UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

|

Filed by the Registrant ☒ |

|

|

|

|

Filed by a Party other than the Registrant ☐ |

|

|

|

Check the appropriate box:

|

☐ |

Preliminary Proxy Statement |

|

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

☒ |

Definitive Proxy Statement |

|

☐ |

Definitive Additional Materials |

|

☐ |

Soliciting Material Pursuant to §240.14a-12 |

ShotSpotter, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☒ |

No fee required. |

|

☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

|

1) |

Title of each class of securities to which transaction applies: |

|

|

2) |

Aggregate number of securities to which transaction applies: |

|

|

3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|

|

4) |

Proposed maximum aggregate value of transaction: |

|

|

5) |

Total fee paid: |

|

☐ |

Fee paid previously with preliminary materials. |

|

☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

1) |

Amount Previously Paid: |

|

|

2) |

Form, Schedule or Registration Statement No.: |

|

|

3) |

Filing Party: |

|

|

4) |

Date Filed: |

April 29, 2019

Dear Stockholder:

You are cordially invited to attend the 2019 Annual Meeting of Stockholders of ShotSpotter, Inc. to be held at 7677 Gateway Blvd., 2nd Floor, Newark, CA 94560 on Thursday, June 13, 2019 at 9:30 a.m., local time (the “Annual Meeting”). The attached Notice of Annual Meeting of Stockholders and Proxy Statement describe the formal business to be transacted at the meeting.

We are furnishing proxy materials to our stockholders through the mail. You may also read, print and download our Annual Report on Form 10-K for the year ended December 31, 2018 and Proxy Statement at www.edocumentview.com/SSTI.

You may vote your shares by proxy or in person at the Annual Meeting. The Annual Meeting is being held so that stockholders may consider the election of two Class II directors, the ratification of the appointment of Baker Tilly Virchow Krause, LLP as ShotSpotter, Inc.’s independent registered public accounting firm for the year ending December 31, 2019, and to conduct any other business properly brought before the meeting. Please see the enclosed Notice of Annual Meeting and Proxy Statement for information on how to vote your shares.

The Board of Directors of ShotSpotter, Inc. has determined that the matters to be considered at the Annual Meeting are in the best interests of ShotSpotter, Inc. and its stockholders. For the reasons set forth in the Proxy Statement, the Board of Directors unanimously recommends a vote “FOR” each of the Company’s nominees for Class II director and “FOR” the ratification of the Company’s independent registered public accounting firm.

On behalf of the Board of Directors and the officers and employees of ShotSpotter, Inc. I would like to take this opportunity to thank you for your continued support. We look forward to seeing you at the Annual Meeting.

|

Sincerely, |

|

|

|

|

|

|

|

|

Ralph A. Clark President and Chief Executive Officer |

|

|

|

|

|

ShotSpotter, Inc. |

|

|

7979 Gateway Blvd., Suite 210 |

+1 888 274 6877 toll free |

|

Newark, CA 94560 |

www.shotspotter.com |

7979 Gateway Blvd. Suite 210

Newark, CA 94560

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

You are cordially invited to attend the 2019 Annual Meeting of Stockholders (the “Annual Meeting”) of ShotSpotter, Inc. (the “Company”). The meeting will be held at 7677 Gateway Blvd., 2nd Floor, Newark, California, 94560 at 9.30 a.m. local time on Thursday, June 13, 2019 for the following purposes:

|

|

1. |

To elect two nominees for Class II director named in the accompanying Proxy Statement, each to hold office until the 2022 Annual Meeting of Stockholders or until a successor is duly elected and qualified or until the director’s earlier death, resignation or removal. |

|

|

2. |

To ratify the appointment of Baker Tilly Virchow Krause, LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2019. |

These proposals are more fully described in the Proxy Statement following this Notice. You will also be asked to transact such other business, if any, as may properly come before the Annual Meeting.

The Board of Directors recommends that you vote (i) FOR the election of both nominees to serve as Class II directors of the Company, and (ii) FOR the ratification of the appointment of Baker Tilly Virchow Krause, LLP as our independent registered public accounting firm for the year ending December 31, 2019.

In accordance with rules established by the Securities and Exchange Commission, we are providing you access to our proxy materials over the Internet. Accordingly, we plan to mail a Notice of Internet Availability of Proxy Materials (the “Notice”) to our stockholders on or about May 1, 2019. The Notice will describe how to access and review our proxy materials, including our proxy statement and annual report on Form 10-K. The Notice as well as the printed copy of proxy cards will also describe how you may submit your proxy on the Internet or by telephone. If you received a Notice by mail and would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting such materials included in the Notice.

The Board of Directors has fixed the close of business on April 18, 2019 as the record date for the determination of the stockholders entitled to notice of, and to vote at, the Annual Meeting. Accordingly, only stockholders of record at the close of business on that date will be entitled to vote at the Annual Meeting.

All stockholders are cordially invited to attend the Annual Meeting in person. To attend the Annual Meeting, you will need to present a form of photo identification. If your shares are held in street name, you will also need to bring proof of your ownership of our common stock, such as your most recent brokerage statement that shows you owned your shares as of the record date. Whether or not you plan to attend the Annual Meeting, please vote as soon as possible.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to Be Held on June 13, 2019 at 9:30 a.m. at 7677 Gateway Blvd., 2nd Floor, Newark, California.

The Proxy Statement and Annual Report on Form 10-K for the year ended December 31, 2018

are available at www.edocumentview.com/SSTI.

|

By order of the Board of Directors, |

|

|

|

|

|

Alan R. Stewart |

|

Secretary |

|

|

|

April 29, 2019 |

YOUR VOTE IS IMPORTANT

You are cordially invited to attend the Annual Meeting in person. Whether or not you expect to attend the Annual Meeting, please cast your vote as promptly as possible in order to ensure your representation at the meeting. If you are a stockholder of record, please vote by the internet or by telephone, or, if you receive a paper proxy card by mail, by completing, dating, signing and returning the proxy mailed to you. Submitting your vote via the internet or by telephone or proxy card will not affect your right to vote in person if you decide to attend the Annual Meeting. If your shares are held in street name (held for your account by a broker, bank, or other nominee), you will receive instructions from your nominee explaining how to vote your shares, and you will have the option to cast your vote by telephone or over the internet if your voting instructions from your nominee include instructions for doing so. Even if you have voted by proxy, you may still vote in person if you attend the Annual Meeting. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the Annual Meeting, you must obtain a proxy issued in your name from that record holder.

TABLE OF CONTENTS

i

ShotSpotter, Inc.

FOR THE 2019 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON

THURSDAY, JUNE 13, 2019 AT 9:30 A.M.

Questions and Answers About these Proxy Materials

Why did I receive a notice regarding the availability of proxy materials on the Internet?

Pursuant to rules adopted by the Securities and Exchange Commission (the “SEC”), we have elected to provide access to our proxy materials over the Internet. Accordingly, we have sent you a Notice of Internet Availability of Proxy Materials (the “Notice”) because the Board of Directors (the “Board of Directors” or the “Board”) of ShotSpotter, Inc. (sometimes referred to as the “Company,” “ShotSpotter” or in the first person) is soliciting your proxy to vote at the 2019 Annual Meeting of Stockholders (the “Annual Meeting”), including at any adjournments or postponements of such meeting. All stockholders will have the ability to access the proxy materials on the website referred to in the Notice or request to receive a printed set of the proxy materials. Instructions on how to access the proxy materials over the Internet or to request a printed copy may be found in the Notice.

We intend to mail the Notice on or about May 1, 2019 to all stockholders of record entitled to vote at the Annual Meeting.

