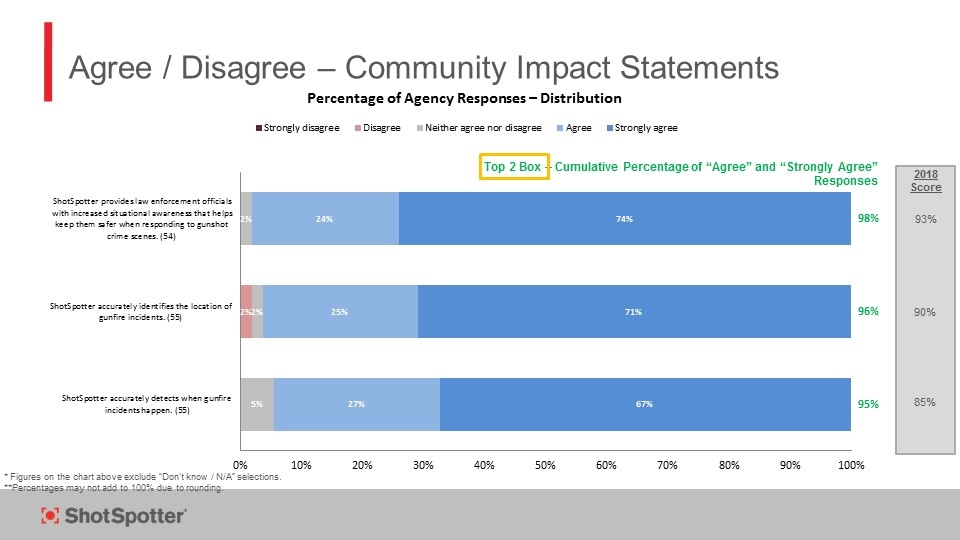

* Figures on the chart above exclude “Don’t know / N/A” selections. **Percentages may not add to 100% due to rounding. Agree / Disagree – Community Impact Statements 2018 Score 93% 90% 85% Top 2 Box – Cumulative Percentage of “Agree” and “Strongly Agree” Responses

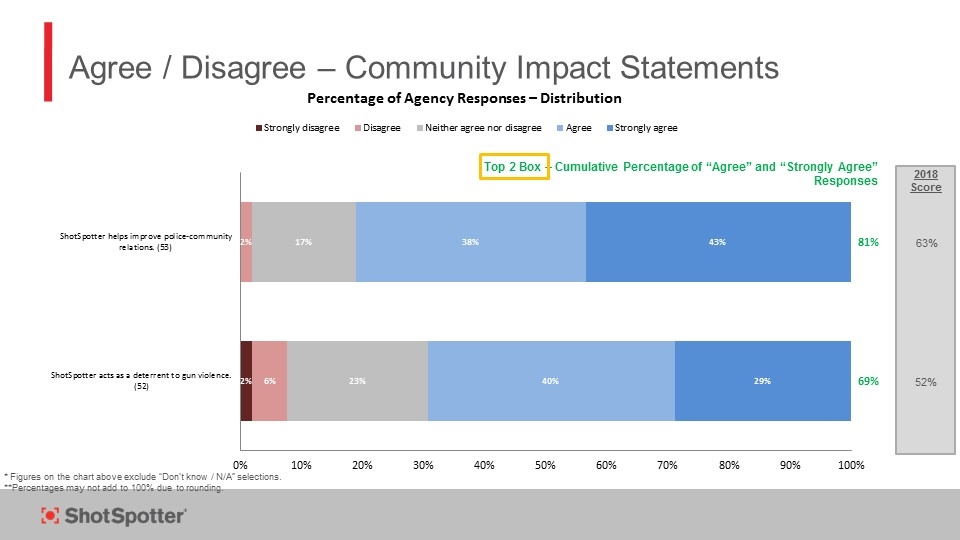

* Figures on the chart above exclude “Don’t know / N/A” selections. **Percentages may not add to 100% due to rounding. Agree / Disagree – Community Impact Statements 2018 Score 63% 52% Top 2 Box – Cumulative Percentage of “Agree” and “Strongly Agree” Responses

Positive Sentiment: Applications, Reports and Services “ ” The Investigative Lead Summary is yet another example of what proves that ShotSpotter is ever evolving with technology and looking to provide the best products possible based on needs of its customers. The Rochester Police Department has already benefited during its investigations with this new feature at the fingertips of responding officers and investigators at the scene. – Sergeant, Rochester, NY ShotSpotter applications and reports are used everyday and as a tool in briefings where communication is passed down to all the watches and this information is also used as an aid to further our felony cases. – Commander, Chicago Police Department ShotSpotter has been an extremely important component with regard to evidence collection and feeding NIBIN, especially since 76% of our gunfire incidents in our SST coverage areas are unreported. – Sergeant, Fresno, CA

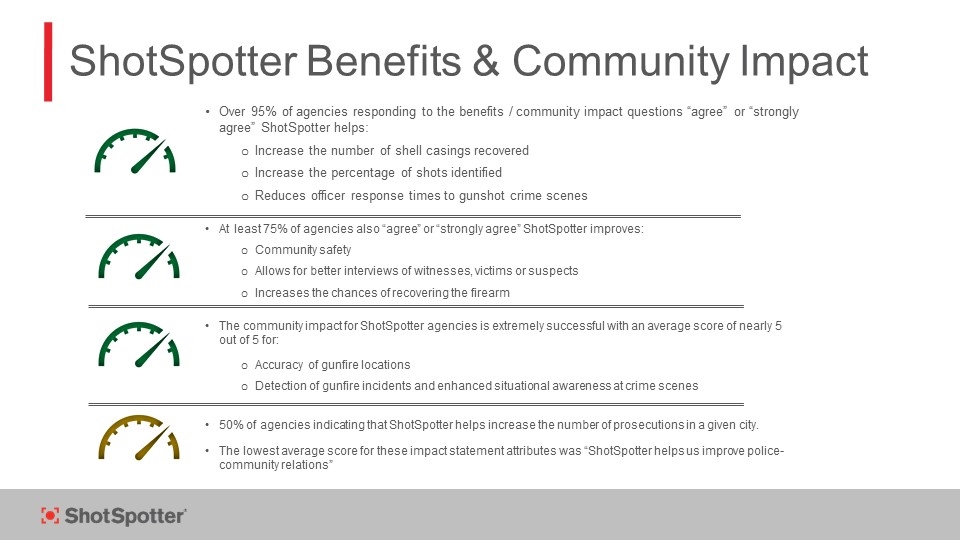

Over 95% of agencies responding to the benefits / community impact questions “agree” or “strongly agree” ShotSpotter helps: Increase the number of shell casings recovered Increase the percentage of shots identified Reduces officer response times to gunshot crime scenes At least 75% of agencies also “agree” or “strongly agree” ShotSpotter improves: Community safety Allows for better interviews of witnesses, victims or suspects Increases the chances of recovering the firearm The community impact for ShotSpotter agencies is extremely successful with an average score of nearly 5 out of 5 for: Accuracy of gunfire locations Detection of gunfire incidents and enhanced situational awareness at crime scenes 50% of agencies indicating that ShotSpotter helps increase the number of prosecutions in a given city. The lowest average score for these impact statement attributes was “ShotSpotter helps us improve police-community relations” ShotSpotter Benefits & Community Impact

Having ShotSpotter has really helped us in responding quicker to shooting scenes. This has helped our solvability rate as well. – Police Dept., Atlantic City, NJ ShotSpotter has improved our response time, has garnered us positive community responses, and works as advertised. – Assistant Chief, Louisville, KY ShotSpotter allows our officers to approach shots fired areas in a safe manner. Also in conjunction with our robust NIBNs system we are making connections amongst shootings and suspects. – Assistant Deputy Chief, Rockford, IL ShotSpotter has proven to greatly increase the accuracy of our response to gun fire in our coverage area which has led to reducing the overall amount of gun fire that was occurring before we put the technology in use. – Captain, Jackson, TN Benefits of ShotSpotter – Comments “ ”

We use this technology each and every day to help improve public safety for the community. – Police Dept., Wilmington, DE ShotSpotter has exceeded our expectations. The intelligence and real time data it provides is invaluable. Great company with outstanding service team and customer service. ShotSpotter is an integral part of our strategy. ShotSpotter Respond provides an accurate and immediate investigative tool to address gunfire within our city. Investigative lead summary is a valuable tool our detectives use to understand a crime scene. Investigator Portal allows us to use historical data to assist in deploying resources more efficiently. Audio analysis support team provide a timely response of missed or mislocated incidents to help document crime scenes. – Police Dept., Wilmington, NC ShotSpotter gets us to the right location, and much quicker. We've made over 20 arrests and seized multiple guns. It's been great. [Account review] was perfect. – LT, Bakersfield, CA Benefits of ShotSpotter – Comments “ ”

