May 1, 2023

Dear Stockholder:

You are cordially invited to attend the 2023 Annual Meeting of Stockholders of SoundThinking, Inc. The meeting will be held virtually, via a live audio webcast at www.meetnow.global/MUNUWWZ on Wednesday, June 21, 2023 at 9:00 a.m., Pacific Time (the “Annual Meeting”). The attached Notice of Annual Meeting of Stockholders and Proxy Statement describe the formal business to be transacted at the meeting.

On April 10, 2023, ShotSpotter, Inc. (Nasdaq: SSTI), a leading public safety technology company that combines data-driven solutions and strategic advisory services for law enforcement and community assistance groups, announced a rebranding and name change to SoundThinking, Inc. The new name reflects our focus on public safety through industry-leading law enforcement tools and community-focused solutions for non-law enforcement entities to utilize for a holistic approach to violence prevention, social services and economic assistance.

We believe that a virtual meeting provides expanded stockholder access and participation and improved communications, while affording stockholders the same rights as if the meeting were held in person, including the ability to vote shares electronically and ask questions during the meeting in accordance with our rules of conduct for the meeting. We encourage you to attend online and participate. We recommend that you log in a few minutes before 9:00 a.m., Pacific Time, on June 21, 2023 to ensure you are logged in when the Annual Meeting starts.

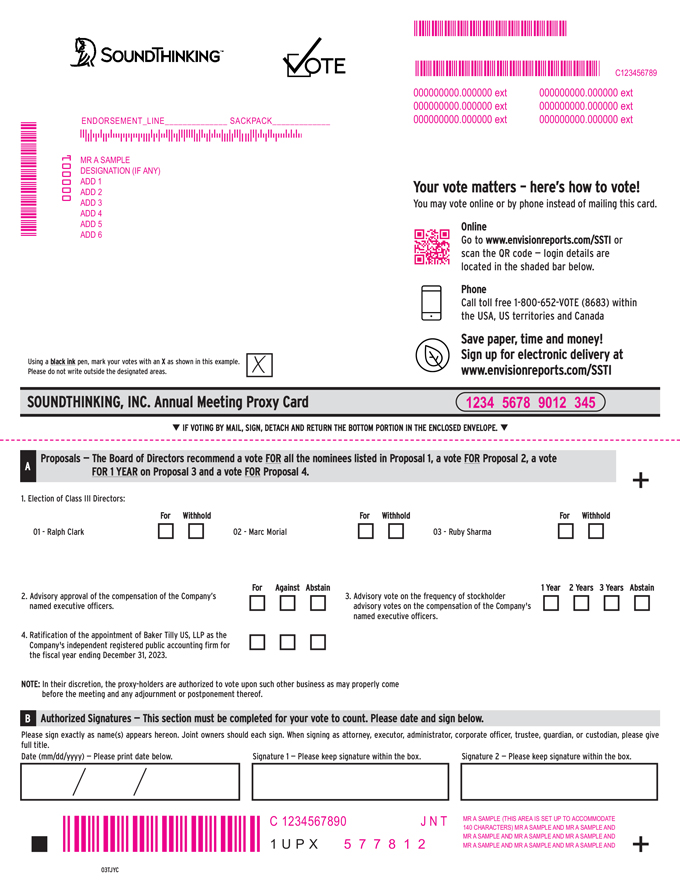

You may vote your shares by proxy or online at the Annual Meeting. The Annual Meeting is being held so that stockholders may consider the election of three Class III directors; the approval, on an advisory basis, of the compensation of our named executive officers, as disclosed in the enclosed Proxy Statement; the indication, on an advisory basis, of the frequency of stockholder advisory votes on the compensation of our named executive officers; the ratification of the appointment of Baker Tilly US, LLP as our independent registered public accounting firm for the year ending December 31, 2023; and any other business properly brought before the meeting. Please see the enclosed Notice of Annual Meeting and Proxy Statement for information on how to vote your shares.

The Board of Directors unanimously recommends a vote FOR each of its nominees for Class III director, FOR the advisory approval of compensation of our named executive officers, as disclosed in the enclosed Proxy Statement, for ONE YEAR as the preferred frequency of advisory votes to approve executive compensation, and FOR the ratification of our independent registered public accounting firm.

On behalf of our Board of Directors, officers and employees, I would like to take this opportunity to thank you for your continued support. We look forward to your attendance at the Annual Meeting.

Sincerely,

Ralph A. Clark

President and Chief Executive Officer

| SoundThinking, Inc. 39300 Civic Center Dr., Suite 300 Fremont, CA 94538 |

+1 888 274 6877 toll free www.soundthinking.com |

2