Will I receive any other proxy materials by mail?

We may send you a proxy card, along with a second Notice, on or after May 1, 2019. You may also request that we mail you a full set of the proxy materials. Instructions on how to request a printed copy may be found in the Notice.

What is the date, time and place of the Annual Meeting?

The Annual Meeting will be held on Thursday, June 13, 2019, beginning at 9.30 a.m. local time, at 7677 Gateway Blvd., 2nd Floor, Newark, CA 94560.

How do I attend the Annual Meeting?

Directions to the Annual Meeting may be found at www.edocumentview.com/SSTI. Information on how to vote in person at the Annual Meeting is discussed below.

Who is entitled to vote at the Annual Meeting?

Only stockholders of record at the close of business on April 18, 2019, the record date for the Annual Meeting, are entitled to receive notice of and to participate in the Annual Meeting. If you were a stockholder of record on that date, you will be entitled to vote all of the shares you held on that date at the Annual Meeting. As of the record date, there were 11,320,920 shares of common stock outstanding, all of which are entitled to be voted at the Annual Meeting.

1

What am I voting on?

At the Annual Meeting, stockholders will act upon the matters outlined in the Notice of Annual Meeting of Stockholders. There are two matters scheduled for a vote:

|

|

• |

Election of the two Class II directors named herein, each to hold office until the 2022 annual meeting of stockholders or until a successor is duly elected and qualified or until the director’s earlier death, resignation or removal (Proposal 1); and |

|

|

• |

Ratification of the appointment of Baker Tilly Virchow Krause, LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2019 (Proposal 2). |

You may either vote “FOR” each of the nominees for election to the Board or you may “WITHHOLD” your vote for any nominee you specify. You may either vote “FOR” or “AGAINST” or abstain from voting for the ratification of the appointment of Baker Tilley Virchow Krause, LLP as the Company’s independent registered public accounting firm.

What if another matter is properly brought before the Annual Meeting?

The Board knows of no other matters that will be presented for consideration at the Annual Meeting. If any other matters are properly brought before the Annual Meeting, it is the intention of the persons named in the proxy card to vote on those matters in accordance with their best judgment.

How do I vote?

Stockholder of Record: Shares Registered in Your Name

If on April 18, 2019, your shares were registered directly in your name with ShotSpotter’s transfer agent, Computershare Limited, then you are a stockholder of record. As a stockholder of record, you may vote in person at the Annual Meeting or vote by proxy. Whether or not you plan to attend the Annual Meeting, we urge you to cast your vote as soon as possible to ensure your vote is counted.

|

|

• |

To vote by proxy by internet. You may access the website of the Company’s tabulator, Computershare. Please follow the steps outlined on the proxy card. Your shares will be voted in accordance with your instructions. Your Internet vote must be received by 1:00 am Eastern Time on June 13, 2019 to be counted. |

|

|

• |

To vote by proxy by telephone. To vote over the telephone, dial toll-free 1-800-652-VOTE (8683) using a touch-tone phone and follow the recorded instructions. You will be asked to provide the company number and control number from the Notice. Your telephone vote must be received by 1:00 a.m. Eastern Time on June 13, 2019 to be counted. |

|

|

• |

To vote by proxy by mail. To vote using the proxy card, simply complete, sign and date the proxy card that may be delivered and return it promptly in the envelope provided. If you return your signed proxy card to us before the Annual Meeting, we will vote your shares as you direct. |

|

|

• |

To vote in person. If you attend the Annual Meeting in person, you may vote in person by completing a form of ballot or proxy card that we will provide to you at the Annual Meeting. |

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If on April 18, 2019, your shares were held, not in your name, but rather in an account at a brokerage firm, bank or other similar organization, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to

2

direct your broker, bank or other agent regarding how to vote the shares in your account and you should have received instructions from that organization as to how to do so, including by internet, telephone or mail. You are also invited to attend the Annual Meeting. However, because you are not the stockholder of record, you may not vote your shares in person at the meeting unless you request and obtain a valid proxy from your broker, bank or other agent.

How many votes do I have?

Holders of common stock are entitled to one vote per share on each matter that is submitted to stockholders for approval.

If I am a stockholder of record and I do not vote, or if I otherwise cast my vote without giving specific voting instructions, what happens?

If you are a stockholder of record and do not vote by proxy or in person at the Annual Meeting, your shares will not be voted.

If you vote by proxy without marking voting selections, your shares will be voted, as applicable, “FOR” the election of both nominees for Class II director and “FOR” the ratification of the appointment of Baker Tilly Virchow Krause, LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2019. If any other matter is properly presented at the Annual Meeting, your proxyholder (one of the individuals named on your proxy card) will vote your shares using his or her best judgment.

If I am a beneficial owner of shares held in street name and I do not provide my broker or bank with voting instructions, what happens?

If you are a beneficial owner of shares held in street name and you do not instruct your broker, bank or other agent how to vote your shares, your broker, bank or other agent may still be able to vote your shares in its discretion depending on whether the particular proposal is considered to be a routine matter under applicable rules. Brokers and nominees can use their discretion to vote “uninstructed” shares with respect to matters that are considered to be “routine” under applicable rules but not with respect to “non-routine” matters. Under applicable rules and interpretations, “non-routine” matters are matters that may substantially affect the rights or privileges of stockholders, such as elections of directors (even if not contested), mergers, stockholder proposals, executive compensation (including any advisory stockholder votes on executive compensation and on the frequency of stockholder votes on executive compensation), and certain corporate governance proposals, even if management-supported. Proposal 1 is considered to be a “non-routine” matter, but Proposal 2 is considered to be a “routine” matter. Accordingly, your broker or nominee may not vote your shares on Proposal 1 without your instructions, but may vote your shares on Proposal 2 even in the absence of your instruction. If you are a beneficial owner of shares held in street name, in order to ensure your shares are voted in the way you would prefer, you must provide voting instructions to your broker, bank or other agent by the deadline provided in the materials you receive from your broker, bank or other agent.

How are votes counted?

Votes will be counted by the inspector of election appointed for the meeting, who will separately count, for the Proposal 1 to elect directors, votes “FOR,” “WITHHOLD” and broker non-votes; and, with respect to Proposal 2, votes “FOR” and “AGAINST” and abstentions. For Proposal 1, broker non-votes have no effect and will not be counted towards the vote total. For Proposal 2, abstentions will be counted towards the vote total for of Proposal 2, and will have the same effect as “AGAINST” votes.

What are “broker non-votes”?

As discussed above, when a beneficial owner of shares held in street name does not give voting instructions to his or her broker, bank or other securities intermediary holding his or her shares as to how to vote on matters deemed to be “non-routine”, the broker, bank or other such agent cannot vote the shares. These un-voted shares are counted as “broker non-votes.” Proposal 1 is considered to be “non-routine” and we therefore expect broker non-votes to exist in connection with that proposal.

3

As a reminder, if you a beneficial owner of shares held in street name, in order to ensure your shares are voted in the way you would prefer, you must provide voting instructions to your broker, bank or other agent by the deadline provided in the materials you receive from your broker, bank or other agent.

Who can attend the Annual Meeting?

All stockholders as of the record date, or their duly appointed proxies, may attend the Annual Meeting. You will need a form of photo identification to be admitted to the Annual Meeting. Please also note that if you hold your shares in “street name” (that is, through a broker or other nominee), you will need to bring a copy of a brokerage statement reflecting your stock ownership as of the record date in order to be admitted to the Annual Meeting. Whether or not you plan to attend the annual meeting, please vote as soon as possible.

What constitutes a quorum?