Next Steps Opportunities Net New Square Miles: 16 Agencies indicated they would likely expand their area of coverage in the future (versus 7 in 2018) The Value of Promoters: 57 respondents, representing 44 agencies, agreed to serve as a reference or provide a testimonial Customer Retention: 35 of 36 Decision Makers (95%) responding to the “likely to renew” question scored 7 or higher, suggesting a high degree of revenue predictability from these agencies Development of CGIC Strategy Services: 9 Agencies indicated their CGIC strategy is in its early phases of development; and 6 Agencies indicated they are not familiar with CGIC strategies

LATAM Market Opportunity Jon Magin, VP International Sales, LATAM

LATAM Opportunity & Focus Overview: LATAM Averages 24 Homicides Per 100k People 9% Of World Population And 40% Of All Murders Crime #1 Public Concern (Replacing Economy) Crime Cost Totals 3.6% Of GDP (Represents $2.6B In $US) Progress: Visited 10 Countries In 18 Months (Multiple Times) Meetings With 50 Customers/Integrators Met Or Conference Calls With Customers Additional 4 Countries Key Focus Countries: All With Active Proposals Mexico – Multiple Country Visits To Integrators, Customers, Partners, Tradeshow Colombia – Multiple Visits To Integrators, Customers, Partners Brazil – Visit To Integrators, Customers, Partners, Local And International Banks, & Tradeshow Panama – Visits With Customers & Partners NOTE: Newly Elected Presidents Mexico & Brazil That Ran On Law & Order

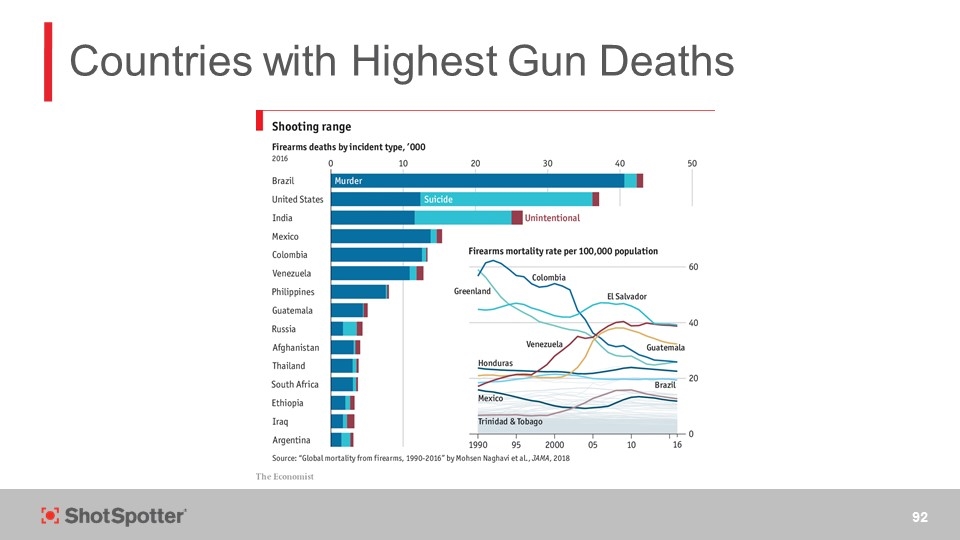

Countries with Highest Gun Deaths

LATAM – Homicide Rates Per 100k

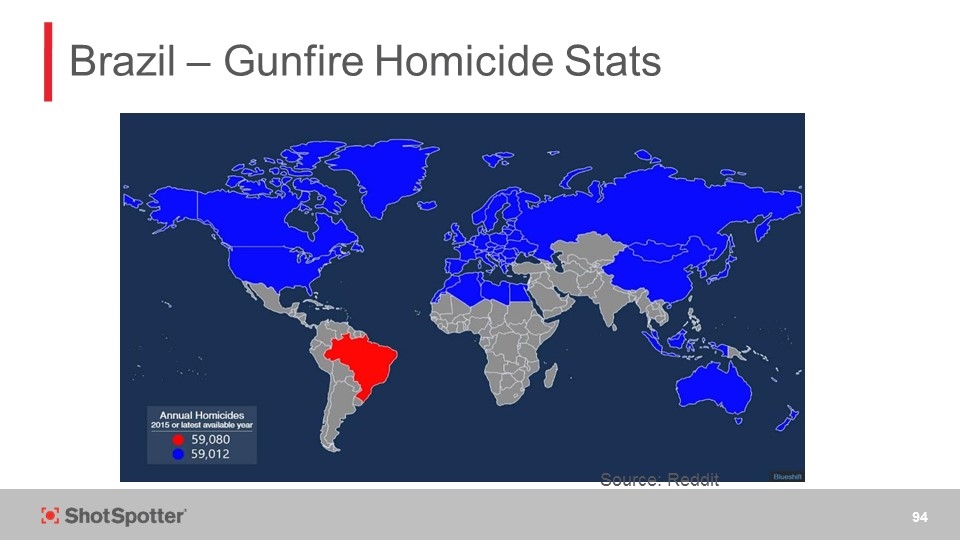

Brazil – Gunfire Homicide Stats Source: Reddit

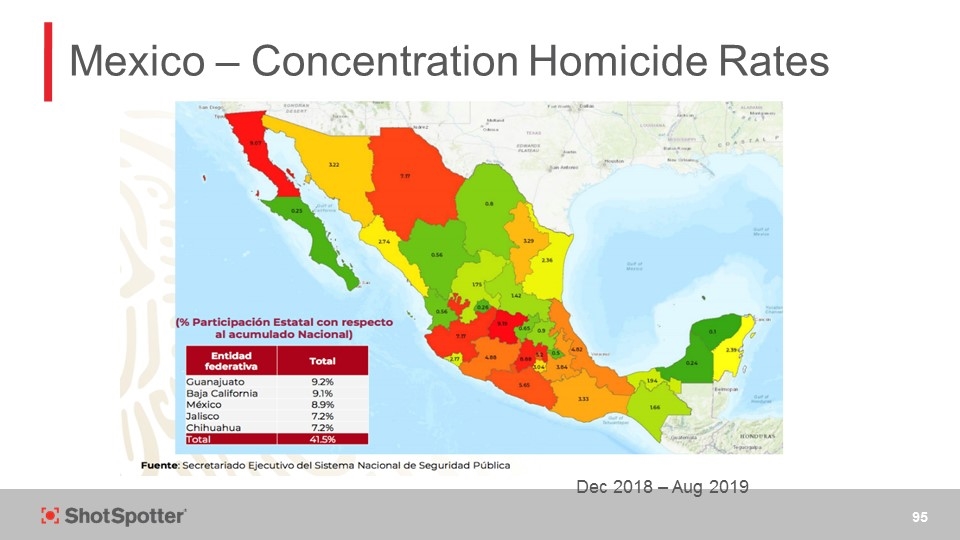

Mexico – Concentration Homicide Rates Dec 2018 – Aug 2019

Mexico – C5 Command & Communications

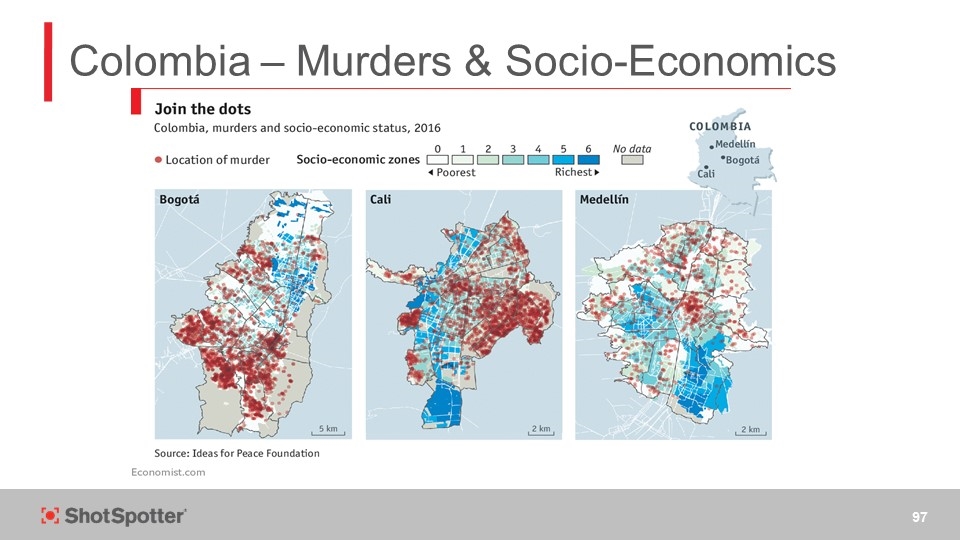

Colombia – Murders & Socio-Economics

LATAM – Collaboration In The Region Software Company – HQ Visit – Leveraging 20 Direct Sales & Marketing Contacts In Region. Participated As A Speaker In Various Partner Customer Conferences. Joint Sales Calls To 15 Integrator/Customer Visits Security Hardware Company(s) – HQ Visit – Leveraging Sales Contacts And Local Rep Network Hardware/Camera/LPR Company - HQ Visit – Sales & Business Development US State Department & Commerce Department - Regional Meetings & Services Police Organizations - Sponsorship Conference In Mexico NGO’s & Funding Sources, Business Councils