The presence at the Annual Meeting, in person or by proxy, of the holders of common stock representing a majority of the voting power of the outstanding shares of stock entitled to vote on the record date will constitute a quorum, permitting the meeting to conduct its business. As of the record date, there were 11,320,920 shares of common stock outstanding, all of which are entitled to be voted at the Annual Meeting. If there is no quorum, the holders of a majority of the shares so represented may adjourn the Annual Meeting without further notice.

What vote is required to approve each item?

For Proposal 1, the election of directors, the two nominees receiving the most “FOR” votes from the holders of shares present in person or represented by proxy and entitled to vote on the election of directors will be elected. Only votes “FOR” will affect the outcome.

For Proposal 2, the ratification of the appointment of Baker Tilly Virchow Krause, LLP as the Company’s independent registered public accounting firm for year ending December 31, 2019, must receive “FOR” votes from the holders of a majority of shares present in person or represented by proxy and entitled to vote on the matter. If you “Abstain” from voting, it will have the same effect as an “AGAINST” vote.

The inspector of election for the Annual Meeting shall determine the number of shares of common stock represented at the meeting, the existence of a quorum and the validity and effect of proxies, and shall count and tabulate ballots and votes and determine the results thereof. Proxies received but marked as abstentions and broker non-votes will be included in the calculation of the number of shares considered to be present at the meeting for purposes of determining a quorum. Broker non-votes will not be counted as votes cast “FOR” or votes “WITHHELD” for the election of directors in Proposal 1. Broker non-votes will be considered in tallying votes cast for Proposal 2, and abstentions will be treated as a vote “AGAINST.”

How can I find out the results of the voting at the Annual Meeting?

Preliminary voting results may be announced at the Annual Meeting. In addition, final voting results will be published in a current report on Form 8-K that we expect to file within four business days after the Annual Meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the Annual Meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an additional Form 8-K to publish the final results.

4

Can I change my vote after submitting my proxy?

Stockholder of Record: Shares Registered in Your Name

Yes. You can revoke your proxy at any time before the final vote at the Annual Meeting. If you are the record holder of your shares, you may revoke your proxy in any one of the following ways:

|

|

• |

You may submit another properly completed proxy with a later date, by internet, telephone or mail. |

|

|

• |

You may send a timely written notice that you are revoking your proxy to ShotSpotter’s Corporate Secretary at 7979 Gateway Blvd., Suite 210, Newark, CA 94560. |

|

|

• |

You may attend the Annual Meeting and vote in person. Simply attending the Annual Meeting will not, by itself, revoke your proxy. |

Your most current proxy card is the one that is counted.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If your shares are held by your broker, bank or other agent, you should follow the instructions provided by your broker, bank or other agent.

Who is paying for this proxy solicitation?

We will pay for the entire cost of soliciting proxies. In addition to these proxy materials, our directors and employees may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

What does it mean if I receive more than one Notice?

If you receive more than one Notice, your shares may be registered in more than one name or in different accounts. Please follow the voting instructions on the Notices to ensure that all of your shares are voted.

What proxy materials are available on the internet?

The Letter to Stockholders, Proxy Statement, and 2018 Annual Report on Form 10-K are available at www.edocumentview.com/SSTI.

When are stockholder proposals and director nominations due for next year’s annual meeting?

To be considered for inclusion in next year’s proxy materials, your proposal must be submitted in writing by January 1, 2020 to our Corporate Secretary, ShotSpotter, Inc., 7979 Gateway Blvd, Suite 210, Newark, California 94560 and you must comply with all applicable requirements of Rule 14a-8 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Pursuant to our amended and restated bylaws, if you wish to bring a proposal before the stockholders or nominate a director at the 2020 annual meeting of stockholders, but you are not requesting that your proposal or nomination be included in next year’s proxy materials, you must notify our Corporate Secretary, in writing, not later than the close of business on March 15, 2020 nor earlier than the close of business on February 14, 2020. However, if our 2020 annual meeting of stockholders is not held between April 29, 2020 and June 28, 2020, to be timely, notice by the stockholder must be received no earlier than the close of business on the 120th day prior to the 2020 annual meeting of stockholders and not later than the close of business on the later of the 90th day prior to the 2020 annual meeting of stockholders or the 10th day following the day on which public announcement of the date of the 2020 annual meeting of stockholders is first made. You are also advised to review our amended and restated bylaws, which contain additional requirements about advance notice of stockholder proposals and director nominations.

5

Election of Directors

In accordance with our amended and restated certificate of incorporation, our Board is divided into three classes with staggered three-year terms. Each director serves until the expiration of the term for which such director was elected or appointed, or until such director’s earlier death, resignation or removal. At each annual meeting of stockholders, the successors to directors whose terms then expire will be elected to serve from the time of election and qualification until the third annual meeting following election. Vacancies on the Board may be filled only by persons elected by a majority of the remaining directors. A director elected by the Board to fill a vacancy in a class, including vacancies created by an increase in the number of directors, shall serve for the remainder of the full term of that class and until the director’s successor is duly elected and qualified.

Our directors are currently divided among the three classes as follows:

|

|

• |

Class II, which consists of Pascal Levensohn and Thomas T. Groos, whose terms will expire at the upcoming Annual Meeting; |

|

|

• |

Class III, which consists of Ralph A. Clark and Marc Morial, whose terms will expire at the 2020 annual meeting of stockholders; and |

|

|

|

•Class I, which consists of William J. Bratton, Randall Hawks, Jr. and Merline Saintil, whose terms will expire at the 2021 annual meeting of stockholders. |

Our Board currently consists of seven members, two of whom are in the class whose term of office expires at the upcoming Annual Meeting. We expect that any additional directorships resulting from any future increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one third of the directors. The division of our Board into three classes with staggered three-year terms may delay or prevent a change of our management or a change in control.

Mr. Levensohn and Mr. Groos have been nominated to serve as Class II directors. Each of these nominees has agreed to stand for reelection at the meeting. Our management has no reason to believe that any nominee will be unable to serve. If elected at the Annual Meeting, each of these nominees would serve until the 2022 annual meeting of stockholders and until his successor has been duly elected, or if sooner, until the director’s death, resignation or removal. It is the Company’s policy that directors and nominees for director are expected to attend each annual meeting.

Vote Required

Directors are elected by a plurality of the votes of the holders of shares present at the meeting or represented by proxy and entitled to vote on the election of directors. Accordingly, the two nominees receiving the highest number of “FOR” votes will be elected. Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the two named above. If any nominee becomes unavailable for election as a result of an unexpected occurrence, shares that would have been voted for that nominee will instead will be voted for the election of a substitute nominee proposed by us.

6

The following table sets forth, for the Class II nominees and our other directors who will continue in office after the Annual Meeting, their ages and position/office held with us as of the date of this proxy statement:

|

Name |

|

Age |

|

Position/Office Held With ShotSpotter |

|

Class II directors for election at the Annual Meeting |

||||

|

Thomas T. Groos(3) |

|

62 |

|

Director |

|

Pascal Levensohn(1) |

|

58 |

|

Director, Chair of the Board |

|

|

|

|

|

|

|

Class III directors, whose terms will expire at the 2020 annual meeting of stockholders |

||||

|

Ralph A. Clark |

|

60 |

|

President and Chief Executive Officer |

|

Marc Morial(2)(3) |

|

61 |

|

Director |

Class I directors, whose terms will expire at the 2021 annual meeting of stockholders

|

William J. Bratton(1) |

|

71 |

|

Director |

|

Randall Hawks, Jr.(1)(2) |

|

68 |

|

Director |

|

Merline Saintil(2) |

|

43 |

|

Director |

|

|

(1) |

Member of the Compensation Committee of the Board (the “Compensation Committee”) |

|

|

(2) |

Member of the Audit Committee of the Board (the “Audit Committee”) |

|

|

(3) |

Member of the Nominating and Corporate Governance Committee of the Board (the “Nominating and Corporate Governance Committee”) |

Set forth below is biographical information for the nominees and each person whose term of office as a director will continue after the Annual Meeting. This includes information regarding each director’s experience, qualifications, attributes or skills that led our Board to recommend them for board service.

Nominees for Election until the 2022 Annual Meeting of Stockholders

Thomas T. Groos has served as a member of our Board since February 2014 and previously served as a member of our Board from 2007 until 2012. Mr. Groos has been a partner at City Light Capital, a venture capital firm, since 2006. Since 2009, Mr. Groos has served as the Vice Chairman of the Board of Minimax-Viking Group, a fire protection company, following its acquisition of the Viking Group, where Mr. Groos served as Chief Executive Officer from 1994 through 2007. Mr. Groos is also a member of the board of directors of Heartland Steel Products, LLC, a Michigan-based manufacturer of industrial robotic systems. Mr. Groos is a co-founder of The ImPact Society, a non-profit dedicated to promotion of impact investing among private investors. He is a member of the Board of Trustees of Cornell University and a director of Endeavor Detroit. Mr. Groos holds a B.A. in Economics from Cornell University and an M.B.A. from Columbia Business School. Our Board believes that Mr. Groos’ experience in the technology industry and investment experience qualify him to serve on our Board.

Pascal Levensohn has served as a member of our Board since 2007 and currently serves as Chair of the Board. Since 2014, Mr. Levensohn has served as a Managing Director of Dolby Family Ventures, L.P., a venture capital fund. Since 1996, Mr. Levensohn has also served as the founder and Managing Partner of Levensohn Venture Partners, a venture capital firm, and the Chief Executive Officer of Generation Strategic Advisors LLC, a consulting firm specializing in startup technology companies. From April 2007 until April 2011, Mr. Levensohn served on the board of directors of the National Venture Capital Association. He is a member of the Council on Foreign Relations and a trustee of the American Academy in Berlin. Mr. Levensohn holds an A.B. in Government from Harvard University. Our Board believes that Mr. Levensohn’s experience investing in technology businesses and his service on numerous boards of directors qualify him to serve on our Board.

The Board Of Directors Recommends

A Vote In Favor Of Each Named Nominee.

Directors Continuing in Office until the 2020 Annual Meeting of Stockholders

Ralph A. Clark has served as our President and Chief Executive Officer and as a member of our Board since August 2010. From September 2005 until July 2010, Mr. Clark served as Chief Executive Officer of GuardianEdge

7

Technologies, Inc., an endpoint data security firm. Prior to that, Mr. Clark served as Vice President, Finance of Adaptec, Inc. following Adaptec’s acquisition of Snap Appliances, Inc., where he had been Chief Financial Officer. Mr. Clark also has held various positions at start-up companies, served in executive sales and marketing roles at IBM and worked as an investment banker at Goldman Sachs and Merrill Lynch. Mr. Clark holds a B.S. in economics from the University of the Pacific and an M.B.A. from Harvard Business School. In May 2017, Mr. Clark was named as a finalist in the Ernst & Young Entrepreneur of the Year program for Northern California. Our Board believes that Mr. Clark’s significant business experience from both inside and outside our industry and his role as our Chief Executive Officer qualify him to serve on our Board.

Marc Morial has served as a member of our Board since September 2015. Since 2003, Mr. Morial also has served as the President and Chief Executive Officer of the National Urban League, a civil rights organization dedicated to economic empowerment in order to elevate the standard of living in historically underserved urban communities. From 1994 to 2002, Mr. Morial served as the Mayor of New Orleans, Louisiana. Prior to serving as Mayor of New Orleans, Mr. Morial held other various positions in public office and nonprofit management. Mr. Morial has a B.A. in economics from the University of Pennsylvania and a J.D. from Georgetown University. Our Board believes that Mr. Morial’s experience in serving underserved urban communities, local governments and community organizations qualifies him to serve on our Board.

Directors Continuing in Office until the 2021 Annual Meeting of Stockholders

William J. Bratton has served as a member of our Board since November 2017 and previously served as a member of our Board from April 2013 until December 2013. Since September 2016, Mr. Bratton has served as Senior Managing Director of Teneo Holdings, a global CEO advisory firm, and as Executive Chairman of its Teneo Risk division. From January 2014 until September 2016, Mr. Bratton served a second term as Commissioner of the New York City Police Department (“NYPD”), by appointment. From November 2012 to December 2013, Mr. Bratton has served as Chief Executive Officer of the Bratton Group LLC, a New York City-based public safety and law enforcement consulting firm, which has consulted extensively in the United States and Latin America on policing, public safety and rule-of-law initiatives. From September 2010 to November 2012, Mr. Bratton served as Chairman of Kroll Advisory Solutions (“Kroll”), a global security solutions and specialized law enforcement company, the successor to Altegrity Risk International where he served as Chairman from November 2009 to November 2012. From October 2002 to October 2009. Mr. Bratton served as Chief of the Los Angeles Police Department (“LAPD”). From 1996 until his appointment as LAPD Chief, Mr. Bratton worked in the private sector, including as Senior Consultant to Kroll’s Public Services Safety Group and Crisis and Consulting Management Group. From 1994 to 1996, Mr. Bratton served his first term as Commissioner of the NYPD by appointment. Mr. Bratton has also served as head of a number of other police agencies including commissioner of the Boston Police Department, Chief of Police of the New York City Transit Police Department, Superintendent of the Massachusetts Metropolitan District Commission of Police and Chief of Police for the Massachusetts Bay Transportation Authority. Mr. Bratton is the Vice Chairman of the Homeland Security Advisory Council. He holds a bachelor’s degree in law enforcement from Boston State College/University of Massachusetts, and is a graduate of the FBI National Executive Institute and the Senior Executive Fellows Program at Harvard’s John F. Kennedy School of Government. Our Board believes that Mr. Bratton’s significant experience in law enforcement both in the United States and abroad and his insight in criminal justice system operations qualify him to serve on our Board.

Randall Hawks, Jr. has served as a member of our Board since 2006. Mr. Hawks is a partner at Claremont Creek Ventures, a venture capital firm where he has been since June 2005. From 1984 to 2000, Mr. Hawks was the Executive Vice President and Chief Operating Officer and Director at Identix Incorporated, an identity protection company. Mr. Hawks also has held various senior management positions at Captiva Software Corp., Texas Instruments, ITT Information Systems and AT&T Paradyne. He has also served on the board of directors of EcoATM, SmartZip, Inapac, Invivodata, Flytecomm, View Central and Be Here. Mr. Hawks holds a B.S. in Electrical Engineering from the University of Arkansas. Our Board believes that Mr. Hawks’s experience investing in technology businesses and his service on numerous boards of directors qualify him to serve on our Board.