LATAM – Marketing Mexico – Hosted Delegation of State Security Secretaries Mexico – Hosting Reception for Police – (200 Officials) Mexico – ExpoSeguridad Booth, May 2019; Largest Security Exposition in Northern LATAM Brazil – LAAD Security & Defense Expo booth; April 2019. Largest Security Exposition in South America Hosted Visits to ShotSpotter US Customers – Multiple Officials/trips From Five countries

Sales – North America Gary Bunyard SVP, Sales, North America

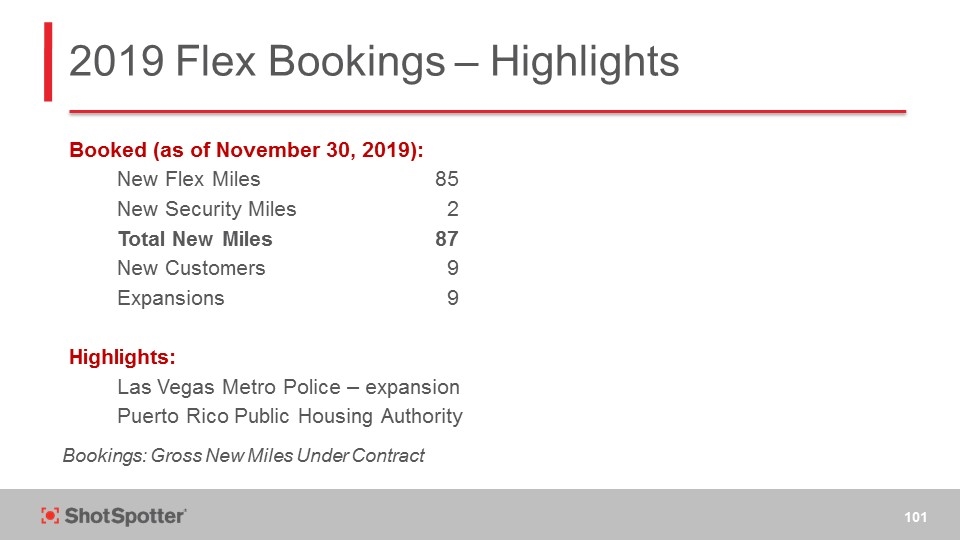

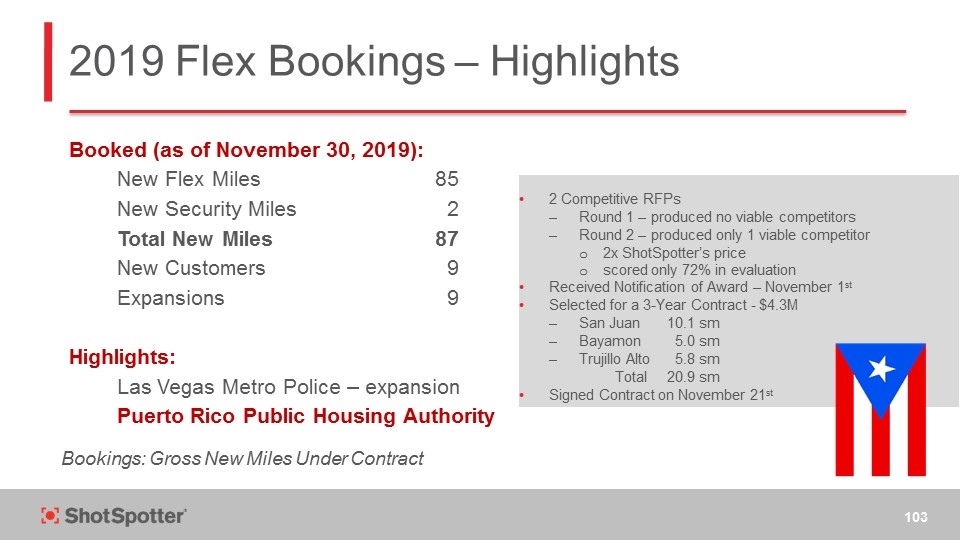

2019 Flex Bookings – Highlights Booked (as of November 30, 2019): New Flex Miles 85 New Security Miles 2 Total New Miles 87 New Customers 9 Expansions 9 Highlights: Las Vegas Metro Police – expansion Puerto Rico Public Housing Authority Bookings: Gross New Miles Under Contract

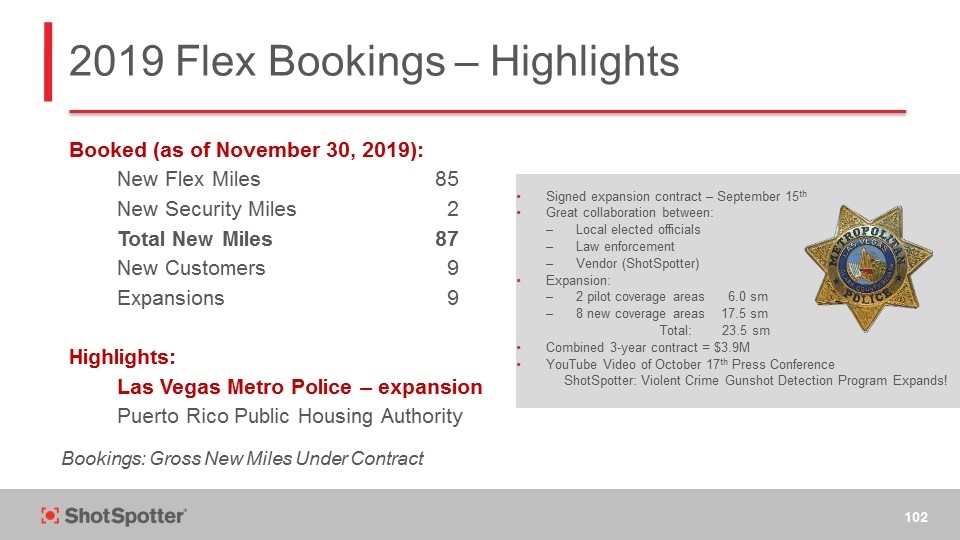

2019 Flex Bookings – Highlights Booked (as of November 30, 2019): New Flex Miles 85 New Security Miles 2 Total New Miles 87 New Customers 9 Expansions 9 Highlights: Las Vegas Metro Police – expansion Puerto Rico Public Housing Authority Signed expansion contract – September 15th Great collaboration between: Local elected officials Law enforcement Vendor (ShotSpotter) Expansion: 2 pilot coverage areas 6.0 sm 8 new coverage areas 17.5 sm Total: 23.5 sm Combined 3-year contract = $3.9M YouTube Video of October 17th Press Conference ShotSpotter: Violent Crime Gunshot Detection Program Expands! Bookings: Gross New Miles Under Contract

2019 Flex Bookings – Highlights Booked (as of November 30, 2019): New Flex Miles 85 New Security Miles 2 Total New Miles 87 New Customers 9 Expansions 9 Highlights: Las Vegas Metro Police – expansion Puerto Rico Public Housing Authority 2 Competitive RFPs Round 1 – produced no viable competitors Round 2 – produced only 1 viable competitor 2x ShotSpotter’s price scored only 72% in evaluation Received Notification of Award – November 1st Selected for a 3-Year Contract - $4.3M San Juan 10.1 sm Bayamon 5.0 sm Trujillo Alto 5.8 sm Total 20.9 sm Signed Contract on November 21st Bookings: Gross New Miles Under Contract

2019 Flex Bookings – Highlights Booked (as of November 30, 2019): New Flex Miles 85 New Security Miles 2 Total New Miles 87 New Customers 9 Expansions 9 Highlights: Las Vegas Metro Police – expansion Puerto Rico Public Housing Authority Year-End Sales Funnel: Working Opportunities 6 Potential New Flex Miles 30 We expect to close out 2019 with >100 New Miles… Bookings: Gross New Miles Under Contract