Merline Saintil has served as a member of our Board since April 2019. Ms. Saintil currently serves as Chief Operating Officer, R&D and IT at Change Healthcare, a healthcare technology company, a position she has held since April 2019. Prior to that, Ms. Saintil served from November 2014 to July 2018 as Head of Operations for the Product & Technology group at Intuit Inc., a software company, where her core responsibilities included driving

8

global strategic growth priorities, leading merger and acquisition integration and divestitures, and overseeing the vendor management office. Prior to Intuit, Ms. Saintil served as Yahoo!’s (prior to its acquisition by Verizon Media) Head of Operations for Mobile & Emerging Products from January 2014 to November 2014. Prior to joining Yahoo!, Ms. Saintil held various roles at Joyent, Inc., a software company from November 2011 to September 2013, PayPal Holdings Inc. (Nasdaq: PYPL), a payments company, from July 2010 to November 2011, Adobe Inc. (Nasdaq: ADBE), a software company, from April 2006 to July 2010, and Sun Microsystems (prior to its acquisition by Oracle Corporation) from October 2000 to April 2006. Ms. Saintil serves on the boards of directors of Banner Corporation (Nasdaq: BANR), a bank holding company, and Nav, Inc., a privately held financial technology company. Ms. Saintil received a B.S. in Computer Science (summa cum laude) from Florida A&M University, an M.S. in Software Engineering Management from Carnegie Mellon University, and has completed Stanford Directors’ College and Harvard Business School’s executive education program. She is certified in Cybersecurity Oversight by the National Association of Corporate Directors and the Carnegie Mellon Software Engineering Institute. In addition to her business interests, Ms. Saintil is passionate about supporting women and girls in leadership and technology. She has received numerous awards for her contributions to her community and support of women in technology including being recognized as #6 on their list of the 22 Most Powerful Women Engineers in the World by Business Insider magazine, as a Women of Influence 2017 by Silicon Valley Business Journal, and earning a Lifetime Achievement Award from Girls in Tech. Our Board believes that Ms. Saintil’s experience in strategic planning, mergers and acquisitions, and technology businesses qualify her to serve on our Board.

9

Information regarding the Board of Directors and Corporate Governance

Director Independence

Our common stock is listed on the Nasdaq Capital Market. Under Nasdaq listing requirements and rules, a majority of the members of a listed company’s board of directors must qualify as “independent”, as affirmatively determined by the company’s board of directors. The Board consults with the Company’s counsel to ensure that the Board’s determinations are consistent with relevant securities and other laws and regulations regarding the definition of “independent,” including those set forth in pertinent listing standards of Nasdaq, as in effect from time to time.

Consistent with these considerations, after review of all relevant identified transactions or relationships between each director, or any of his family members, and the Company, its senior management and its independent auditors, the Board has affirmatively determined that each of the following directors is independent within the meaning of the applicable Nasdaq listing standards: Mr. Bratton, Mr. Groos, Mr. Hawks, Ms. Saintil, Mr. Levensohn and Mr. Morial. In making this determination, our Board considered the current and prior relationships that each non-employee director has with our Company and all other facts and circumstances our Board deemed relevant in determining their independence, including the beneficial ownership of our capital stock by each non-employee director and the transactions involving them described in “Certain Relationships and Related Party Transactions.”

Board Leadership

Our Chair of the Board is currently Pascal Levensohn, an independent director. Currently, our Board believes that it is in the best interests of the Company and our stockholders to have the roles of Chair of the Board and Chief Executive Officer held by different persons. Our Nominating and Corporate Governance Committee periodically considers the leadership structure of our Board, including the separation of the Chair and Chief Executive Officer roles, and makes such recommendations to our Board as our Nominating and Corporate Governance Committee deems appropriate. Our corporate governance guidelines provide that, when the positions of Chair and Chief Executive Officer are held by the same person, the independent directors may designate a “lead independent director.”

Role of the Board in Risk Oversight

One of the Board’s key functions is informed oversight of the Company’s risk management process. The Board does not have a standing risk management committee, but rather administers this oversight function directly through the Board as a whole, as well as through various Board standing committees that address risks inherent in their respective areas of oversight. In particular, our Board is responsible for monitoring and assessing strategic risk exposure, including a determination of the nature and level of risk appropriate for the Company. Our Audit Committee has the responsibility to consider and discuss our major financial risk exposures and the steps our management has taken to monitor and control these exposures, including guidelines and policies to govern the process by which risk assessment and management is undertaken. The Audit Committee also monitors compliance with legal and regulatory requirements, in addition to oversight of the performance of our internal audit function. Our Nominating and Corporate Governance Committee monitors the effectiveness of our corporate governance guidelines, including whether they are successful in preventing illegal or improper liability-creating conduct. Our Compensation Committee assesses and monitors whether any of our compensation policies and programs has the potential to encourage excessive risk-taking. It is the responsibility of the committee chairs to report findings regarding material risk exposures to the Board as quickly as possible.

Meetings of the Board of Directors and its Committees

The Board met seven times during 2018. The Audit Committee met four times during 2018. The Compensation Committee met four times during 2018. The Nominating and Corporate Governance Committee met once during 2018. Each director attended 75% or more of the aggregate number of meetings of the Board, and each of the committees on which he served, held during the portion of the last fiscal year for which he was a director or committee member.

10

As required under the Nasdaq listing standards, the Company’s independent directors met six times in regularly scheduled executive sessions at which only independent directors were present.

Communications with our Board of Directors

The Board has adopted a formal process by which stockholders may communicate with the Board or any of its directors. Stockholders or interested parties who wish to communicate with our Board or with an individual director may do so by mail to our Board or the individual director at 7979 Gateway Blvd., Suite 210, Newark, CA 94560, Attn: Corporate Secretary. The communication may indicate that it contains a stockholder or interested party communication. In accordance with our stockholder communications policy, all such communication will be reviewed by the Company’s Corporate Secretary, and, if appropriate, will be forwarded to the Board or such director.

Board Composition and Refreshment

All Board members are highly engaged and actively involved in overseeing our strategy. We are thoughtful in our approach to Board refreshment and we engage in Board succession planning. As a result of our approach, our director nominees represent diverse perspectives and experiences and bring core strategic, operating, financial and governance skills and experience to our Board.

As stated in our Corporate Governance Guidelines, the Board values diversity and recognizes the importance of having unique and complementary backgrounds and perspectives in the board room. The Board endeavors to bring together diverse skills, professional experience, perspectives, age, race, ethnicity, gender, and cultural backgrounds that reflect our customer base and the citizens served by our customers, and to guide us in a way that reflects the best interests of all of our stockholders.

Diverse Background and Tenure

Below is a breakdown of the composition of our board of directors by gender, racial diversity, independence (as determined in accordance with Nasdaq listing rules) and tenure of service.

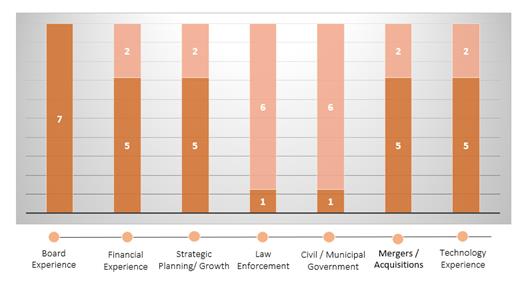

Director Skills and Experience

Below are statistics as to our Board’s skills and experiences across selected categories we believe are valuable to the oversight of our business. The darker shaded portion of each bar represents the number of directors that hold such skills or experience.

11

Board Committees

Our Board has established an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. The following table provides membership and meeting information for the year ended December 31, 2018 for each of the Board committees:

|

Name |

|

Audit |

|

Compensation |

|

Nominating and Corporate Governance |

|

William J. Bratton |

|

|

|

X |

|

|

|

Thomas T. Groos |

|

|

|

|

|

X |

|

Randall Hawks, Jr. |

|

X* |

|

X |

|

|

|

Pascal Levensohn |

|

X |

|

X* |

|

|

|

Marc Morial |

|

X |

|

|

|

X* |

|

Total meetings in fiscal 2018 |

|

4 |

|

4 |

|

1 |

|

* |

Committee Chair |

Audit Committee

The Audit Committee of the Board was established by the Board in accordance with Section 3(a)(58)(A) of the Exchange Act to oversee the Company’s corporate accounting and financing reporting processes and audits of its financial statements. During 2018, our Audit Committee consisted of three directors, Messrs. Hawks, Levensohn and Morial, with Mr. Hawks serving as the chair. Ms. Saintil joined our Board in April 2019 and at that time replaced Mr. Levensohn on the Audit Committee.