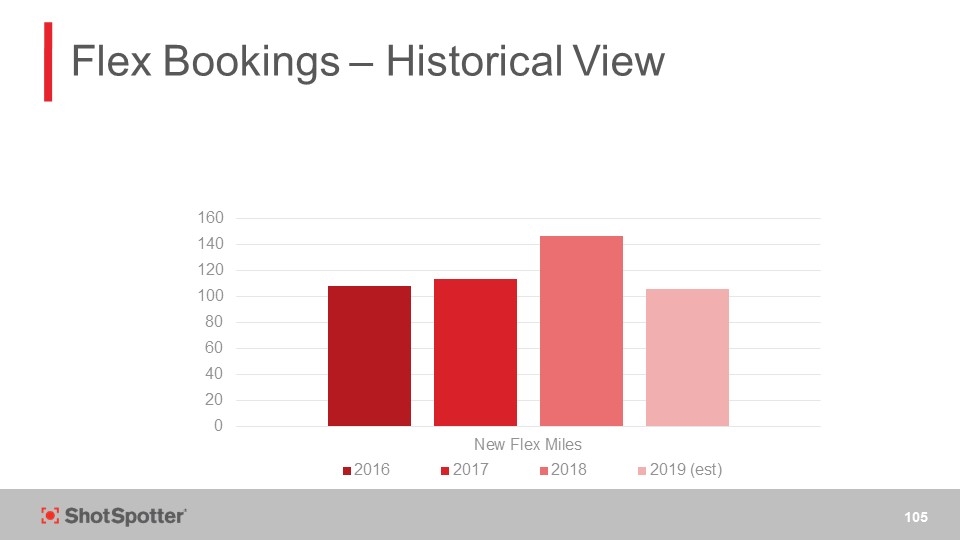

Flex Bookings – Historical View

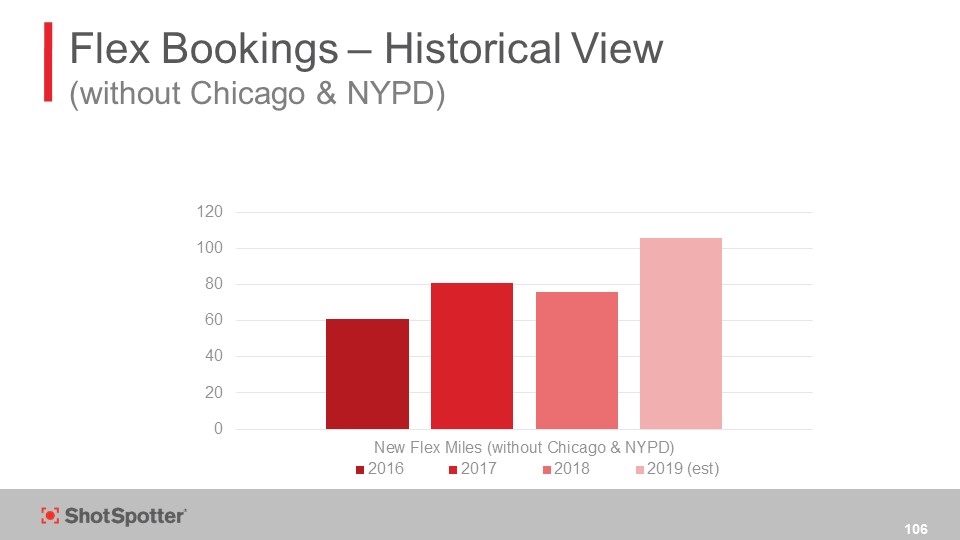

Flex Bookings – Historical View (without Chicago & NYPD)

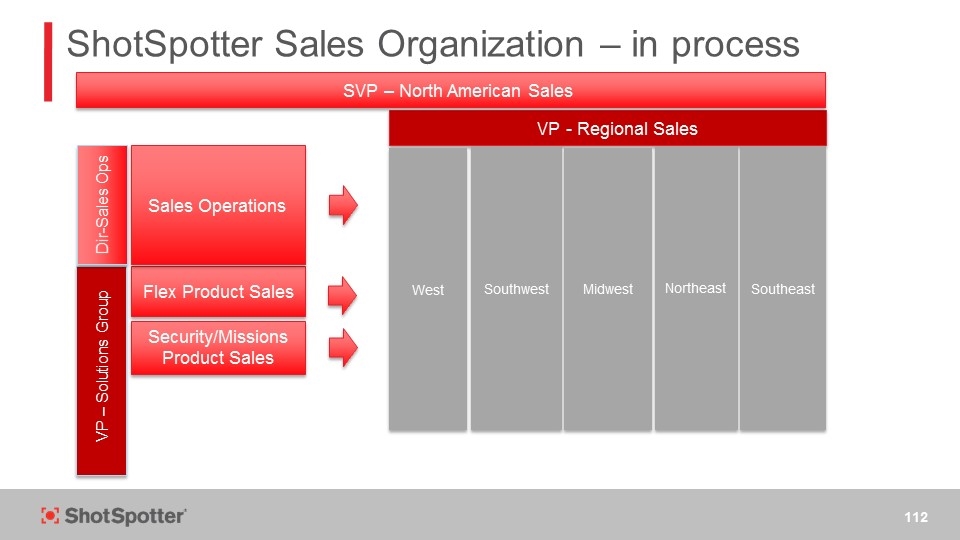

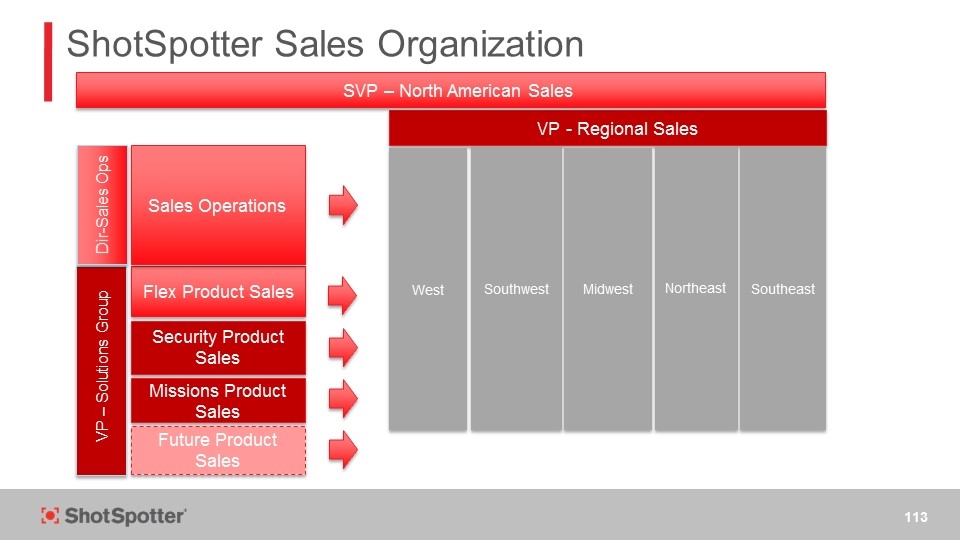

ShotSpotter Sales Organizational Changes Objectives: Expand The Depth/Breadth Of Leadership Allow Senior Sales Leadership To Be More Strategically-Focused Create A More Scalable Sales Engine Expanded Products Expanded Volume Increase Velocity Position Regional Sales Directors To Focus More On New Customers New Miles From Existing Customers Higher Leverage Opportunities Proactively Drive Sales Based Upon Product-based Sales Programs

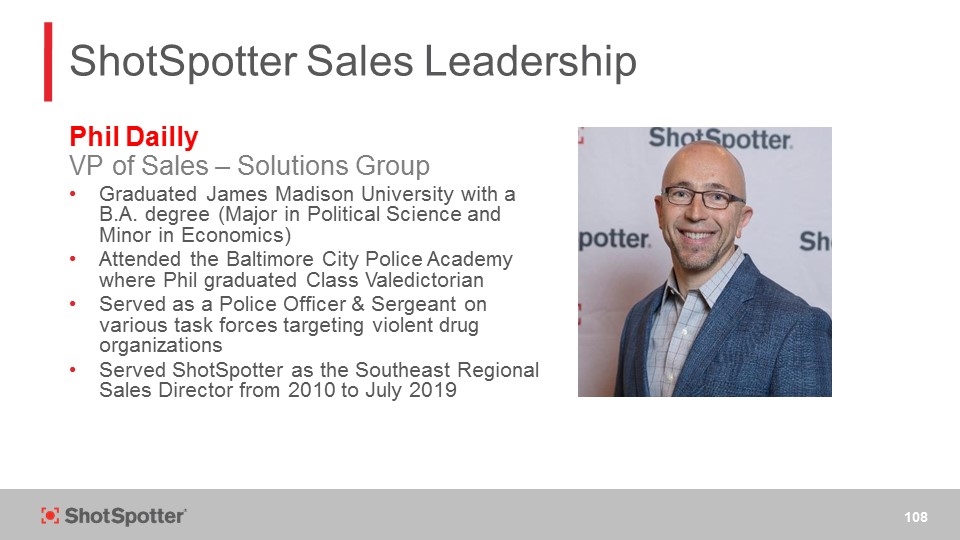

ShotSpotter Sales Leadership Phil Dailly VP of Sales – Solutions Group Graduated James Madison University with a B.A. degree (Major in Political Science and Minor in Economics) Attended the Baltimore City Police Academy where Phil graduated Class Valedictorian Served as a Police Officer & Sergeant on various task forces targeting violent drug organizations Served ShotSpotter as the Southeast Regional Sales Director from 2010 to July 2019

ShotSpotter Sales Leadership Joe Rodriguez VP – Regional Sales Spent The First Four Years Of His Career Working As A Police Officer In Miami Worked Five Years At Tiburon, First As Regional Sales Manager And Then As Sales Director Lead Sales At Intergraph, As US Director Of Sales For Public Safety Joined Deccan International, As VP Of Sales In Early 2018

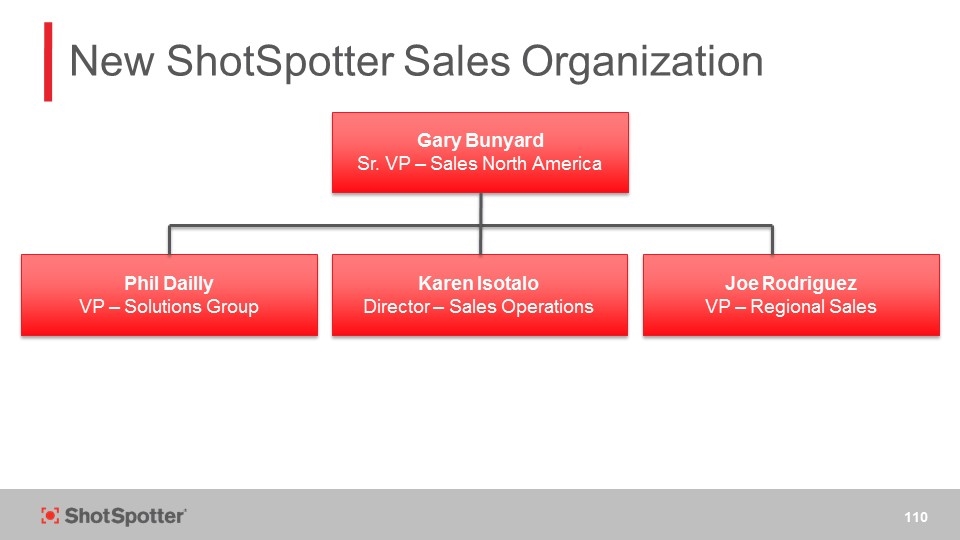

New ShotSpotter Sales Organization Gary Bunyard Sr. VP – Sales North America Karen Isotalo Director – Sales Operations Joe Rodriguez VP – Regional Sales Phil Dailly VP – Solutions Group

ShotSpotter Sales Organization – looking back Southwest West Northeast Southeast Midwest Flex Product Sales Security/Missions Product Sales SVP – North American Sales Sales Operations Dir-Sales Ops

ShotSpotter Sales Organization – in process VP - Regional Sales Southwest West VP – Solutions Group Northeast Southeast Midwest Flex Product Sales Security/Missions Product Sales SVP – North American Sales Sales Operations Dir-Sales Ops

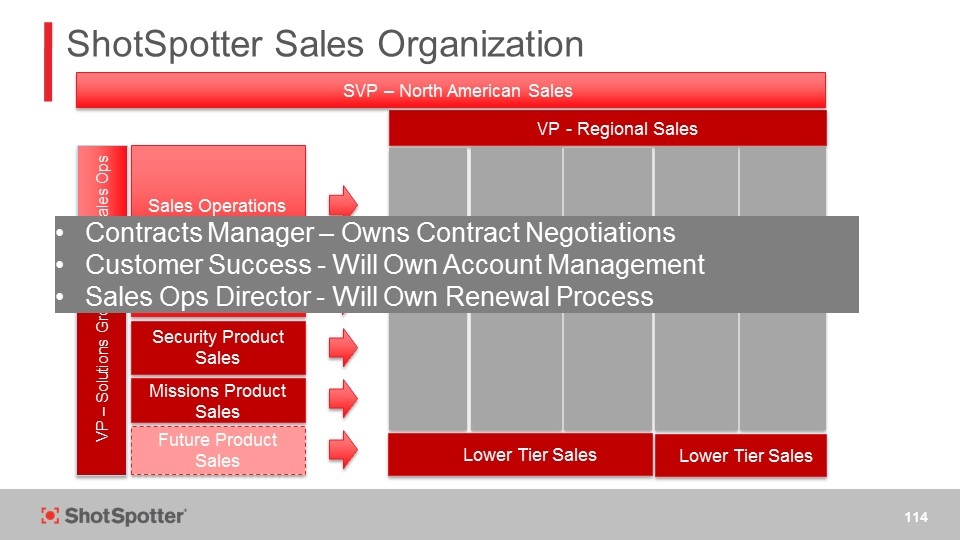

ShotSpotter Sales Organization VP - Regional Sales Southwest West VP – Solutions Group Northeast Southeast Midwest Flex Product Sales Security Product Sales Missions Product Sales Future Product Sales SVP – North American Sales Sales Operations Dir-Sales Ops

ShotSpotter Sales Organization VP - Regional Sales Southwest West VP – Solutions Group Northeast Southeast Midwest Flex Product Sales Security Product Sales Missions Product Sales Future Product Sales SVP – North American Sales Sales Operations Dir-Sales Ops Lower Tier Sales Lower Tier Sales Contracts Manager – Owns Contract Negotiations Customer Success - Will Own Account Management Sales Ops Director - Will Own Renewal Process

ShotSpotter Sales Model - Controls Territory Business Plans Salesforce Product Sales Playbook Opportunity Playbook This Photo by Unknown Author is licensed under CC BY

TAM Analysis - Total Addressable Market General Forces Business Objectives Existing Customers Ranked Remediation Plans Account Review Plan Sales Funnel Existing Customers New Customers Sales Commits Existing Customers New Customers Profile - Top 5 Opportunities General Challenges Business Outlook Regional Territory Business Plans This Photo by Unknown Author is licensed under CC BY-NC-ND Manage each region like a business and according to a documented business plan…

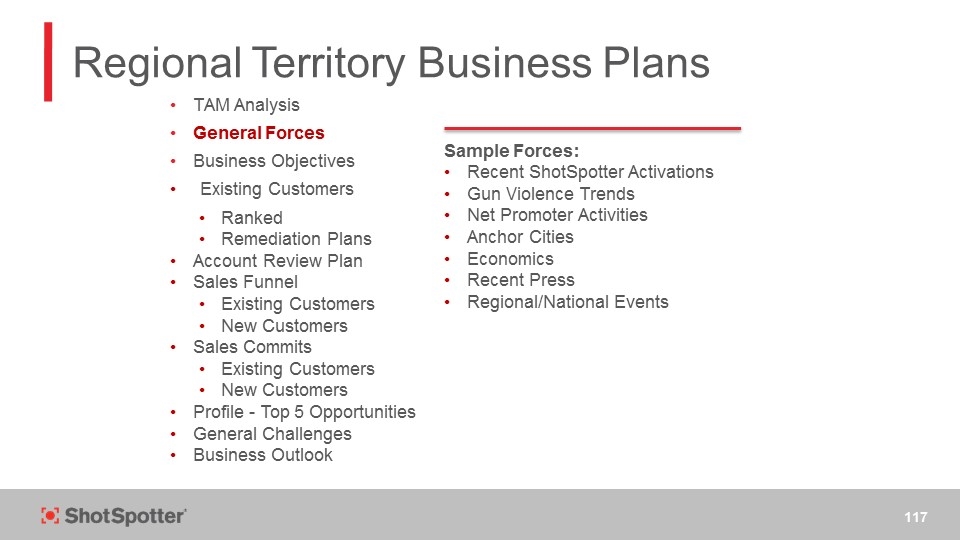

TAM Analysis General Forces Business Objectives Existing Customers Ranked Remediation Plans Account Review Plan Sales Funnel Existing Customers New Customers Sales Commits Existing Customers New Customers Profile - Top 5 Opportunities General Challenges Business Outlook Regional Territory Business Plans This Photo by Unknown Author is licensed under CC BY-NC-ND Sample Forces: Recent ShotSpotter Activations Gun Violence Trends Net Promoter Activities Anchor Cities Economics Recent Press Regional/National Events