The principal duties and responsibilities of our Audit Committee include, among other things:

|

|

• |

selecting a qualified firm to serve as the independent registered public accounting firm to audit our financial statements; |

|

|

• |

helping to ensure the independence and performance of the independent registered public accounting firm; |

12

|

|

• |

discussing the scope and results of the audit with the independent registered public accounting firm, and reviewing, with management and the independent accountants, our interim and year-end operating results; |

|

|

• |

developing procedures for employees to submit concerns anonymously about questionable accounting or audit matters; |

|

|

• |

reviewing our policies on risk assessment and risk management; |

|

|

• |

reviewing related party transactions; |

|

|

• |

obtaining and reviewing a report by the independent registered public accounting firm at least annually, that describes our internal quality-control procedures, any material issues with such procedures, and any steps taken to deal with such issues when required by applicable law; and |

|

|

• |

approving (or, as permitted, pre-approving) all audit and all permissible non-audit services, other than de minimis non-audit services, to be performed by the independent registered public accounting firm. |

The Board adopted a written charter that satisfies applicable Nasdaq listing standards and is available to stockholders on the Company’s website at ir.shotspotter.com.

Audit Committee members must satisfy the independence requirements set forth in Nasdaq Rule 5605(c)(2) and Rule 10A-3 under the Exchange Act (“Rule 10A-3”). To be considered to be independent for purposes of Rule 10A-3, a member of an Audit Committee of a listed company may not, other than in his capacity as a member of our Audit Committee, our Board, or any other committee of our Board: (1) accept, directly or indirectly, any consulting, advisory, or other compensatory fee from the listed company or any of its subsidiaries; or (2) be an affiliated person of the listed company or any of its subsidiaries.

Our Board also determined that Messrs. Hawks, Levensohn, Morial and Ms. Saintil each satisfy the independence standards for the Audit Committee established by Nasdaq listing standards and Rule 10A-3. For 2018, the Board determined that Mr. Hawks, the Audit Committee chair, and Mr. Levensohn were each an “audit committee financial expert” as defined by Item 407(d) of Regulation S-K under the Securities Act of 1933 (the “Securities Act”). Mr. Hawks continues to be the audit committee financial expert on the Audit Committee with the replacement of Mr. Levensohn by Ms. Saintil in April 2019.

Compensation Committee

Our Compensation Committee consists of three directors, Messrs. Bratton, Hawks and Levensohn, with Mr. Levensohn serving as the chair. The principal duties and responsibilities of our Compensation Committee include, among other things:

|

|

• |

reviewing and approving, or recommending that our Board approve, the compensation of our executive officers; |

|

|

• |

reviewing and recommending to our Board the compensation of our directors; |

|

|

• |

reviewing and approving, or recommending that our Board approve, the terms of compensatory arrangements with our executive officers; |

|

|

• |

administering our stock and equity incentive plans; |

13

|

|

• |

reviewing and approving, or recommending that our Board approve, incentive compensation and equity plans; and |

|

|

• |

reviewing and establishing general policies relating to compensation and benefits of our employees and reviewing our overall compensation philosophy. |

The Board adopted a written Compensation Committee charter that satisfies applicable Nasdaq listing standards and is available to stockholders on the Company’s website at ir.shotspotter.com.

The Board has determined that Messrs. Bratton, Hawks and Levensohn each satisfy the independence requirements for the Compensation Committee set forth in Nasdaq Rule 5605(d)(2) and Rule 10C-1 promulgated under the Exchange Act, are “non-employee directors” as defined in Rule 16b-3 promulgated under the Exchange Act, or the Exchange Act, and are “outside directors” as that term is defined in Section 162(m) of the Internal Revenue Code of 1986 (the “Code”).

Compensation Committee Processes and Procedures

In 2018, the Compensation Committee retained independent compensation consultants at Deloitte Consulting, LLP (“Deloitte”) to conduct market research and analysis to assist the Compensation Committee in developing appropriate compensation and incentives for our executive officers and non-employee directors, to advise the Compensation Committee and to provide ongoing recommendations regarding material executive officer and non-employee director compensation decisions, and to review compensation proposals from management. Deloitte reports directly to the Compensation Committee and does not provide any non-compensated-related services to the Company. After review and consultation with Deloitte, the Compensation Committee determined that Deloitte is independent and that there is no conflict of interest resulting from retaining Deloitte. In reaching these conclusions, our Compensation Committee considered factors set forth in SEC and Nasdaq listing rules.

Our executive officers submit proposals to our Board and Compensation Committee regarding our executive and non-employee director compensation. Our Chief Executive Officer provides feedback and recommendations to our Compensation Committee with respect to executive compensation, other than his own compensation, including with regard to senior executive performance, responsibility and experience levels. The Compensation Committee often takes into consideration both our Chief Executive Officer’s input and the input of other senior executives in setting compensation levels.

Compensation Committee Interlocks and Insider Participation

None of the members of the Compensation Committee is currently or has been at any time one of our executive officers or employees. None of our executive officers currently serves, or has served during the last year, as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving as a member of our Board or Compensation Committee.

Nominating and Corporate Governance Committee

Our Nominating and Corporate Governance Committee consists of two directors, Messrs. Groos and Morial, with Mr. Morial serving as the chair. The Nominating and Corporate Governance Committee’s responsibilities include, among other things:

|

|

• |

identifying, evaluating and selecting, or recommending that our Board approve, nominees for election to our Board and its committees; |

|

|

• |

evaluating the performance of our Board and of individual directors; |

|

|

• |

considering and making recommendations to our Board regarding the composition of our Board and its committees; |

14

|

|

• |

reviewing developments in corporate governance practices; |

|

|

• |

evaluating the adequacy of our corporate governance practices and reporting; |

|

|

• |

developing and making recommendations to our Board regarding corporate governance guidelines and matters; and |

|

|

• |

overseeing an annual evaluation of the Board’s performance. |

The Board adopted a written Nominating and Corporate Governance Committee charter that satisfies applicable Nasdaq listing standards and is available to stockholders on the Company’s website at ir.shotspotter.com.

The Board has determined that Messrs. Groos and Morial are each independent (as independence is currently defined in Rule 5605(a)(2) of the Nasdaq listing standards).

Nominations to the Board of Directors

With the goal of developing a diverse, experienced and highly qualified Board, the Nominating and Corporate Governance Committee is responsible for developing and recommending to our Board the desired qualifications, expertise and characteristics of members of our Board, including qualifications that the committee believes must be met by a committee-recommended nominee for membership on our Board and specific qualities or skills that the committee believes are necessary for one or more of the members of our Board to possess.

The Nominating and Corporate Governance Committee believes that candidates for director should have certain minimum qualifications, including being able to read and understand basic financial statements, being over 21 years of age and having the highest personal integrity and ethics. The Nominating and Corporate Governance Committee also intends to consider such factors as possessing relevant expertise upon which to be able to offer advice and guidance to management, having sufficient time to devote to the affairs of the Company, demonstrated excellence in his or her field, having the ability to exercise sound business judgment and having the commitment to rigorously represent the long-term interests of the Company’s stockholders. However, the Nominating and Corporate Governance Committee will periodically review and assess these qualifications from time to time through the development and evaluation of the Company’s corporate governance guidelines. Any changes to the Company’s corporate governance guidelines proposed by the Nominating and Corporate Governance Committee are submitted to the Board for approval. Candidates for director nominees are reviewed in the context of the current composition of the Board, the operating requirements of the Company and the long-term interests of stockholders. In conducting this assessment, the Nominating and Corporate Governance Committee will consider diversity (including diversity of gender, race, ethnicity, age, sexual orientation and gender identity), skills, and such other factors as it deems appropriate, given the current needs of the Board and the Company, to maintain a balance of knowledge, experience and capability.