TAM Analysis General Forces Business Objectives Existing Customers Ranked Remediation Plans Account Review Plan Sales Funnel Existing Customers New Customers Sales Commits Existing Customers New Customers Profile - Top 5 Opportunities General Challenges Business Outlook Regional Territory Business Plans This Photo by Unknown Author is licensed under CC BY-NC-ND Prospecting Qualifying Active Opportunity Proposal Submitted Proposal Approved Contract Negotiation

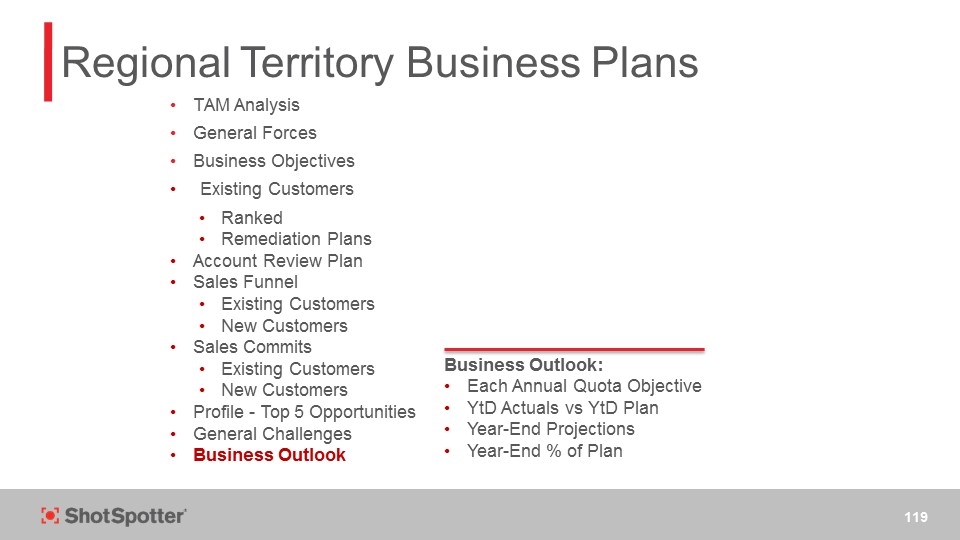

TAM Analysis General Forces Business Objectives Existing Customers Ranked Remediation Plans Account Review Plan Sales Funnel Existing Customers New Customers Sales Commits Existing Customers New Customers Profile - Top 5 Opportunities General Challenges Business Outlook Regional Territory Business Plans This Photo by Unknown Author is licensed under CC BY-NC-ND Business Outlook: Each Annual Quota Objective YtD Actuals vs YtD Plan Year-End Projections Year-End % of Plan

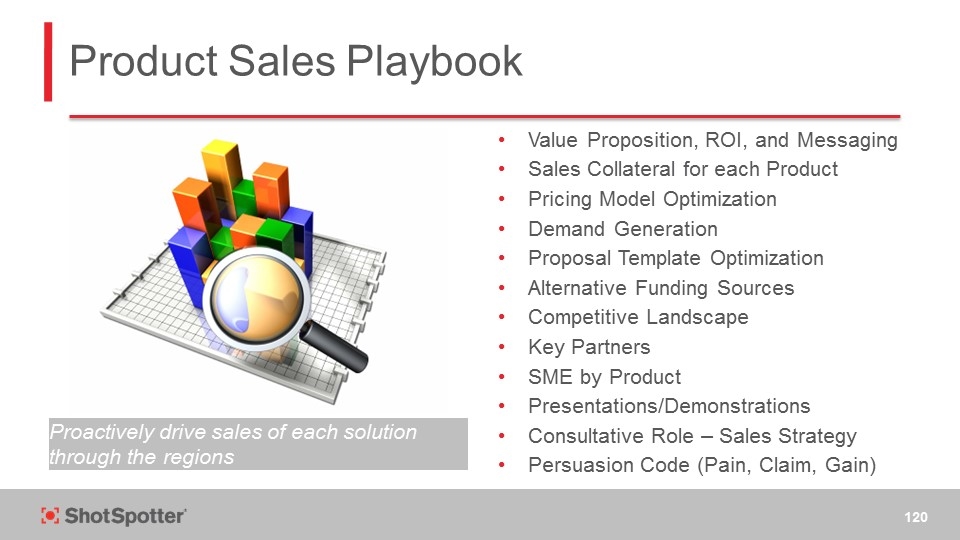

Product Sales Playbook Value Proposition, ROI, and Messaging Sales Collateral for each Product Pricing Model Optimization Demand Generation Proposal Template Optimization Alternative Funding Sources Competitive Landscape Key Partners SME by Product Presentations/Demonstrations Consultative Role – Sales Strategy Persuasion Code (Pain, Claim, Gain) Proactively drive sales of each solution through the regions

Salesforce Today: Opportunity Management Funnel Management Proposal Request/Tracking Renewal Processing Competitor Tracking Task Tracking Moving forward: Funnel Source Dashboards Funnel Analysis Velocity Tracking Sales-Cycle Tracking Funding Sources Performance (Plan vs Actuals) Focus: visibility, accountability, and analytics…

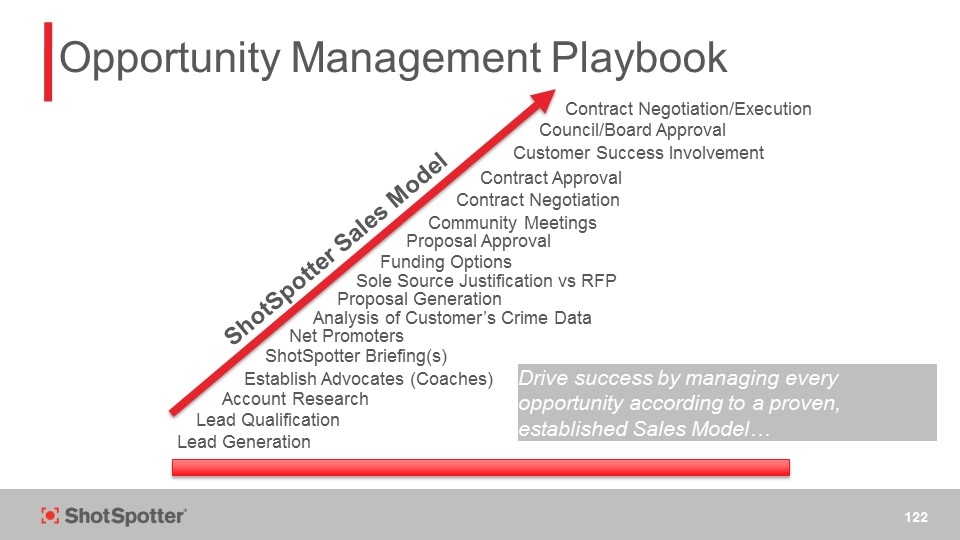

Opportunity Management Playbook Lead Generation Community Meetings Council/Board Approval Contract Approval Contract Negotiation Proposal Approval Funding Options Sole Source Justification vs RFP Proposal Generation Analysis of Customer’s Crime Data Net Promoters ShotSpotter Briefing(s) Establish Advocates (Coaches) Account Research Lead Qualification Contract Negotiation/Execution Customer Success Involvement ShotSpotter Sales Model Drive success by managing every opportunity according to a proven, established Sales Model…

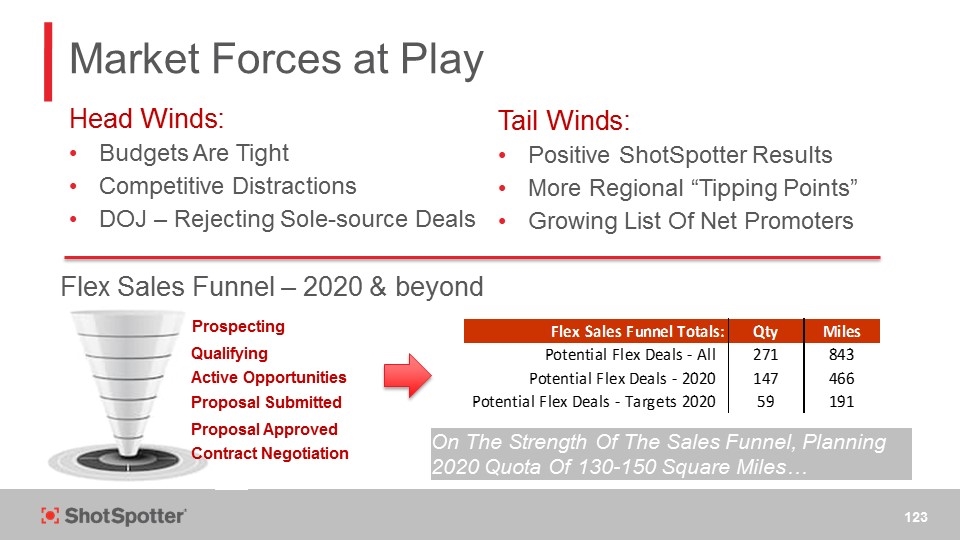

Market Forces at Play Head Winds: Budgets Are Tight Competitive Distractions DOJ – Rejecting Sole-source Deals Tail Winds: Positive ShotSpotter Results More Regional “Tipping Points” Growing List Of Net Promoters Flex Sales Funnel – 2020 & beyond Prospecting Qualifying Active Opportunities Proposal Submitted Proposal Approved Contract Negotiation On The Strength Of The Sales Funnel, Planning 2020 Quota Of 130-150 Square Miles… Flex Sales Funnel Totals: Qty Miles Potential Flex Deals - All 271 843 Potential Flex Deals - 2020 147 466 Potential Flex Deals - Targets 2020 59 191

Business Model & KPIs Alan Stewart, CFO

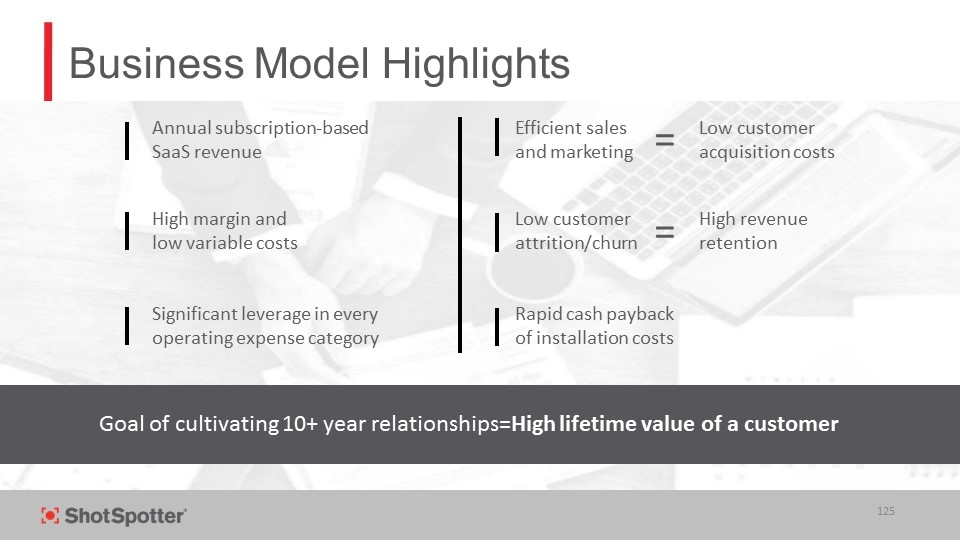

Business Model Highlights Annual subscription-based SaaS revenue Efficient sales and marketing Low customer acquisition costs High margin and low variable costs = Rapid cash payback of installation costs Significant leverage in every operating expense category Low customer attrition/churn High revenue retention = Goal of cultivating 10+ year relationships=High lifetime value of a customer

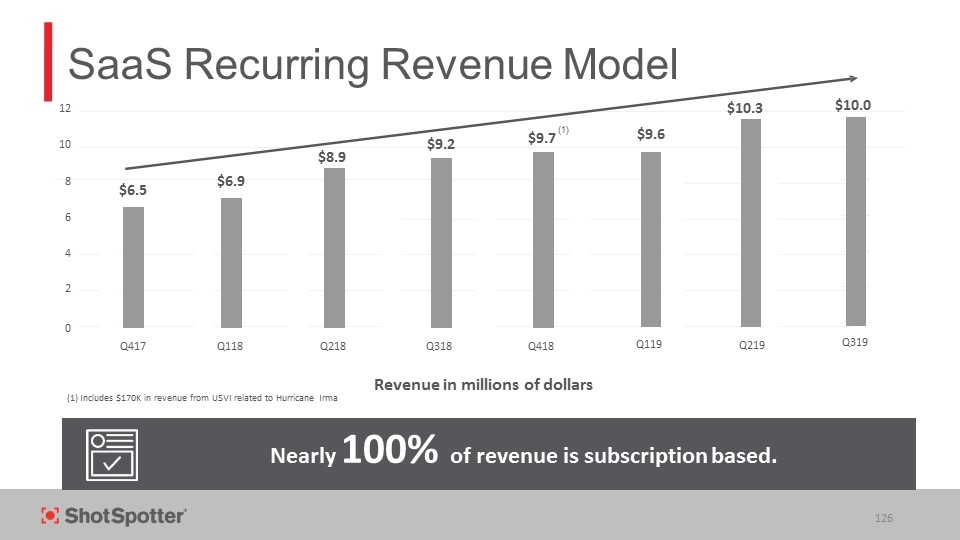

Revenue in millions of dollars SaaS Recurring Revenue Model (1) Includes $170K in revenue from USVI related to Hurricane Irma Nearly 100% of revenue is subscription based. 12 10 8 6 4 2 0 Q318 Q418 Q119 $6.5 $6.9 $8.9 $9.2 $9.7 $9.6 Q417 Q118 Q218 Q219 $10.3 Q319 $10.0 (1)

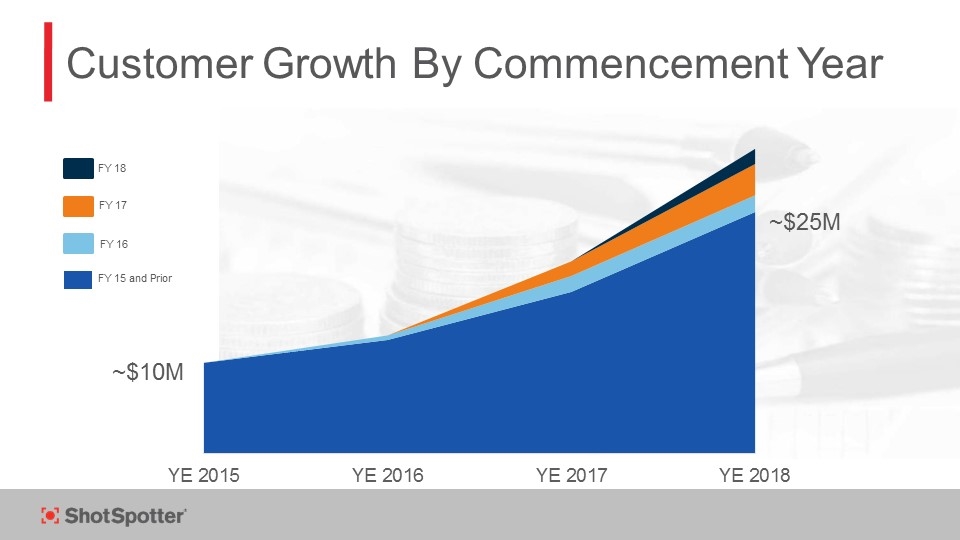

FY 16 FY 17 FY 18 FY 15 and Prior Customer Growth By Commencement Year ~$10M ~$25M