In the case of incumbent directors whose terms of office are set to expire, the Nominating and Corporate Governance Committee reviews these directors’ overall service to the Company during their terms, including the number of meetings attended, level of participation, quality of performance and any other relationships and transactions that might impair the directors’ independence. The Nominating and Corporate Governance Committee also takes into account the results of the Board’s self-evaluation, conducted annually on a group and individual basis. In the case of new director candidates, the Nominating and Corporate Governance Committee also determines whether the nominee is independent for Nasdaq purposes, which determination is based upon applicable Nasdaq listing standards, applicable SEC rules and regulations and the advice of counsel, if necessary. The Nominating and Corporate Governance Committee then uses its network of contacts to compile a list of potential candidates, but may also engage, if it deems appropriate, a professional search firm. The Nominating and Corporate Governance Committee conducts any appropriate and necessary inquiries into the backgrounds and qualifications of possible candidates after considering the function and needs of the Board. The Nominating and Corporate Governance Committee meets to discuss and consider the candidates’ qualifications and then selects a nominee for recommendation to the Board by majority vote.

15

The Nominating and Corporate Governance Committee will consider director candidates recommended by stockholders. The Nominating and Corporate Governance Committee does not intend to alter the manner in which it evaluates candidates, including the minimum criteria set forth above, based on whether or not the candidate was recommended by a stockholder. Stockholders who wish to recommend individuals for consideration by the Nominating and Corporate Governance Committee to become nominees for election to the Board may do so by delivering a written recommendation to the Nominating and Corporate Governance Committee at the following address: Corporate Secretary, ShotSpotter, Inc., 7979 Gateway Blvd, Suite 210, Newark, California 94560 at least 90 days, but no more than 120 days, prior to the anniversary date of the preceding year’s annual meeting. Submissions must include (1) the name, age, business address and residence address of such nominee; (2) the principal occupation or employment of such nominee; (3) the class and number of shares of each class of capital stock of the corporation which are owned of record and beneficially by such nominee; (4) the date or dates on which such shares were acquired and the investment intent of such acquisition; (5) a statement whether such nominee, if elected, intends to tender, promptly following such person’s failure to receive the required vote for election or re-election at the next meeting at which such person would face election or re-election, an irrevocable resignation effective upon acceptance of such resignation by the Board; and (6) such other information concerning such nominee as would be required to be disclosed in a proxy statement soliciting proxies for the election of such nominee as a director in an election contest (even if an election contest is not involved), or that is otherwise required to be disclosed pursuant to Section 14 of the Exchange Act and the rules and regulations promulgated thereunder (including such person’s written consent to being named as a nominee and to serving as a director if elected).

Code of Business Conduct and Ethics

We have adopted a code of business conduct and ethics that applies to all of our employees, officers and directors, including those officers responsible for financial reporting. Our code of business conduct and ethics is available on our website at ir.shotspotter.com. We intend to disclose any amendments to the code, or any waivers of its requirements, on our website to the extent required by the applicable rules and exchange requirements. The inclusion of our website address in this document does not include or incorporate by reference into this document the information on or accessible through our website.

16

Ratification of Appointment of Independent

Registered Public Accounting Firm

Our Audit Committee has appointed Baker Tilly Virchow Krause, LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2019 and has further directed that the Board submit this appointment for ratification by the stockholders at the Annual Meeting.

Baker Tilly Virchow Krause, LLP audited our financial statements for the years ended December 31, 2015, 2016, 2017 and 2018. Representatives of Baker Tilly Virchow Krause, LLP are expected to participate over the phone during the Annual Meeting, where they will be available to respond to appropriate questions and, if they desire, to make a statement.

Our Board is submitting this selection as a matter of good corporate governance and because we value our stockholders’ views on our independent registered public accounting firm. Neither our bylaws nor other governing documents or law require stockholder ratification of the selection of our independent registered public accounting firm. If the stockholders fail to ratify this selection, our Audit Committee will reconsider whether or not to retain that firm. Even if the selection is ratified, our Audit Committee may direct the appointment of different independent auditors at any time during the year if they determine that such a change would be in the best interests of ShotSpotter and its stockholders.

Vote Required

An affirmative vote from holders of a majority in voting power of the shares present at the meeting or represented by proxy and entitled to vote on the proposal will be required to ratify the selection of Baker Tilly Virchow Krause, LLP.

Principal Accountant Fees and Services

The following table provides the aggregate fees for services provided by Baker Tilly Virchow Krause, LLP for the fiscal years ended December 31, 2018 and 2017.

|

|

|

Fiscal Year Ended December 31, |

|

|||||

|

|

|

2018 |

|

|

2017 |

|

||

|

Audit Fees (1) |

|

$ |

340,830 |

|

|

$ |

226,826 |

|

|

Audit-related Fees (2) |

|

|

— |

|

|

|

21,500 |

|

|

Tax Fees |

|

|

— |

|

|

|

— |

|

|

All Other Fees (3) |

|

|

— |

|

|

|

68,250 |

|

|

Total Fees |

|

$ |

340,830 |

|

|

$ |

316,576 |

|

|

|

(1) |

Consists of fees billed for professional services rendered in connection with the audit of our consolidated financial statements, including audited financial statements presented in our Annual Report on Form 10-K, review of the interim consolidated financial statements included in our quarterly reports and services normally provided in connection with regulatory filings. |

|

|

(2) |

Consists of fees billed for assurance and related services that are reasonably related to the performance of the audit or review of the Company’s consolidated financial statements and are not reported under “Audit Fees.” |

|

|

(3) |

Consists of fees billed for professional services, and services rendered in connection with review of registration statements in 2017 and 2018 that are not reported under “Audit Fees”, “Audit-related Fees” or “Tax Fees.” |

Pre-Approval Policies and Procedures

Consistent with the requirements of the SEC and the Public Company Accounting Oversight Board, regarding auditor independence, the Audit Committee has responsibility for appointing, setting compensation, retaining and overseeing the work of our independent registered public accounting firm. In recognition of this responsibility, the Audit Committee has adopted a policy and procedures for the pre-approval of audit and non-audit services rendered by our independent registered public accounting firm, Baker Tilly Virchow Krause, LLP. The policy generally pre-

17

approves specified services in the defined categories of audit services, audit-related services and tax services up to specified amounts. Pre-approval may also be given as part of the Audit Committee’s approval of the scope of the engagement of the independent auditor or on an individual, explicit, case-by-case basis before the independent auditor is engaged to provide each service.

All of the services provided Baker Tilly Virchow Krause, LLP for our fiscal years ended December 31, 2018 and 2017 described above were pre-approved by the Audit Committee. Our Audit Committee has determined that the rendering of services other than audit services by Baker Tilly Virchow Krause, LLP is compatible with maintaining the principal accountant’s independence.

The Board of Directors Recommends

A Vote in Favor of Proposal 2.