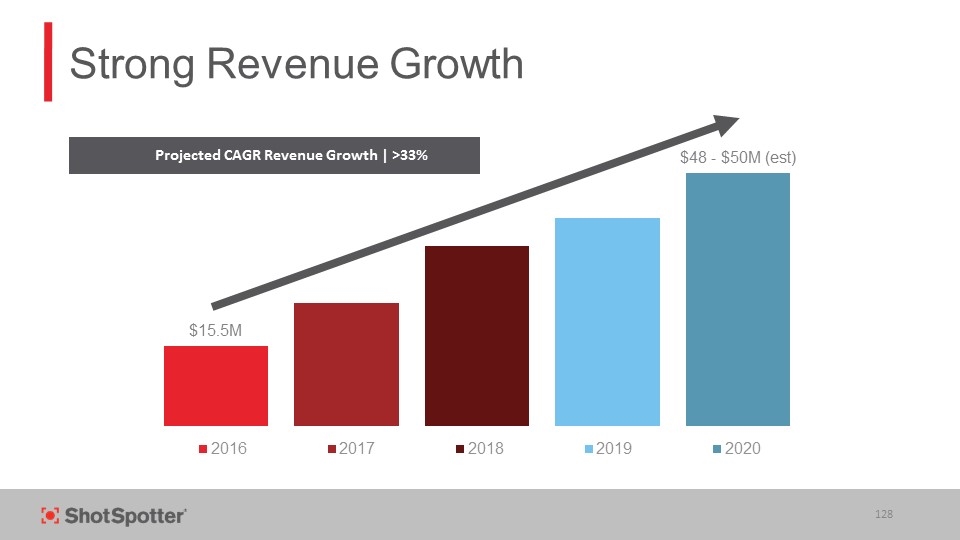

Strong Revenue Growth

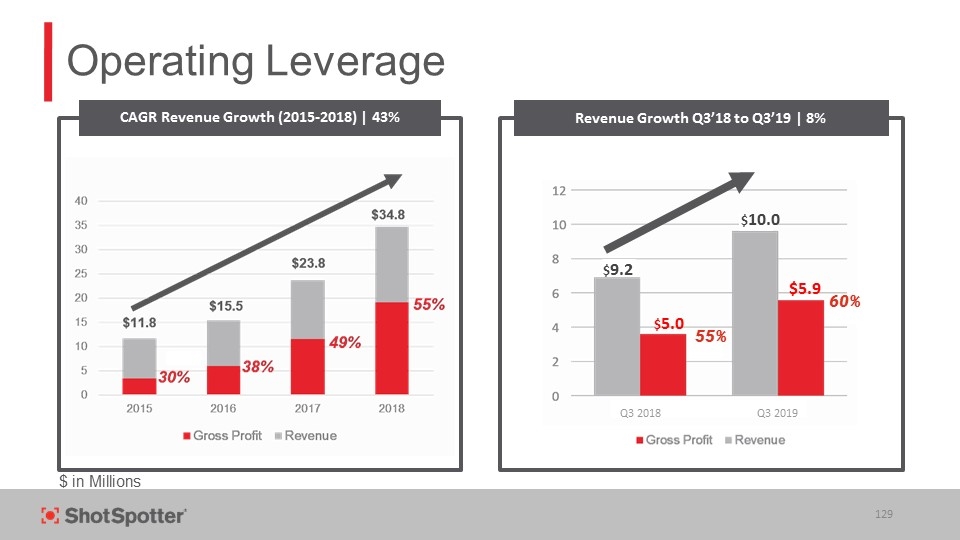

Operating Leverage CAGR Revenue Growth (2015-2018) | 43% Revenue Growth Q3’18 to Q3’19 | 8% $9.2 $10.0 Q3 2018 Q3 2019 $5.0 $5.9 60% 55% $ in Millions

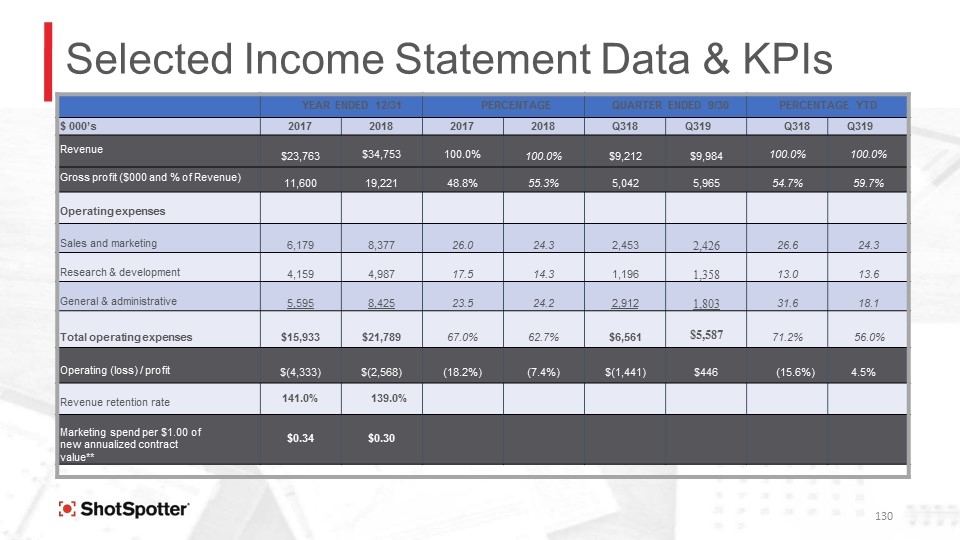

Selected Income Statement Data & KPIs YEAR ENDED 12/31 PERCENTAGE QUARTER ENDED 9/30 PERCENTAGE YTD $ 000’s 2017 2018 2017 2018 Q318 Q319 Q318 Q319 Revenue $23,763 $34,753 100.0% 100.0% $9,212 $9,984 100.0% 100.0% Gross profit ($000 and % of Revenue) 11,600 19,221 48.8% 55.3% 5,042 5,965 54.7% 59.7% Operating expenses Sales and marketing 6,179 8,377 26.0 24.3 2,453 2,426 26.6 24.3 Research & development 4,159 4,987 17.5 14.3 1,196 1,358 13.0 13.6 General & administrative 5,595 8,425 23.5 24.2 2,912 1,803 31.6 18.1 Total operating expenses $15,933 $21,789 67.0% 62.7% $6,561 $5,587 71.2% 56.0% Operating (loss) / profit $(4,333) $(2,568) (18.2%) (7.4%) $(1,441) $446 (15.6%) 4.5% Revenue retention rate 141.0% 139.0% Marketing spend per $1.00 of new annualized contract value** $0.34 $0.30

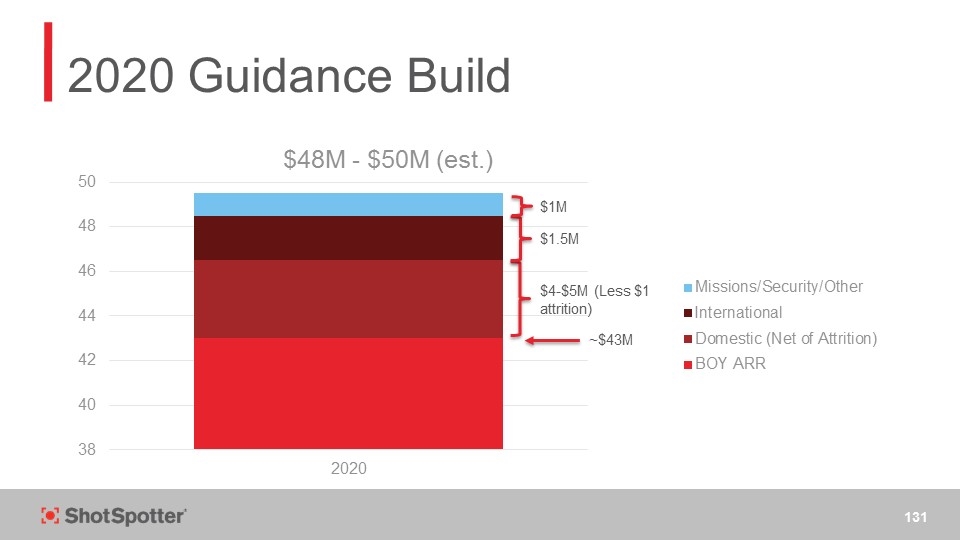

2020 Guidance Build $4-$5M (Less $1 attrition) $1.5M $1M ~$43M

Capital Allocation M&A Acquired Hunchlab Technology (Missions) Total Cost Less Than $3M (Including Earnout) Significant Potential Value Creation Share Repurchase Sold 250,000 shares in 2019 – Netting >$11.2M Repurchased ~260,000 Shares for Cost of ~$6.5M As of December 17, 2019

Large and Under-penetrated Market Opportunity First Mover Advantage in a Market with Little/No Direct Competition Significant Barriers to Entry – Technology, Experience & Brand Reputation Vertical Business Model Advantage Growing Revenues (33% CAGR – 2016- 2020 (est.)) “Sticky” Revenues (139% Revenue Retention – 2018) Low Customer Discovery & Creation Costs ($0.30/1$ -(S&M per $ of Annualized Contract Rev – 2018)) Cost-Efficient to Serve Purpose-Driven Culture – “Doing Well By Doing Good” Key Investment Themes