18

The Audit Committee has reviewed and discussed the audited financial statements for the fiscal year ended December 31, 2018 with the management of ShotSpotter, Inc. The Audit Committee has also reviewed and discussed such financial statements with Baker Tilly Virchow Krause, LLP, the Company’s independent registered public accounting firm, with and without management present. The Audit Committee has discussed with its independent registered public accounting firm the matters required to be discussed by Auditing Standard No. 1301, “Communications with Audit Committees”, issued by the Public Company Accounting Oversight Board (the “PCAOB”). The Audit Committee has also received the written disclosures and the letter from its independent registered public accounting firm required by applicable requirements of the PCAOB regarding the independent accountants’ communications with the Audit Committee concerning independence, and has discussed with the independent registered public accounting firm the accounting firm’s independence. Based on the foregoing, the Audit Committee has recommended to our board of directors that the audited financial statements be included in ShotSpotter, Inc. Annual Report on Form 10-K for the fiscal year ended December 31, 2018.

The Audit Committee

Randall Hawks, Jr. (Chair)

Pascal Levensohn

Marc Morial

The material in this report is not “soliciting material,” is not deemed “filed” with the SEC and is not to be incorporated by reference in any filing of ShotSpotter, Inc under the Securities Act or the Exchange Act, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing.

19

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth the beneficial ownership of our common stock as of April 18, 2019, for:

|

|

• |

each person, or group of affiliated persons, who is known by us to beneficially own more than 5% of our common stock; |

|

|

• |

each of our named executive officers (as such term is defined in “Executive and Director Compensation - Summary Compensation Table” below); |

|

|

• |

each of our directors; and |

|

|

• |

all of our executive officers and directors as a group. |

The percentage ownership information shown in the table is based upon 11,320,920 shares of common stock outstanding as of April 18, 2019.

We have determined beneficial ownership in accordance with the rules of the SEC. These rules generally attribute beneficial ownership of securities to persons who possess sole or shared voting power or investment power with respect to those securities. In addition, the rules include shares of common stock that may be issuable pursuant to outstanding restricted stock units (“RSUs”), or that may be issuable pursuant to the exercise of stock options or warrants that are either immediately exercisable or exercisable on or before June 17, 2019, which is 60 days after April 18, 2019. These shares are deemed to be outstanding and beneficially owned by the person holding those options or warrants for the purpose of computing the percentage ownership of that person, but they are not treated as outstanding for the purpose of computing the percentage ownership of any other person. Unless otherwise indicated, the persons or entities identified in this table have sole voting and investment power with respect to all shares shown as beneficially owned by them, subject to applicable community property laws.

Except as otherwise noted below, the address for persons listed in the table is c/o ShotSpotter, Inc., 7979 Gateway Blvd., Suite 210, Newark, California 94560.

|

|

|

Beneficial Ownership |

|

|||||

|

Name of Beneficial Owner |

|

Shares |

|

|

Percentage of Total |

|

||

|

5% or greater stockholders: |

|

|

|

|

|

|

|

|

|

Entities affiliated with Lauder Partners LLC(1) |

|

|

2,292,406 |

|

|

|

20.2 |

% |

|

Gilder, Gagnon, Howe & Co. LLC(2) |

|

|

2,187,139 |

|

|

|

19.3 |

% |

|

Named executive officers and directors |

|

|

|

|

|

|

|

|

|

William J. Bratton(3) |

|

|

11,369 |

|

|

* |

|

|

|

Thomas T. Groos(4) |

|

|

536,175 |

|

|

|

4.7 |

% |

|

Randall Hawks, Jr.(5) |

|

|

11,447 |

|

|

* |

|

|

|

Pascal Levensohn(6) |

|

|

32,300 |

|

|

* |

|

|

|

Marc Morial(7) |

|

|

19,446 |

|

|

* |

|

|

|

Meriline Saintil(8) |

|

|

340 |

|

|

* |

|

|

|

Gary T. Bunyard(9) |

|

|

19,308 |

|

|

* |

|

|

|

Ralph A. Clark(10) |

|

|

537,910 |

|

|

|

4.8 |

% |

|

R. Samuel Klepper(11) |

|

|

21,615 |

|

|

|

|

|

|

Alan R. Stewart(12) |

|

|

35,686 |

|

|

* |

|

|

|

All current executive officers and directors as a group (13 persons)(12) |

|

|

1,290,051 |

|

|

|

11.4 |

% |

|

* |

Represents beneficial ownership of less than 1%. |

|

|

(1) |

Consists of (i) 1,147,529 shares of common stock held by The Gary M. Lauder Revocable Trust; (ii) 1,136,725 shares of common stock held by Lauder Partners LLC; and (iii) 8,152 shares of common stock held directly by Mr. Lauder. Mr. Lauder is a Trustee of The Gary |

20

|

|

M. Lauder Revocable Trust and the General Partner of Lauder Partners LLC. The address for The Gary M. Lauder Revocable Trust and Lauder Partners LLC is 40th Floor, 767 Fifth Ave., New York, NY 10153. |

|

|

(2) |

Consists of (i) 2,154,718 shares held in customer accounts over which partners and/or employees of the Gilder, Gagnon, Howe and Co. LLC have discretionary authority to dispose of or direct the disposition of the shares; (ii) 11,983 shares held in the account of the profit sharing plan of the Gilder, Gagnon, Howe and Co. LLC; and (iii) 20,438 shares held in accounts owned by the partners of Gilder, Gagnon, Howe and Co. LLC and their families. The address for Gilder, Gagnon, Howe and Co. LLC is 475 10th Avenue, New York, NY 10018. |

|

|

(3) |

Consists of (i) 3,074 shares of common stock held directly by Mr. Bratton; (ii) 5,000 shares of common stock issuable under outstanding stock options exercisable within 60 days of April 18, 2019; and (iii) 3,295 shares of common stock issuable pursuant to RSUs vesting within 60 days of April 18, 2019. |

|

|

(4) |

Consists of (i) 418,376 shares of common stock held by RT Groos, LLC and 39,881 shares of common stock issuable to RT Groos, LLC pursuant to warrants exercisable within 60 days of April 18, 2019; (ii) 50,514 shares of common stock held by the Thomas T. Groos Revocable Trust and 13,973 shares of common stock issuable to the Thomas T. Groos Revocable Trust pursuant to warrants exercisable within 60 days of April 18, 2019; (iii) 10,136 shares of common stock held directly by Mr. Groos; and (iv) 3,295 shares of common stock expected to be issued to Mr. Groos upon settlement of RSUs within 60 days of April 18, 2019. Thomas T. Groos holds voting and dispositive power for the shares held by RT Groos LLC, and the Thomas T. Groos Revocable Trust and disclaims beneficial ownership of these securities except to the extent of his pecuniary interest therein. The address for RT Groos LLC, and the Thomas T. Groos Revocable Trust is Ionia St. SW, Suite 505, Grand Rapids, MI 49503. |

|

|

(5) |

Consists of (i) 8,152 shares of common stock held directly by Mr. Hawks, Jr.; and (ii) 3,295 shares of common stock issuable pursuant to RSUs vesting within 60 days of April 18, 2019. |

|

|

(6) |

Consists of (i) 3,214 shares of common stock held by Pascal Levensohn Revocable Trust; (ii) 226 shares of common stock held by Levensohn Venture Partners, LLC; (iii) 22,198 shares of common stock held directly by Mr. Levensohn; (iv) 1,961 shares of common stock issuable to Mr. Levensohn under outstanding stock options exercisable within 60 days of April 18, 2019; and (v) 4,701 shares of common stock expected to issue upon settlement of RSUs within 60 days of April 18, 2019. Pascal Levensohn holds voting and dispositive power for the shares held by Pascal Levensohn Revocable Trust and disclaims beneficial ownership of these securities except to the extent of his pecuniary interest therein. The address for Pascal Levensohn Revocable Trust is 1971 Vallejo Street, Saint Helena, CA 94574. |

|

|

(7) |